Chancellor and Prime Minister will have to answer a financial “black hole” that could be as large as £60bn – which may require up to £35bn of spending cuts and an extra £25bn raised through taxation…reports Asian Lite News

Jeremy Hunt will unveil his autumn statement on Thursday, where he will attempt to find up to £60bn from a combination of tax hikes and spending cuts to rebalance the books.

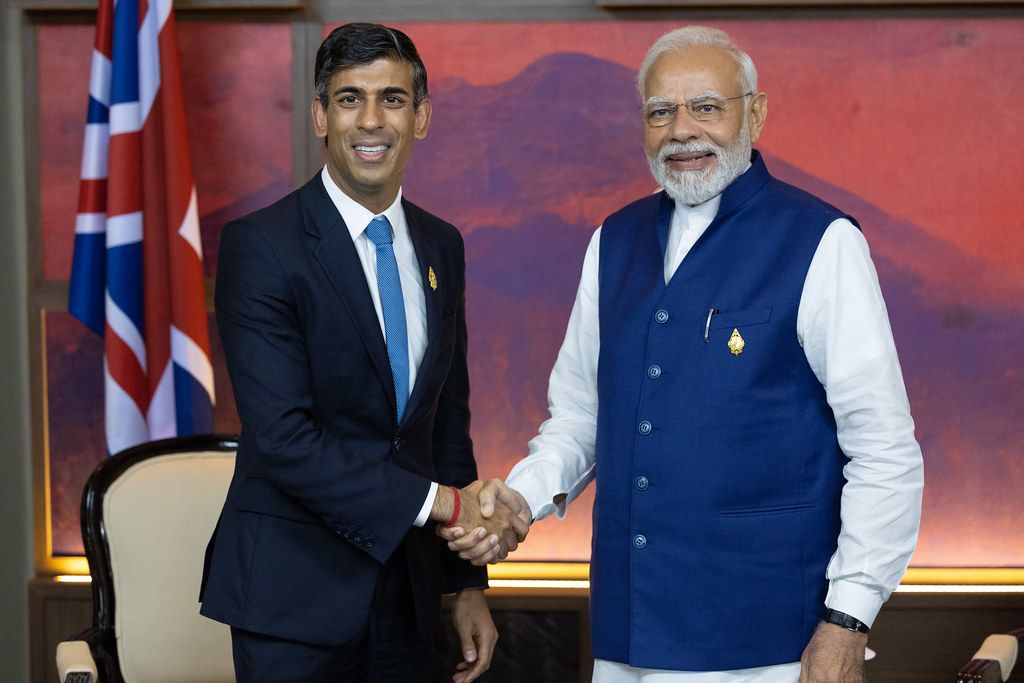

Both the chancellor and Prime Minister Rishi Sunak have warned that “difficult decisions” will need to be made in order to restore the UK’s economic credibility.

But speculation continues about what exact measures will form the autumn statement.

A report from the Resolution Foundation economic think tank has suggested Sunak and Hunt face a thankless task to rebalance the nation’s finances, with at least £40bn needing to be found by the government.

Treasury sources said the financial “black hole” could be as large as £60bn – which may require up to £35bn of spending cuts and an extra £25bn raised through taxation.

Minimum wage

Britain has a legal minimum wage which all firms should pay and all workers should receive which goes up every April.

With the cost of living soaring, there have been calls for the government to increase the minimum wage – officially known as the National Living Wage – by more than was planned in the autumn statement.

At present, the National Living Wage for over-23s is £9.50 an hour, for those aged 21-22 it is £9.18, for those aged 18-20 it is £6.83 and for those under-18 or apprentices it is £4.81.

The rates are the same across all parts of the UK.

Hunt will announce a rise in the National Living Wage for over-23s from £9.50 an hour to about £10.40 an hour.

The rise of nearly 10% would benefit around 2.5 million people, the original report in The Times said.

The newspaper also reports that eight million households will receive cost of living payments worth up to £1,100 a year.

Council tax

The Daily Telegraph has reported the government is also considering removing the requirement for local authorities to hold a referendum before increasing council tax by more than 2.99%, allowing them to raise significantly more money.

The new threshold could be 5%, according to the newspaper, which would see households in Band D paying up to £100 extra.

It could also mean that average council tax bills exceed £2,000 a year for the first time.

Under present rules, councils responsible for social care are allowed to increase their bills by 2.99%, including a 1% levy for social care.

If a local authority wants to raise bills any further, it must hold a local referendum.

But under new plans expected to be unveiled in the autumn statement, the maximum amount councils can increase bills without holding a referendum is expected to rise to 4.99% to help pay for social care.

Most councils are expected to take advantage of the freedom to charge residents more.

The Conservative Party manifesto in 2019 pledged to keep a veto on large council tax rises, insisting local people would “continue to have the final say”.

But a Treasury source told the Telegraph that councils need “more flexibility” to raise money.

The Telegraph has also suggested that the chancellor is considering plans to reduce the amount of funding received by councils for some of the services for refugees hosted by UK families.

Freezing tax thresholds

In the 2021 spring budget, Sunak, who was chancellor at the time, froze personal tax thresholds, which meant more low-income households had to pay the basic rate of income tax while those with earnings nearing £50,000 were made to pay the higher 40% rate.

The freezes were at the time forecast to last five years and raise billions for the Treasury by 2026, but it is thought this could be extended to 2028.

The Conservative Party’s winning 2019 manifesto promised to keep taxes low, so prolonging the freeze in the threshold at which workers start paying taxes is politically delicate ground for Mr Sunak’s government

However, it would send a signal the UK is committed to balancing its books over the long term.

Income tax

As chancellor, Sunak also promised to cut the basic rate of income tax to 19% in April 2024 and then to gradually reduce it to 16% by 2029.

While Truss’s government had said it would cut 1p of the basic rate of income tax from April 2023 – given the great need to cut the country’s debt, it is unclear whether or not this will be a pledge that is kept.

The Telegraph newspaper has suggested Hunt is planning on reverting to Sunak’s initial policy and planning a delay in the cut to the basic rate of income tax until 2024.

The cut could be completely off the table, however the Conservative Party’s commitment to keeping taxes low where possible suggests this is a less likely outcome.

The paper has also reported that ministers have discussed slashing the rate of income tax relief that is applied to higher rate taxpayers from 40p to 20p – which would mean millions of higher rate taxpayers could face paying more income tax.

Officials are also said to have discussed raising the top rate of income tax – which was 50p until it was abolished by former chancellor George Osborne in 2013.

But this is believed to be a less likely path for Sunak and Hunt to choose to go down.