Now, the resumption of the Federal Reserve’s annual retreat in Grand Teton National Park signals something of a return to normalcy as the pandemic wanes…reports Asian Lite News

As the US central bank’s annual summer gathering is underway, the biggest worry will be that as the US dollar gets stronger, China might weaken yuan which will result in skyrocketing inflation.

The inflation talk is expected to dominate in the Jackson Hole, Wyoming meeting which kicked off Thursday evening.

According to Forbes, it is pertinent to note that since 1997, the central bankers gathering at the Jackson Hole summit had not gotten worried about Asia, however, the time has changed. Until now, Covid-19 kept the Federal Reserve System refrained from holding in-person conferences.

Now, the resumption of the Federal Reserve’s annual retreat in Grand Teton National Park signals something of a return to normalcy as the pandemic wanes. With the meeting underway, markets are on edge as Chairman Jerome Powell prepares to shed light on the Fed’s most dangerous inflation battle since the mid-1990s.

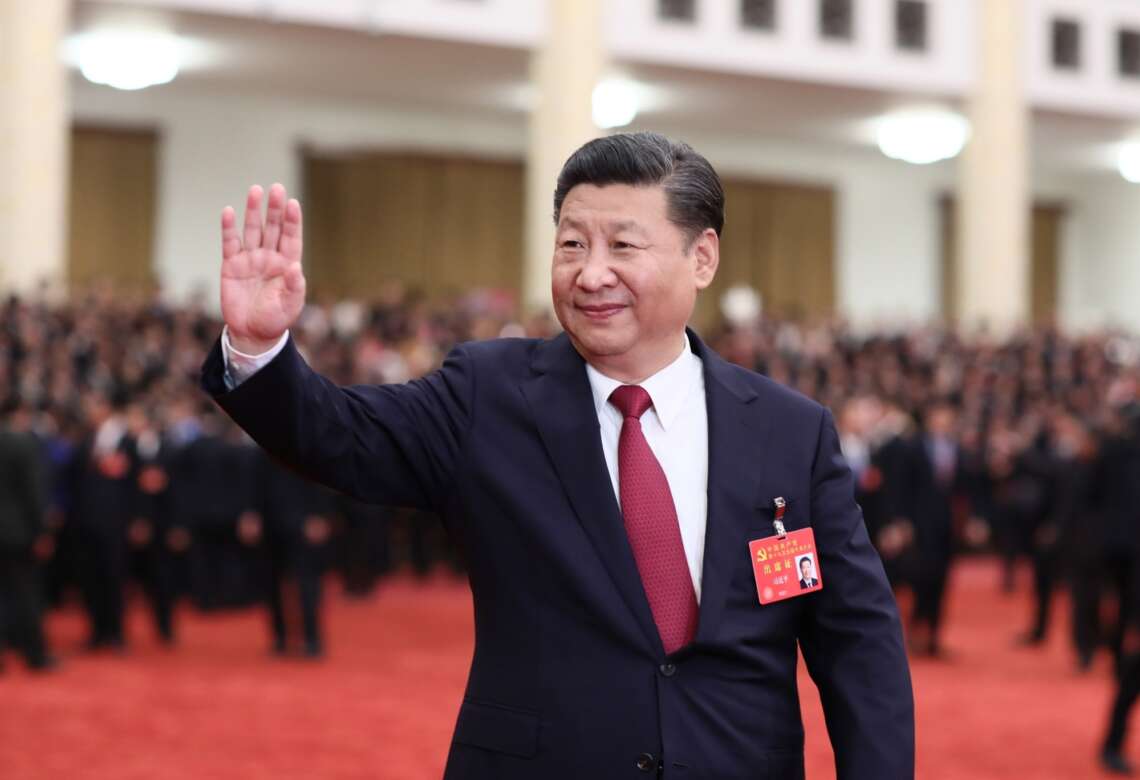

No serious economist thinks that Chinese President Xi Jinping’s economy will get anywhere near this year’s 5.5 PC growth target. In fact, the 0.4 pc expansion China eked out in the April-June quarter year-on-year suggests it will be lucky to get even halfway there.

Among the things concerning the economy in Asia is Xi’s obsession with massive “zero Covid” lockdowns. The policy is wildly out of sync with global efforts to adjust to more transmissible, but less deadly, coronavirus strains.

Now, as China stumbles, central bankers gathered in Jackson Hole are faced with their biggest Asia-related concerns in 25 years. The crisis began in Bangkok in July 1997 when a too-strong U.S. dollar prompted the Bank of Thailand to scrap the currency peg and devalue the baht.

The resulting chaos quickly pushed Indonesia into crisis and, later that year, South Korea, then a top-10 economy. By the time Fed officials welcomed counterparts from around the globe to Jackson Hole, stocks from New York to London to Tokyo had begun to tank, too.

One of the big worries then was that China might devalue the yuan. Thankfully, Beijing didn’t. But flash-forward 25 years and China’s troubles will be the 800-pound economic risk in the room. Any discussion of how much further the Powell Fed will tighten links to how higher U.S. yields will affect China’s path toward 2023.

The stronger the dollar gets against the yen, the more officials will worry Beijing might weaken the yuan, too. China’s uncertain trajectory is a much bigger problem for today’s global economy than it was in the late 1990s.

Back then, China wasn’t the largest trading nation or the generator of some USD 17 trillion worth of global GDP.

Suddenly, Beijing’s go-slow approach to fixing the country’s economic cracks these last 10 years is a clear and present danger to the economies of central bankers jetting into Wyoming this weekend. (ANI)