Debt Africa owes China is persistently on the rise with an annual infrastructure financing deficit of more than USD 93 billion….reports Asian Lite News

The impact of Chinese loans in Africa is far more complex than it is often portrayed.

Online research paper, IJSER reported that some scholars argue that Chinese loans have created a debt trap in Africa, and China is leveraging on the debt trap to strategically penetrate Africa’s political landscape.

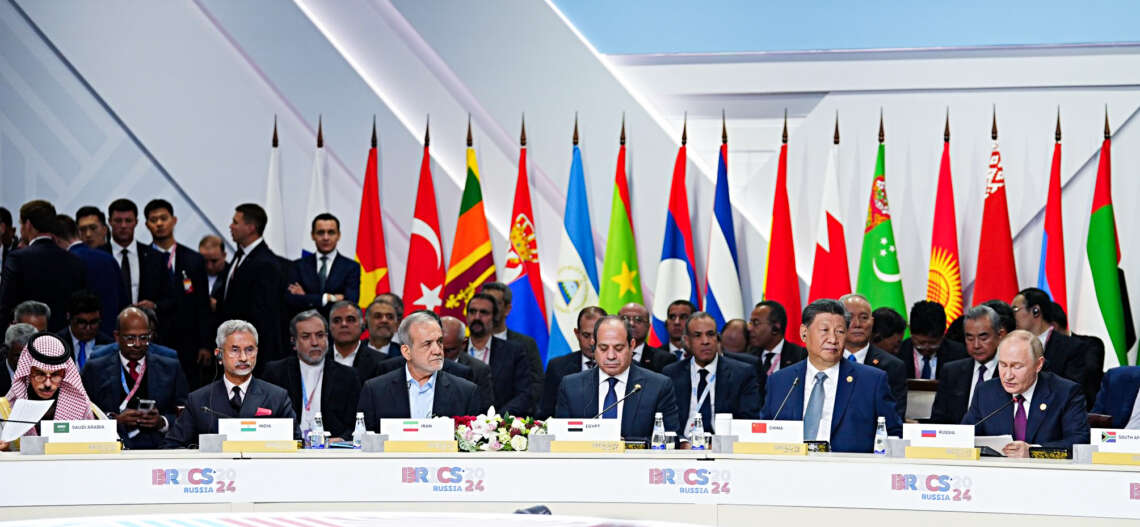

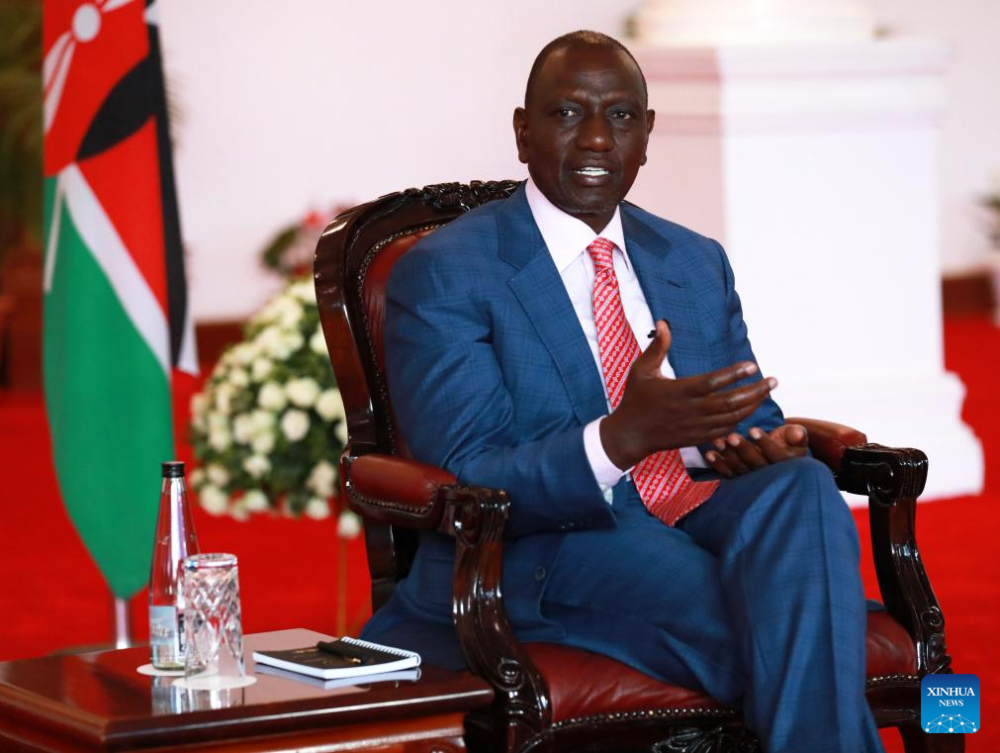

China has recently emerged as a major lender in more than 32 African countries including Angola (USD 21.5 billion in 2017), Ethiopia (USD 13.7 billion), Kenya (USD 9.8 billion), Republic of Congo (USD 7.42 billion), Cameroon (USD 5.57 billion)1and Zambia reaching USD 11.2 billion in 2019.

Notwithstanding, debt Africa owes China is persistently on the rise with an annual infrastructure financing deficit of more than USD 93 billion.

According to SAIS-CARI researchers, Chinese financiers have so far committed more than USD 153 billion to African public sector borrowers between 2000 and 2019. This is likely going to continue to drive debt on the continent.

Research historically has shown that soaring debt has the ability to compromise the sovereignty of African states, owing to the complexity of corruption and frequent political instability in the continent, IJSER reported.

Scholars argue that even the “aid” that China offers to promote education in Africa has severe colonial implications. For example, the thousands of scholarships that China offers to African students to study in various Chinese universities are aimed at shaping and cultivating Africa’s next generation of leaders to remain loyal to future Chinese policies toward Africa.

There is the contention that Chinese loans to Africa primarily provide business and employment opportunities for Chinese citizens and contractors to work overseas. This is because China often imposes most of the loans on infrastructure development in Africa.

The imposition is always in favour of Chinese companies which are mostly ‘state-owned enterprises’, in order to boost “China’s Going Out strategy” which maintains Chinese companies as contractors of various projects that are financed by Chinese loans, reported IJSER.

The companies, therefore, create employment opportunities for Chinese citizens in Africa. It feels like China gives out money with one hand and collects it back with another hand.

This is because when Chinese companies build infrastructure projects that are financed by Chinese loans in Africa, they deprived Africans of skills acquisition.

Moreover, the bulk of Chinese loans to Africa is offered with the intention to secure natural resources from Africa. China understands most African countries have low credit ratings in international financial systems.

China is saddling Africa with unsustainable debt with the intention of leveraging on debt to further its geopolitical control over the continent.

This is evident with the use of Chinese roads/traffic signs in several African cities such as Nairobi where China has constructed road networks, reported IJSER.

China is executing a modern form of colonialism at Africa’s expense in order to enable her to become a global player. China deploys troops to Africa in order to meet its mineral and oil needs.

An example is when the oilfields in Kordofan were imminent of an attack, the Chinese deployed soldiers to protect the oilfields and their economic interests. (ANI)