With this limited-period offer from PhonePe Payment Gateway, businesses across India that join the platform can save up to Rs 8 lakh. …reports Asian Lite News

Leading fintech company PhonePe on Wednesday announced that its Payment Gateway enables small and medium businesses to save up to Rs 8,00,000.

While most payment gateways charge a standard transaction fee of 2 per cent, the PhonePe Payment Gateway has a special offer for new merchants to onboard for free, with no hidden charges, setup fees, or annual maintenance fees. For instance, if businesses with a monthly sales volume of Rs 1 crore choose the PhonePe Payment Gateway for free, they could potentially save around Rs 2 lakh per month.

With this limited-period offer from PhonePe Payment Gateway, businesses across India that join the platform can save up to Rs 8 lakh. This straightforward and transparent pricing helps merchants enhance their payment experience seamlessly, allowing them to invest the savings from onboarding costs into growing their businesses.

Talking about the true potential of PhonePe Payment Gateway, Suman Patra, Co-Founder, FlowerAura & Bakingo said: “As an e-commerce business, it is important to have a reliable payment gateway partner and we are happy to have PhonePe Payment Gateway as our growth partner because of their legacy and experience. PhonePe has helped us improve the customer experience, reduce drop-offs, and increase the overall success rate of payments. PhonePe’s smooth onboarding process and excellent merchant support have been key factors in our decision to continue working with them”.

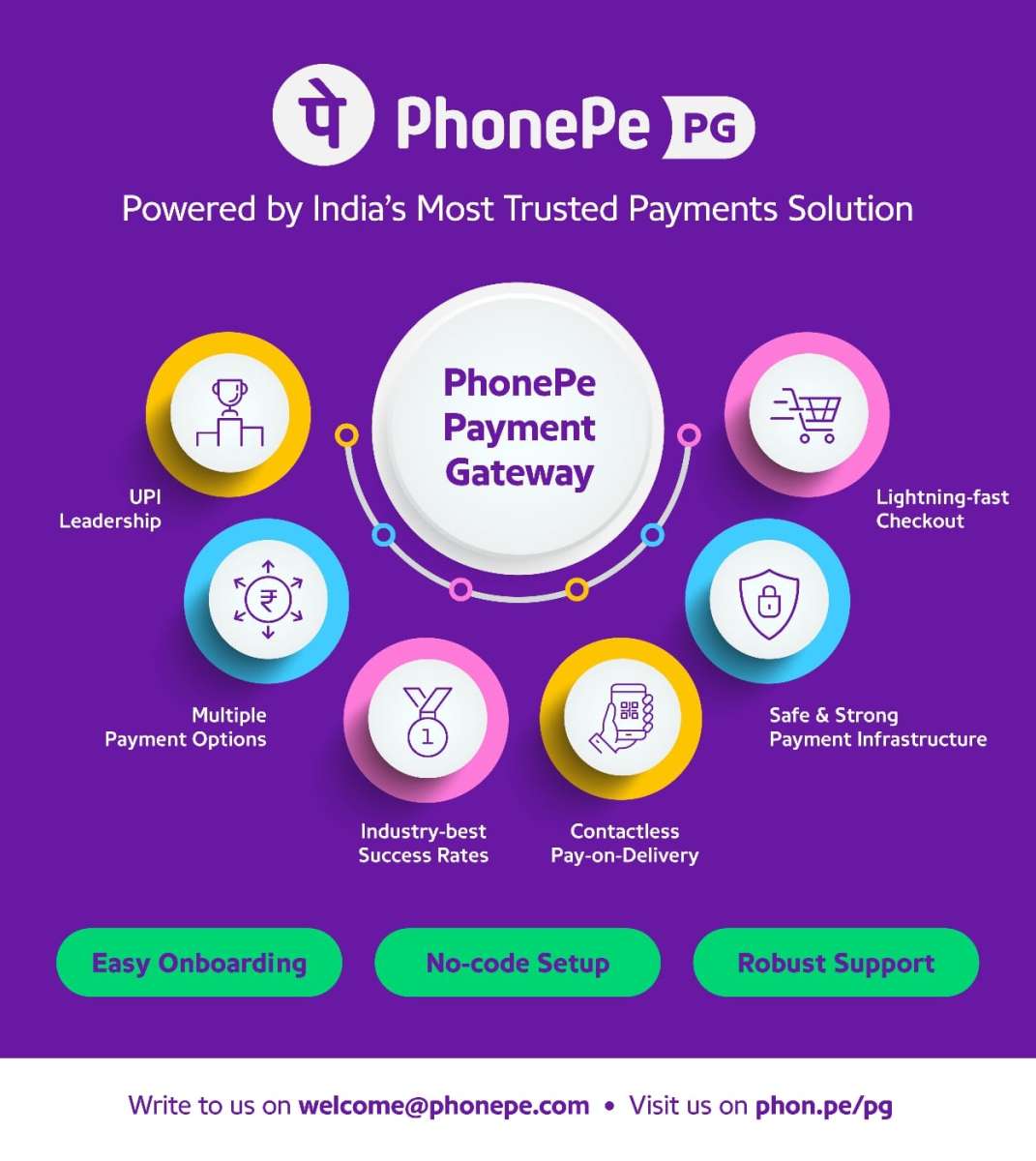

PhonePe is already a market leader in UPI with over 50 per cent market share by value. The company’s ability to handle large-scale transactions and the strong consumer trust in the platform have translated into PhonePe launching its Payment Gateway business to provide the best-in-class payment experience to consumers and merchants alike.

The ease of use to enhance merchant experience which includes effortless integration, digital self-onboarding, and a seamless checkout experience for customers is making the PhonePe Payment Gateway a preferred choice among businesses and MSMEs across the country.

Nishchay AG, Co-Founder & CEO at Jar shares his experience of working with PhonePe Payment Gateway’s best-in-class payment experience: “When we started Jar, we were clear from day one that we wanted PhonePe as our payment partner because of its reach and responsiveness. PhonePe’s massive distribution network makes it a lot easier for us because users are already UPI-ready.

“The Payment Gateway team at PhonePe has been very collaborative throughout and has been working together to continuously improve the overall systems, which has resulted in higher success rates for us.”

Moreover, the company said that the PhonePe Payment Gateway is reliable and ensures 100 per cent uptime for merchants and comes with industry-best success rates. It proactively detects downtimes and ensures stable success rates of transactions with real-time instrument health-tracking capability.

The PhonePe Payment Gateway is also preferred by merchants as it comes with a hassle-free, no-code setup for effortless integration across all platforms. PhonePe helps its merchant partners and businesses to accept online payments across Android, iOS, mobile web, and desktop.

The PhonePe Payment Gateway is in compliance with RBI Laws to securely store customers’ tokenised cards in the PhonePe Card Vault after taking consumer consent.