The Middle East region, although considered remote and non-core by a section of Chinese policy makers, has witnessed a noticeable rise in Chinese engagements over the past decade….reports Sumit Kumar Singh

The Chinese pursuit of its rightful place on the global stage and emergence from a century of humiliation at foreign hands has an intricate design. Sun Tzu’s golden nuggets of winning without firing a shot and winning through cunning seem to be at the core of its approach.

For its neighbours, the Chinese gambits at territory grab reveal its hegemonic ambition, both on land and in the maritime domain. On the other hand, for its distant targets, there is debt trap diplomacy at play, fuelling its economically imperialistic desire.

Chinese approach for its neighbours has followed a coax and coerce design. To the vulnerable and strained economies, China has been offering sugar-coated deals in return of long-term projects, strategic leverage and economic dependency facilitation.

As a result, many susceptible states are becoming ensnared in a debt trap that leaves them exposed to China’s assertive influence. Sri Lanka, Maldives, Nepal and Cambodia have joined its long list of victims.

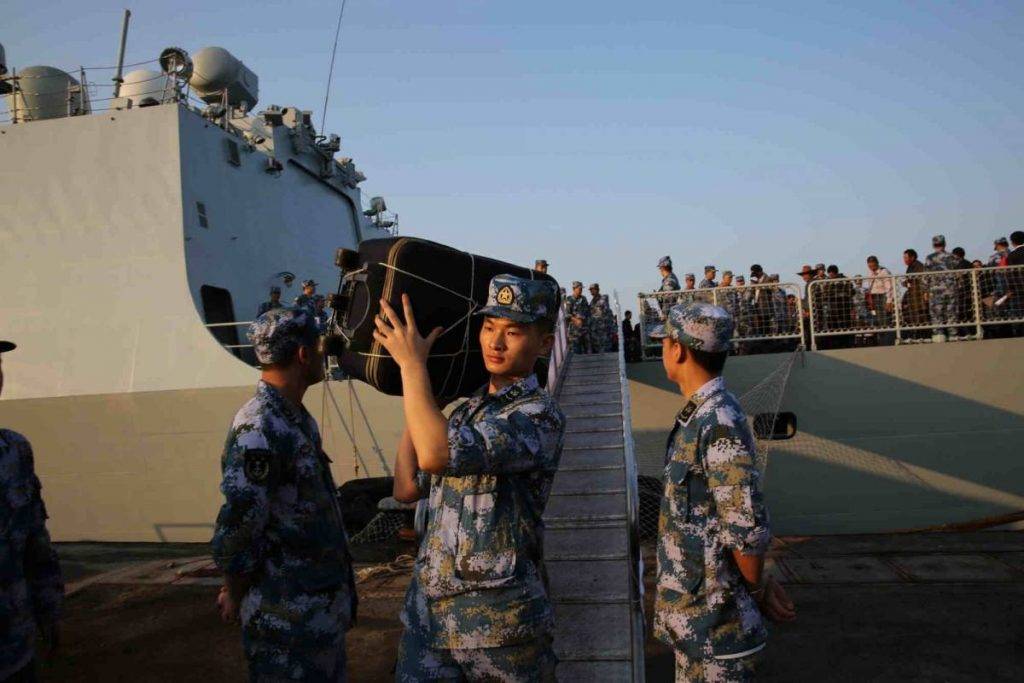

For those who resist the Chinese overtures, there has been cunning military coercion, both on the land front as well as in the maritime domain.

Harassment of vessels belonging to its maritime neighbours in the South China Sea, to the extent of endangering life through intentional collision, has been a regular affair in these waters.

The dastardly act of using improvised tools to kill Indian soldiers on their land borders was yet another viciously cunning act on the part of the Chinese People’s Liberation Army (PLA) in its continuum of cunning.

All claimed to be within the agreed terms and without firing a shot, yet lives were lost. Such actions by the Chinese forces seem to suggest employment of vicious tactics to undercut the benign spirit of agreements signed in good faith, while claiming to operate within its textual content.

Trust China to honour its commitment, but watch out for its surreptitious approach to undermine the same.

Beyond its borders, the Chinese leadership has truly excelled in the use of economic tools to advance its interests. The Belt and Road Initiative (BRI) is conveniently bejeweled with grandiose infrastructure projects and lucrative loans.

However, in the overall scheme, the BRI behemoth is ultimately aimed at facilitating Chinese access to resources and markets. Contribution of BRI to local economic development and other advertised benefits, if any, are at best consequential.

Loans offered towards infrastructural developments are not without riders. Interestingly, the sheer size of Chinese economy offers it a cushion to absorb minor debt. The heavy loans thrust by China, if paid, are welcome, and if not, there’s always opportunity for economic and strategic entrapment.

Either ways, it’s a win-win situation for China. Several projects are already bleeding money and the initially enthusiastic host states are finding themselves under burgeoning debt, spiraling towards an increasingly helpless situation at the mercy of the Dragon.

Liberal democracies might stand a chance at course correction due to inherent dynamism in the governing processes. However, states with a weaker democratic setup and monarchies would be most vulnerable to this economic onslaught.

Countries in the Gulf being absolute monarchies are relatively easy game for China. The region, although considered remote and non-core by a section of Chinese policy makers, has witnessed a noticeable rise in Chinese engagements over the past decade.

Heavy dependency of the Gulf states on Chinese energy imports for generating state revenue contributes substantially to Chinese economic clout in the region.

However, it is equally true that GCC countries remain weary and expect no hand holding from China in times of crisis. Consequentially, GCC countries tend to balance between China and the US for their economic and security needs.

For the time being, most of the oil rich members of GCC are expected to remain economically stable despite severe impact of the Covid-19 pandemic.

However, it may be interesting to note that the state of Oman seems to suggest otherwise. Oman remains precariously over-exposed to Chinese dependency for its economic needs. Vulnerability of this debt-ridden country has only amplified over years.

Despite measures at diversification away from its oil-based economy, Oman has managed only modest progress on this count.

With a promised $10.2 billion investment in its ambitious Duqm project, Oman sees a friend in China for its diversification plans. Oman has embraced the BRI under this grandiose promise, but on ground realisation is far from envisaged.

For Oman, more than 80 per cent of its oil is also exported to China, making the latter its essential source of revenue.

Oman’s borrowings from Chinese banks exceed $3.55 billion, the highest among GCC states. A substantial part of this would be due for payment in the coming year.

In December 2019, the Oman Electricity Transmission Company sold off 49 per cent of its stake to the China National Electricity Grid Corporation for $1 billion.

Huawei, the ICT giant, is also making rapid inroads into Oman’s 5G setup. As it stands, China is slowly but steadily spreading its tentacles in Oman.

With large stakes in power sector, dominant presence in ICT and associated infrastructure, fiscal influence due to loans and promise for future investments, the Dragon is clearly inching towards a greater influence on Oman.

Its recent gift of Covid vaccines to Oman, which came with a rider of prioritising Chinese citizens over others, clearly highlights the glitch in its generosity.

Limited oil reserves, fluctuating oil prices and demand, slowdown due to Covid-19, increasing pressure on the social schemes and job creation programmes in country, and rising budget deficit makes Oman most vulnerable to economic opportunism by China.

Oman this year has already received some financial assistance from its neighbours, but remains on the lookout for more. As its fiscal fate hangs in balance, who would bail out Oman remains to be seen.

Chinese hawks could very well jump at the opportunity of bagging yet another strategically located and economically vulnerable prey in its treacherous trap. As the dragon makes inroads in the Middle East, there would be more to swallow.