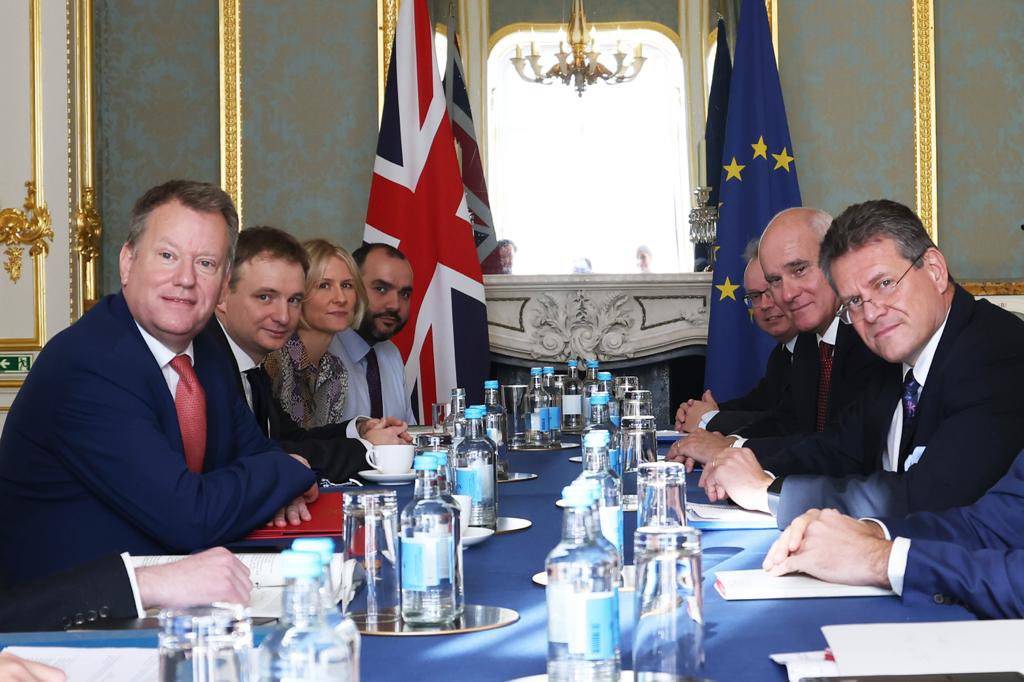

Britain and EU have been trying for months to overcome a deadlock over the Northern Ireland protocol, which sets the trading rules for the British region that London agreed before it left the European Union…reports Asian Lite News

Britain and the European Union are at an impasse over changes to parts of the Brexit deal governing trade with Northern Ireland, Britain’s Europe minister James Cleverly told a parliamentary committee on Thursday.

The two sides have been trying for months to overcome a deadlock over the Northern Ireland protocol, which sets the trading rules for the British region that London agreed before it left the EU but now says are unworkable.

Britain’s EU withdrawal pact effectively left Northern Ireland within the EU’s single market and customs union given its open border with EU member Ireland, though in so doing raised some barriers to trade between Northern Ireland and the rest of the United Kingdom.

“The truth is that we have come to something of an impasse, and I don’t think that’s through a lack of goodwill, and I think it’s more through what we regard in the UK as an overly limited (EU) negotiating mandate,” he said.

The government argues the deal in its current form is causing friction to trade between Britain and Northern Ireland, and in turn threatening the 1998 peace agreement that mostly ended three decades of sectarian violence in the province.

Britain has previously argued it has grounds to trigger a clause in the deal allowing parts of the Brexit treaty to be abandoned – a move that could badly damage an already fragile diplomatic and economic relationship with the EU.

“The situation as we now see it is not working,” Cleverly said. “It is not doing what it was meant to do, which is to protect equally north-south and east-west trade, and that, by extension, is causing community tensions in Northern Ireland.” Cleverly said he still hoped to reach a negotiated deal with the EU. He declined to comment on media reports that the government was preparing legislation that would unilaterally overrule parts of the Brexit deal.

But, he did say that pressure to find a way forward was mounting and Prime Minister Boris Johnson had been clear on the need to look at ways to alleviate the tension caused by the current arrangements.

“We’re looking at a range of options about what we can do to ease these tensions,” Cleverly said.

Perceptions that the protocol erodes Northern Ireland’s place in the United Kingdom has sparked anger in pro-British communities, helped fuel some street violence last year.

However, a majority in Northern Ireland voted in favour of remaining in the EU in the 2016 referendum that resulted in a national 52%-48% margin in favour of leaving the bloc.

Closer US ties may ‘reboot’ UK finance

Britain should move further and faster in reforming its financial rules to ‘reboot’ after Brexit and rethink the “anti-competitive” tax system on banks, top bankers and think-tanks said on Thursday.

Britain has already launched over 30 public consultations, including on reforming insurance rules on Thursday, to keep London a globally competitive financial centre after being largely cut off from the European Union due to Brexit.

“The debate has moved on from alignment with the EU in exchange for future access. Instead, the UK should focus on closer alignment and cooperation with the U.S. and with other markets around the world,” a joint report from New Financial in London and the Atlantic Council in Washington said.

Britain should focus on “low-hanging fruit” such as faster tweaking of inappropriate rules inherited from the EU, but be wary of going above and beyond standards implemented internationally, the report said.

Banks have welcomed draft reforms so far but want a faster pace given that many will need legislation, which takes time.

Richard Gnodde, CEO of Goldman Sachs International, said he was not seeking a “bonfire of regulations” and Britain needed to look at how to be a global leader in new areas like crypto and carbon markets.

“Nothing is preordained. Those things are up for grabs. How do we secure them?” Gnodde said, adding that the new UK visa regime would help recruit top talent, but tax on banks needed a “lot of work”.

Anna Marie Dunn, EMEA CFO of JPMorgan bank, added that tax on banks in Britain was higher than elsewhere, which is “anti-competitive” and puts off banks from having assets in the UK.

The think-tanks’ report said Britain’s capital markets have the potential to grow by up to 40% if it can close the gap with the United States, this equates to an additional $75 billion annually.

Britain’s financial services minister John Glen told a launch event for the report that he shared its ambition for closer U.S. ties as he brought in “sweeping reforms” to sharpen London’s competitiveness.

ALSO READ-Biden, Modi to meet for Quad in Tokyo