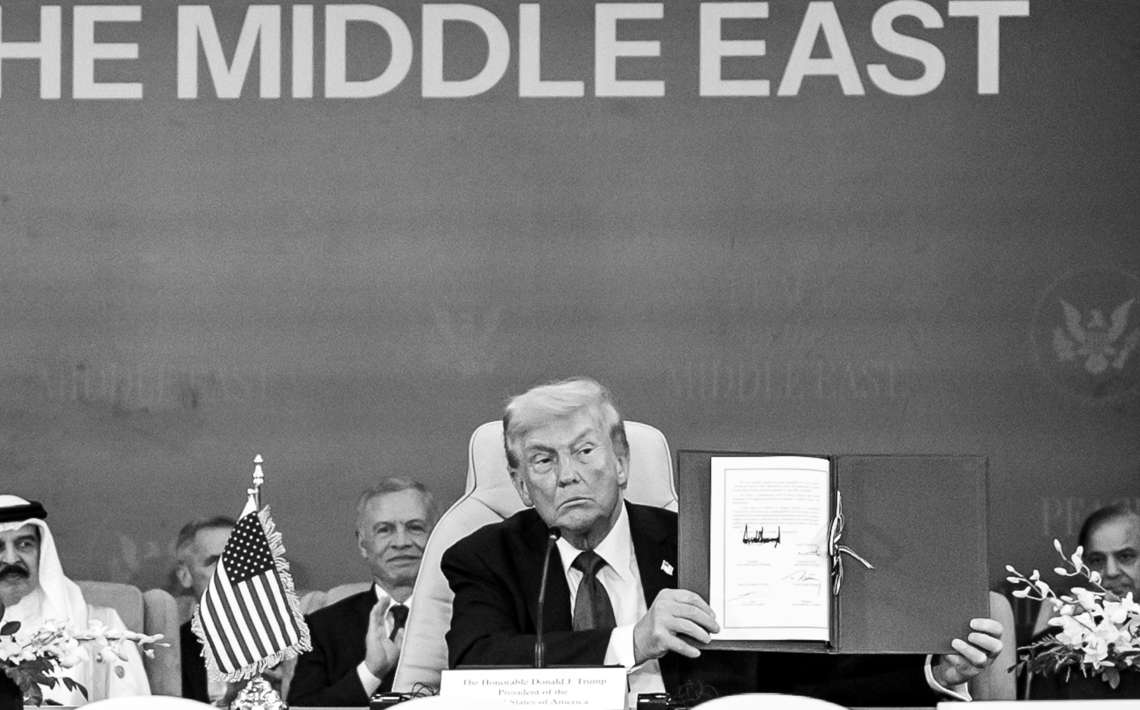

The China-Russia nexus is growing. Will America freeze China’s $3.2 trillion reserves lying with US treasuries to prevent another global disaster … writes Dr George K Simon

Russia’s attack on Ukraine on February 24 marked the beginning of World War III. That is what George Soros, American financier and founder of the Renaissance Foundation, said in an article. According to Soros, Russian President Vladimir Putin and Chinese President Xi Jinping released a large document declaring a close partnership between the two countries, UNIAN reported.

“I was surprised that Xi is clearly giving Putin carte blanche to invade and start a war against Ukraine,” Soros said.

“Putin, with Xi’s backing, has gone about pursuing his lifelong dream with incredible brutality. Putin will soon be 70 years old and he feels that if he wants to make a mark on Russian history, he must act now or never,” Soros wrote.

Another report says the US has information suggesting China has expressed willingness to provide Russia with requested military and financial assistance as part of its war on Ukraine. During a meeting in Rome, a top aide to President Joe Biden warned his Chinese counterpart Xi Jinping of “potential implications and consequences” for China should support for Russia be forthcoming, a senior administration official said. The series of events underscored the growing concern among American officials at the budding partnership between Moscow and Beijing as Biden works to isolate and punish Russia for its aggression in Ukraine.

While officials have said the Chinese President was alarmed at what has taken place since Russia invaded, there is little to indicate China is prepared to cut off its support entirely, CNN reported. That leaves open a troubling possibility for American officials — that China may help prolong a bloody conflict that is increasingly killing civilians, while also cementing an authoritarian alliance in direct competition with the US, the report said.

The China-Russia nexus is growing. Will America freeze China’s $3.2 trillion reserves lying with US treasuries to prevent another global disaster? China will rescue the sanctions-riddled Moscow at this phase. Its plan to economically support Russia through Renminbi-Rouble transactions will materialise or not is in the realm of speculation as there is a fear that Beijing’s $3.2 trillion reserves lying in US treasuries will almost freeze if it continues with any business deal with Moscow.

ALSO READ: Russia may be behind cyberattack in Ukraine

In the initial days of the Ukraine war, China had refused to term the Russian assault on the East European country an “invasion” and had condemned the US-led sanctions on Moscow. But at the same time, it distanced itself from recognising Donetsk and Lugansk—Ukraine’s rebel territories whose independence Russia recognised 72 hours before war on the East European country on February 24.

