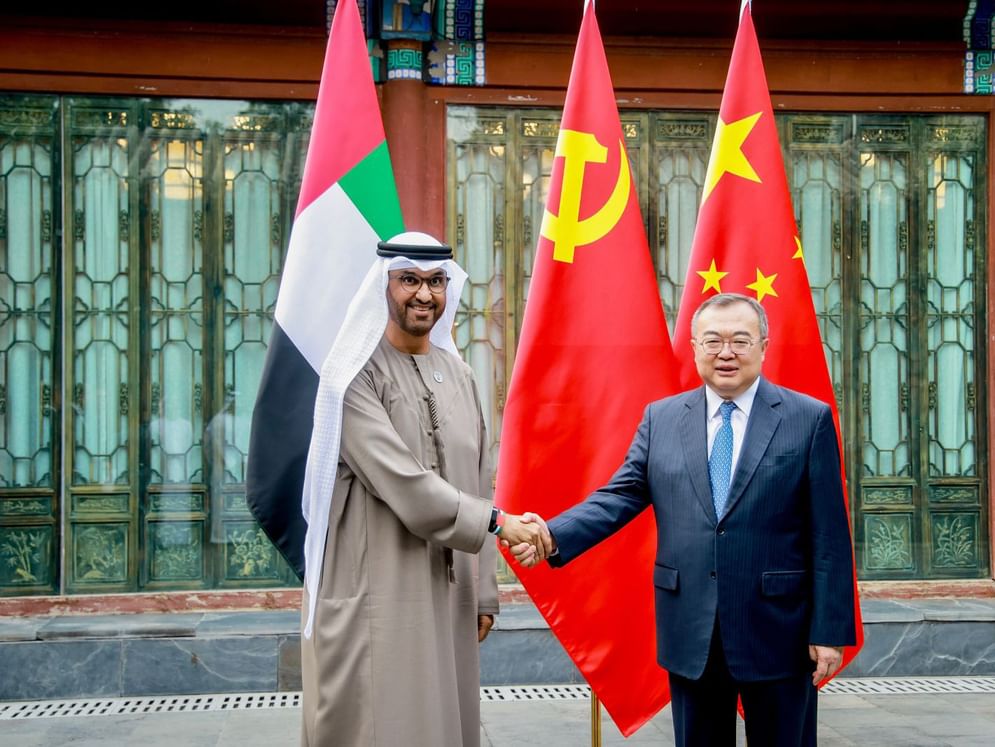

The UAE is aiming to sign 27 bilateral Comprehensive Economic Partnership Agreements with key trading partners, including eight this year.

Global trade, which hit a record high of US$28.5 trillion in 2021, is expected to grow steadily in 2022 and the coming years as a new era of multilateralism counters the impact of the slowing global economy.

As bilateral, regional, and multiparty trade deals are increasing, the UAE government is aiming to sign 27 bilateral Comprehensive Economic Partnership Agreements with key trading partners, including eight this year, as it looks to boost trade and foreign direct investment, according to Dubai Multi Commodities Centre’s (DMCC) latest Future of Trade 2022 report titled ‘A New Era of Multilateralism’.

Elsewhere, China and Taiwan’s stated bids to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, in addition to the United Kingdom’s ongoing accession process, offer opportunities for trade and bilateral investment.

While trade growth may be somewhat slower in 2022 compared to 2021, overall, there is reason for optimism, notwithstanding well-flagged issues such as the fallout from the war in Ukraine and from the pandemic, according to the report.

Pent-up demand from the COVID-19 shock is already driving trade in goods; a rebound in trade in services is set to follow.

“Beyond the immediate support from a rebound in pent-up demand from the COVID-19 shock, there are also more long-term changes underway that should support cross-border trade in the years ahead – these include increased regionalism, strength in services trade, innovation, and climate politics,” said Ahmed Bin Sulayem, Executive Chairman and Chief Executive Officer, DMCC.

“There is a joint imperative for the future of trade and the building of more crisis-resilient economies – financing the shortfalls in infrastructure and in trade finance. Tackling both in a way that is environmentally sustainable will be crucial. So too will be closing the digital divide between countries and sectors to bring the benefits of global trade to all,” he added.

Geopolitics, as ever, will shape the trade landscape in the 2020s, building on new developments in regionalism, bilateral trade, and global investment flows. Nationalist – as opposed to protectionist – trade policies are likely to continue to dominate. A new multilateralism is likely to take hold. Old forms of multilateralism are likely to fade, while new forms, such as increased regionalism, will drive cross-border trade in new sectors, including predominantly in digitalisation and sustainability.

Under the new trade paradigm, cross-border investment and trade will become increasingly market-seeking rather than efficiency-seeking. The intersection between trade liberalisation and digital transformation will continue to be a defining juncture, and the build-up of compatible and connective networks will be critical.

Developments in virtual assets, including central bank digital currencies, stand to reshape global finance, trade, and investment. Innovative technologies continue to drive productivity gains, sustainable development, and growth accelerations around the globe. Trade and technology will continue to seek synergies in 2022 and beyond.

“Robust global trade will help build resilience, sustainability, and economic growth in 2022 and beyond by providing countries with goods and services,” said Feryal Ahmadi, Chief Operating Officer, DMCC. “Global value-chain restructuring will continue to be a source of trade normalisation and of reinvigorating recovery in global growth and cross-border trade, facilitating economic diversification and allowing countries to be less dependent on a limited number of importers, exporters, and sectors.”

The Future of Trade 2022 report puts forward a number of key recommendations to business and government.

ALSO READ:First UAE Analog Mission completes successfully

According to the research, the new era of multilateralism will be shaped by three tectonic shifts in the global economy.

Firstly, there will be a natural migration towards lifting barriers as countries become increasingly sensitive to the costs of protectionism, which many countries saw de facto when the pandemic froze global trade.

Secondly, inflation will continue to climb, and central bank policy-tightening will become more pronounced to combat the rise in prices. This makes borrowing more expensive worldwide, lowering import demand and deteriorating export competitiveness.

Finally, global trade will be impacted by the climate crisis in terms of both the economic shocks and opportunities it will bring. While government intervention may be needed to limit potential economic losses, we should see increased demand growth for sustainable goods in both developed and developing economies, creating new opportunities for sustainable trade.