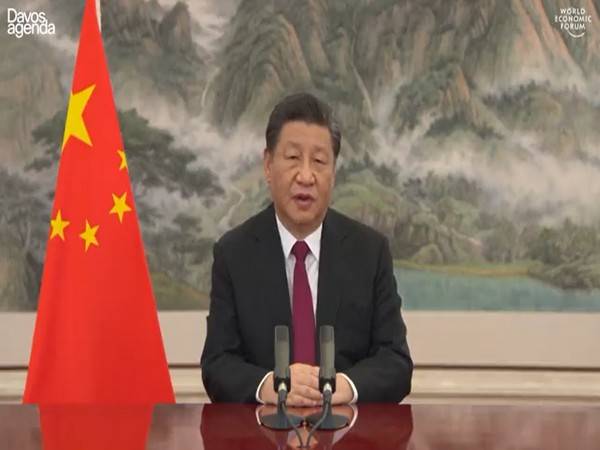

Highly unsustainable levels of debt created by China in the developing world allow it to create economic dependencies and political leverages in these countries….reports Asian Lite News

Pointing at the serious danger posed by China’s lending spree in poorer countries, particularly Africa, German Chancellor Olaf Scholz warned that this could plunge the world into the next financial crisis.

“There is a really serious danger that the next major debt crisis in the global south will stem from loans that China has granted worldwide and doesn’t have a full overview of because there are so many players involved,” Scholz said.

“That would then plunge both China and the global south into a major economic and financial crisis and, incidentally, would not leave the rest of the world unaffected, to put it politely. So, this is a serious concern,” he added.

China’s infamous “debt-trap” policy is singularly responsible for the dire economic situation in many countries. Highly unsustainable levels of debt created by China in the developing world allow it to create economic dependencies and political leverages in these countries.

China has always maintained that its overseas lending follows a “no-strings-attached” approach and respects other countries’ right to select “their own development path” with a focus on developing countries’ control.

“One of the very, very big ambitions we have is to bring China in, as a country that is lending a lot in new ways,” he said, reported Hong Kong Post.

It is interesting to note that while criticizing China for its loan lending approach to the poor economies, Scholz pointed to the European Union’s recently unveiled Global Gateway initiative, which is in part aimed at countering China’s influence.

As per this initiative, the EU aims to invest over 150 billion euros in Africa. The investment is set for many key areas ranging from renewable energy to transport, vaccine production and education.

The ambitious scheme is widely seen as a response to China’s mammoth Belt and Road infrastructure project. Though there is worldwide condemnation of China’s debt-trap policy, Beijing disputes the charge. China argues saying that with the help of its loans the country is trying to alleviate poverty, as per the media portal. (ANI)