Then in the middle of Russia’s attack on Ukraine, China-led Asian Infrastructure Investment Bank (AIIB) in which Moscow is also one of the partners, announced putting all activities relating to Russia and Belarus on hold.

However, before the world could take notice of it, the New Development Bank of the BRICS, in which all five countries, including Russia is an equal stake holder, announced putting all new transactions with Russia on hold citing unfolding uncertainties and restrictions amidst war on Ukraine.

China, which has twice abstained from voting against Russia’s aggression on Ukraine in the UNSC, has a habit of creating a diplomatic miasma. The international community has seen such uniqueness of China’s character in the case of Afghanistan and Myanmar in the recent past.

In particular, in the case of Afghanistan, it appeared that China would play a lead role by recognising the Taliban-led government in Kabul. Every step taken by Beijing, post the US withdrawal from Afghanistan, gave an impression that China would fill the void left by America in the insurgency-hit country.

Nearly eight months have passed since the US left Afghanistan, China is yet to step in the landlocked nation with meaningful help for the Afghan people. China was the first foreign country to pledge emergency humanitarian aid of worth 200 million yuan to Afghanistan.

This is exactly what China is doing in respect to the Ukraine crisis. It condemned the US’ recent decision to expel 12 Russian diplomats of the Russian Permanent Mission to the UN. On the other hand, to show the world that it is against attack on a sovereign country, it repeatedly says, “We always advocate respect for the sovereignty and territorial integrity of all countries, and peaceful resolution of international disputes based on the purposes and principles of the UN Charter.”

In hindsight, it is seen as China’s criticism of Russia for its invasion of Ukraine. It is also seen as Beijing’s balancing act. For the sake of a market and dollar-centric international financial system, it doesn’t want to jeopardise its relations with the European Union and the US. It knows its economy is not in good health. Chinese leaders have themselves set a target of achieving around 5.5 per cent growth in 2022—the lowest in 30 years, yet higher than what analysts have predicted about the Chinese economy.

According to a conservative estimate, the Chinese economy will grow about 4 per cent in 2022. Goldman Sachs has already cut its 2022 forecast for China’s economic growth to 4.3 per cent down from 4.8 per cent previously. Nomura, the Japanese financial holding company, has also predicted 4.3 per cent growth for China’s economy in 2022.

The World Bank has predicted that the Chinese economy will grow to 5.1 per cent in 2022. The Bretton Woods institution has further warned that high debt, persistent supply chain bottlenecks and coronavirus-related restrictions will jeopardize China’s economic activity. Similarly, the International Monetary Fund has projected 4.8 per cent growth for the world’s second-largest economy in 2022 and 5.2 per cent in 2023. In its latest report, the IMF has cited Covid-19 outbreak’s effect on consumer spending and a property market downturn as the reason for the slow growth of the Chinese economy.

In this backdrop, if China wishes to avowedly continue with economic engagement with Russia which has been slapped with umpteen numbers of sanctions, it will find deep in the morass of problem, warn several analysts. From freezing the assets of Russia’s central bank (limiting its ability to access $630 billion of its dollar reserves) to removing its banks from the SWIFT messaging system to banning people and businesses from dealing with its financial institutions to markets to banning imports of gas and oil—are among notable penalties that the US and its western alliance have imposed on Moscow. Those countries which wish to engage with Russia, politically, financially, militarily or in the field of science & technology and space will get themselves shadowed by such harsh sanctions.

But then for China, the Ukrainian crisis has given an opportunity to play its game nonchalantly. It wants to weaken US alliances in Europe and the Indo-Pacific, while at the same time cutting to size America’s global dominance—all this without harming its own economic interests and hitting its relations with the US and the West. It endorses Russia’s stand that the US and NATO are responsible for the war on Ukraine. China’s Foreign Ministry Spokesperson Zhao Lijian in his recent press briefing quoted several experts on Ukraine as saying that “objective and rational assessments have failed to be incorporated into the policy of the US, the West and NATO.” He also said that Russia’s legitimate security demands ought to be taken seriously and properly.

All this along, there is an attempt by China to distance itself from Russia. Chinese Foreign Minister Wang Yi decried Russia’s scale of attack and resultant humanitarian crisis in Ukraine. He said that it is absolutely imperative for all sides to exercise restraint to prevent the conflict from “getting out of control.”

Amidst this, China’s largest state-owned banks have restricted financing for the purchase of Russian commodities. Industrial & Commercial Bank of China (ICBC) have stopped issuing US dollar-denominated letters of credit for the purchase of Russian commodities. The Bank of China has also stopped financing for Russian commodities. However, till date, there is no announcement from China on Renminbi-Rouble transactions. There is a suspicion that China will continue with this mode of financial transaction—all this behind the curtain and away from the international community’s scrutinizing eyes.