The United Arab Emirates (UAE) on Tuesday offered to buy Pakistan’s minority shares in publicly-listed government-owned companies at a negotiated price along with a seat on each of the firm’s boards…reports Asian Lite News

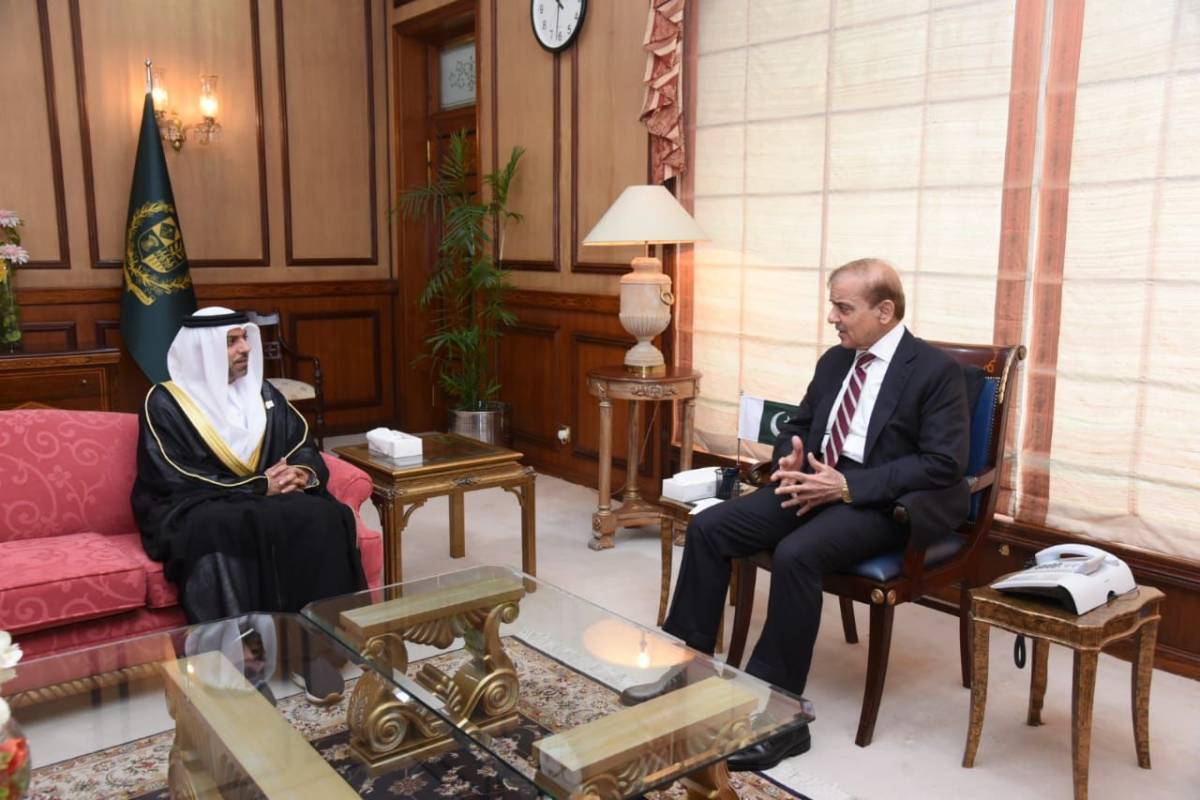

The offer comes as a response to Pakistan’s Prime Minister Shehbaz Sharif’s request for a multibillion dollars bailout package during his visit to the UAE in April and it could give a big boost to the cash-starved government marking a departure from the traditional lender-borrower relationship between Islamabad and Abu Dhabi, The Express Tribune reported.

A delegation was sent by the UAE to meet PM Sharif in the first week of May in Lahore.

The development takes place after China decided to rollover another $2 billion Pakistani debt that matures from June 27 to July 23.

The UAE government has offered to acquire 10-12 per cent shares in government-owned companies that are listed at the stock market through its sovereign wealth funds, the local media reported quoting sources.

Pakistan’s Finance Minister Miftah Ismail said, “There is a proposal from a friendly country to purchase Pakistani companies’ stocks on buy-back basis, which means buying secured-loan based securities.”

Pakistani authorities have not been able to come up with a firm response due to confusion over legality of such negotiated transactions.

Confusion over the legality of such negotiated transactions has caused a delay in a firm response by the Pakistani authorities.

The government wants to add a provision where it will have a right to buy back these stakes after a certain period, The Express Tribune reported citing sources.

Pakistan’s economy has been struggling and the country is trying to lock out a deal with the International Monetary Fund (IMF)

On Friday, the Shehbaz Sharif government increased the tax rates for the salaried class to fulfil the demand of the IMF.

ALSO READ:Modi, Sheikh Mohamed discuss strategic ties binding UAE and India

The Ministry of Finance high-ups disclosed to The News that all IMF’s demands on the fiscal front were almost fulfilled and now it was expected that the Fund staff would share a draft of the Memorandum of Financial and Economic Policies (MEFP) next week on Monday.

According to sources, Pakistan failed to pay back USD $2 billion loans received from the UAE in February 2019 and as a result, Abu Dhabi was not inclined to hand over another cheque of $2 billion to Islamabad. The UAE rolled over $2 billion debt for one more year in March.

It also mentioned that several UAE sovereign funds, which include the Abu Dhabi Investment Authority (ADIA) and Mubadala Investment Company or the Abu Dhabi National Oil Company (ADNOC), can take exposure in Pakistan. (ANI)