After the court’s verdict in October, White House Press Secretary Karine Jean-Pierre said that the “temporary order” would not prevent borrowers from applying for student debt relief at the website….reports Asian Lite News

A Texas judge on Thursday blocked President Joe Biden’s student loan forgiveness program, which was already on hold as a federal appeals court in St. Louis considers a separate lawsuit by six states challenging it, media reported.

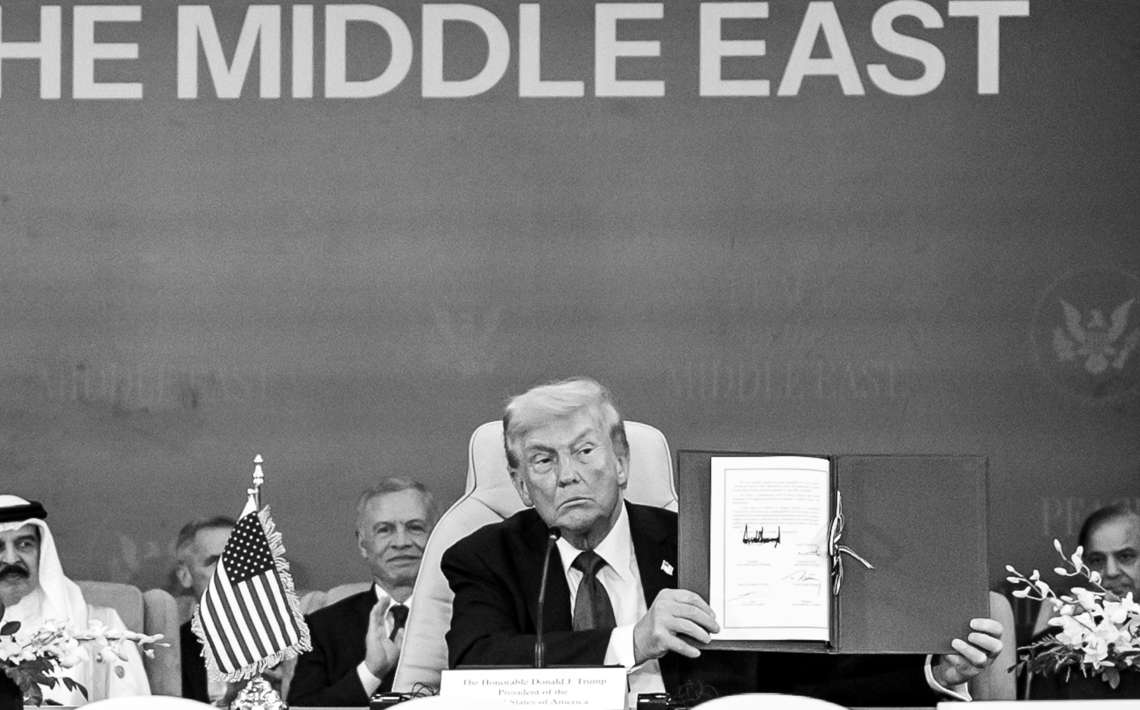

District Court Judge Mark Pittman, an appointee of former President Donald Trump based in Fort Worth, said the program usurped Congress’ power to make laws., the Associated Press reported.

“In this country, we are not ruled by an all-powerful executive with a pen and a phone. Instead, we are ruled by a Constitution that provides for three distinct and independent branches of government,” Pittman wrote.

He added: “The Court is not blind to the current political division in our country. But it is fundamental to the survival of our Republic that the separation of powers as outlined in our Constitution be preserved.”

In October, an order to temporarily block the program came from the 8th US Circuit Court of Appeals in reference to the case brought by six Republican-led states after a lower court ruled that their September lawsuit to stop the debt forgiveness program lacked standing.

After the court’s verdict in October, White House Press Secretary Karine Jean-Pierre said that the “temporary order” would not prevent borrowers from applying for student debt relief at the website.

“We encourage eligible borrowers to join the nearly 22 million Americans whose information the Department of Education already has. It also does not prevent us from reviewing these applications and preparing them for transmission to loan servicers,” Pierre said as quoted by a press statement released by the White House.

She also noted that the order does not reverse the trial court’s dismissal of the case, or suggest that the case has merit. It merely prevents debt from being discharged until the court makes a decision.

“We will continue to move full speed ahead in our preparations in compliance with this order. And, the Administration will continue to fight Republican officials suing to block our efforts to provide relief to working families,” the statement added.

Biden’s student loan forgiveness program was first announced in August with an intention to deliver debt relief to millions of borrowers before federal student loan payments resume in January after a nearly three-year, pandemic-related pause.

Borrowers are eligible for this relief if their individual income is less than $125,000 ($250,000 for married couples). No high-income individual or high-income household – in the top 5 per cent of incomes – will benefit from this action, according to the statement released by White House on August 24.