The central banks of other gulf nations have revised their benchmark borrowing rates following the US Federal Reserve decision…reports Asian Lite News

The Central Bank of Bahrain (CBB) has decided to raise its key policy interest rate. CBB’s key policy interest rate on the one-week deposit facility is raised from 1.75% to 2.50%.

The decision is in light of the development of the international financial market and the continuous measures taken by the CBB to ensure the smooth functioning of the money markets in the Kingdom, Bahrain News Agency (BNA) reported.

The Bank has also decided to raise the overnight deposit rate from 1.50% to 2.25%, the four-week deposit rate from 2.50% to 3.25% and the lending rates from 3.00% to 3.75%.

The CBB continues to monitor global and local market developments closely in order to take any further necessary actions to maintain monetary and financial stability in the Kingdom.

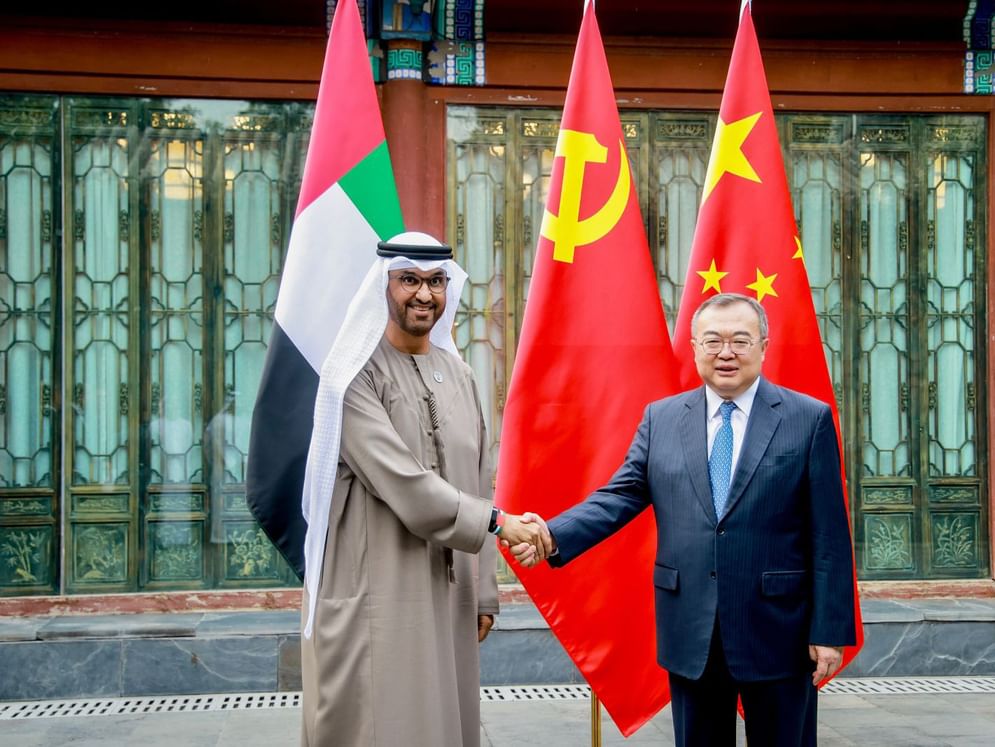

ALSO READ:UAE leaders receive Moon mission team

The central banks of Saudi Arabia, Qatar and Kuwait too fell in line with the rate hikes to reflect the Fed decision.

In line with the goal of the Saudi Central Bank to maintain monetary and financial stability, and in light of local and global developments, the Saudi Central Bank decided to raise the rate of “repo” agreements by 0.5% from 1.75 to 2.25%, as well as raising the rate of reverse repurchase agreements (RRP) by 0.5% from 1.25 to 1.75%., the Saudi Press Agency, said in a report.