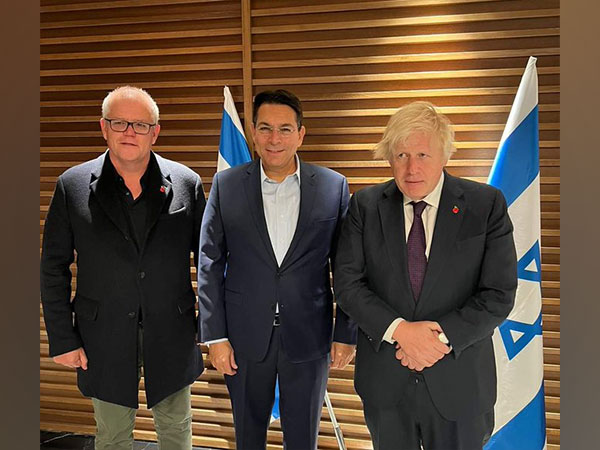

Changing these policies would “help millions realise the dream of home ownership”, Mr Johnson said…reports Asian Lite News

Prime Minister has pledged to “finish the right to own reforms” started by Margaret Thatcher in the 1980s. He said working people would be able to put housing benefits towards their first mortgage.

He told an audience in Blackpool that it would be easier for hard-working families to “put away a little every month” to save a deposit.

Mr Johnson said it was time to “turn benefits to bricks” in his speech as he aimed to rebuild his leadership after a confidence vote this week. But critics say the proposals are unworkable and would make the housing crisis worse, BBC reported.

In Monday’s confidence vote on Mr Johnson’s leadership, four in 10 Tory MPs backed getting rid of him, amid anger over widespread Covid rule-breaking in Downing Street during lockdown. There is also disquiet among Conservatives over the government’s decision to raise National Insurance, while the cost of living is soaring and the public finances have been battered by the expense of dealing with Covid.

Mr Johnson restated the government’s commitment to extending a home-buying scheme, known as right to buy, to housing association tenants. He said he wanted to extend it “within existing spending plans” and ensure a “one-for-one replacement” of each home sold.

The prime minister also said universal credit recipients would get to choose whether to spend their benefits on rent or put them towards a mortgage. The government will explore discounting Lifetime ISA and Help to Buy ISA savings from Universal Credit eligibility rules, Mr Johnson said. Currently, claimants are only eligible for universal credit if they have savings below £16,000, and Lifetime ISAs are included in this limit.

Changing these policies would “help millions realise the dream of home ownership”, Mr Johnson said.

Housing benefits, which help low-income or unemployed people pay their rent, cost the government around £30bn a year, much of which goes to private landlords. A person is not usually eligible for the payments if they have a mortgage.

There is already a shortage of social housing without selling properties – 1.1 million people are on waiting lists. The government has not revealed who will be able to take advantage of the scheme, how much it will cost and whether it will be capped

Commenting on plans to extend the right to buy scheme announced by the government, Tom Fyans, director of campaigns and policy at CPRE, the countryside charity, said: ‘Unfortunately, this is another example of a government rapidly losing touch with the realities of rural life. Extending right to buy will do nothing to address the rural affordable homes crisis because the problem is a lack of homes in the first place. There are 176,000 families in rural areas on social housing waiting lists. These are families that could be even further disadvantaged by housing associations being forced to sell their limited homes on the cheap.

‘The number one lesson of right to buy in a rural context is that it decimated rural social housing stocks. What low-income families need is hundreds of thousands more truly affordable homes to live in. Those living in the countryside are hampered by low wages and high house prices. That’s why the government needs to commit to building 145,000 social homes a year to fill the gap between supply and demand.

‘The demand for social housing is growing nearly six times faster than the rate of supply in rural areas. At current rates, the backlog of low-income families needing accommodation would take 121 years to clear. This is an utterly unsustainable situation and potentially selling off the few remaining housing association properties we do have will make a bad situation immeasurably worse.’