From Zero to 13 per cent of the global market! The kind of growth the pharma industry has seen in India, from a non-existent to a global pharmacy, is undoubtedly extraordinary. This impressive growth is an outcome of a series of sound legislation and economic environment, timely actions, and to the greater extent, the motive of welfare to the masses … writes Dr Rajesh Kurup

The Pharmaceutical industry in India has seen a massive expansion over the last few years. It is expected to reach about 13% of the size of the global pharma market while enhancing its quality, affordability, and innovation.

Performing as per its tag as the ‘pharmacy of the world’, India has been a global generic medicine supplier for over 200 countries from both developed and emerging markets. Moreover, India has attained recent traction for being the largest producer of vaccines in the world, contributing 60% to the world’s supply of vaccines. As per the report by McKinsey, a large presence of local players producing branded generics, along with lower price levels, has provided the Indian pharmaceutical industry with a unique opportunity.

The kind of growth the pharma industry has seen in India, from a non-existent to a global pharmacy, is undoubtedly extraordinary. This impressive growth is an outcome of a series of sound legislation and economic environment, timely actions, and to a greater extent, the motive of welfare to the masses.

It all began with the introduction of the Patents Act of 1970, leading to process patents instead of product patents. This implied that patenting was focused on manufacturing and not product patents. It enabled Indian pharma companies in three main ways. First, manufacturers engaged in manufacture drugs without paying patent holders’ exorbitant royalty.

Second, it allowed India to reduce dependence on drug imports and development of self-reliant Indian pharmaceutical industry. Third, the pharma industry boomed in India by developing affordable versions of patented drugs and gradually moved to the global market as a generic drug supplier.

However, after the WTO’s establishment, India signed TRIPS agreement and changed its patent norms. India then made a few amendments to its patent laws as the agreement required patents for pharmaceutical products and processes inventions. Despite the paradigm shift, India by that time experienced stellar progress in its pharma supply.

Cut to 2020, when the world grappled with the Covid-19 crisis, Indian pharma found an unprecedented window of opportunity. Combining expansion in R&D ecosystem with favourable policies, India became a major vaccine supplier to the world, ensuring self-reliance in vaccine provisioning.

India administered free vaccine doses to its citizens, reaching one billion marks. Besides acquiring its role as an important international player, India provided COVID-19-related medical assistance to over 150 countries.

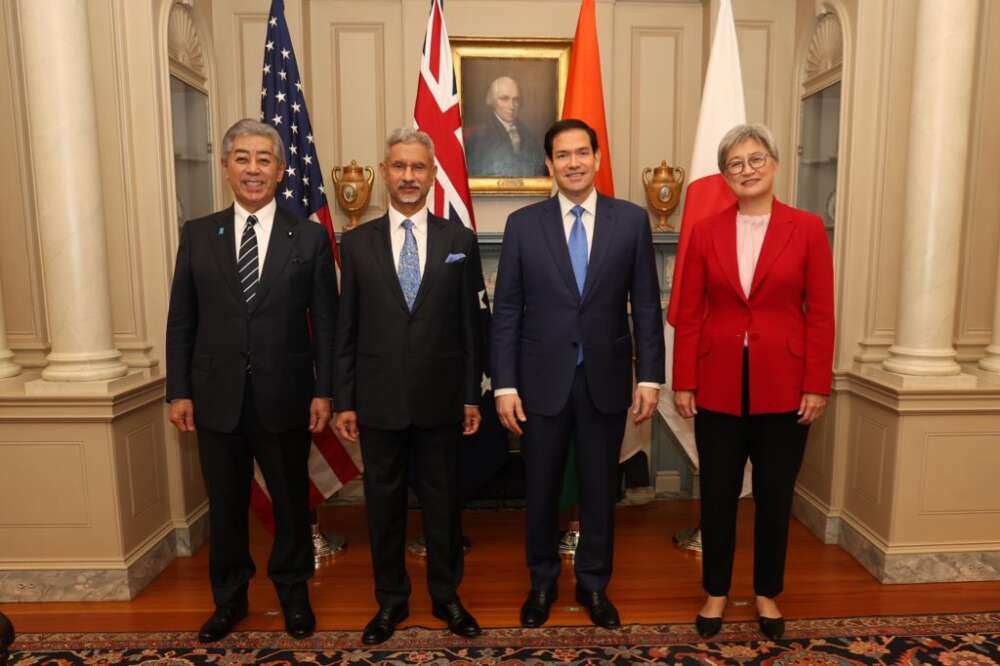

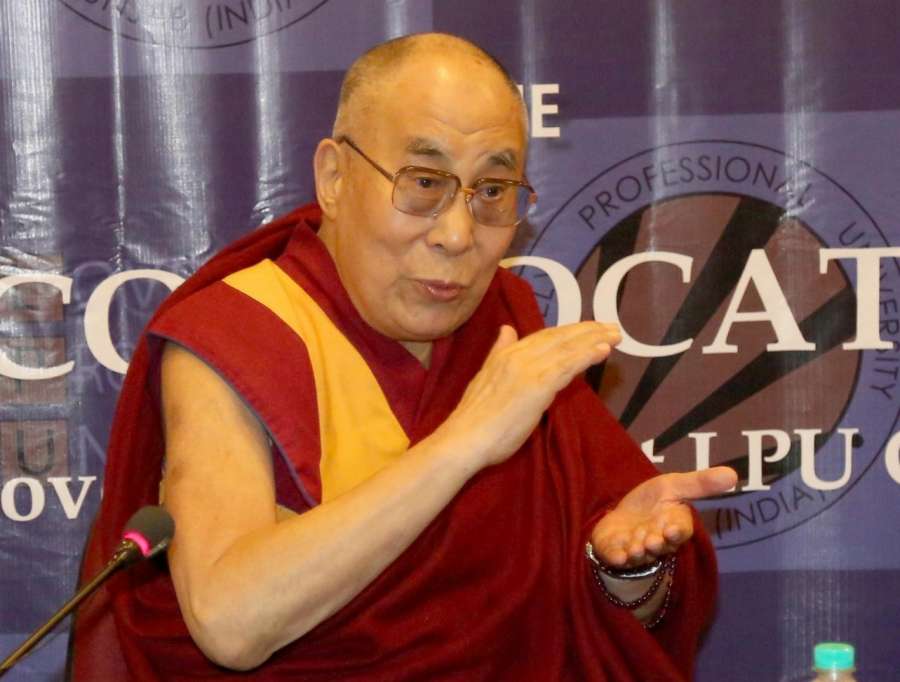

Sticking to its motto of Vasudhaiva Kutumbhakam, India started a Vaccine Maitri Programme in January 2021, supplying 72.3 million doses of COVID vaccine to more than 94 countries by the end of 2021. Many countries also preferred the Indian vaccine due to its low-cost vaccine development and ability to make large-scale export consignments, besides the effectiveness of vaccines. This was of special significance for low-income countries that could not compete with richer nations for vaccine procurement1 during the crisis. According to an expert, Indian pharma has learned to respond to the crisis by producing large-scale drugs quickly at short notice compared to any other country.

It is important to note that the boom for Indian pharma is not sporadic. It continues to experience sustained and robust growth in the post-pandemic period as well. By the end of 2022, Indian pharma has turned from volume to value creator. As per an expert, with a heightened sense of collaboration between the industry and the government, the industry’s focus has shifted to other diseases, the advancement of cell therapies, and policies for IP and government procurements. Cumulative FDI in the pharma sector was over USD 20 billion in September 2022. India is the largest vaccine supplier, with the Serum Institute of India producing 1.5 billion vaccines a year for polio, diphtheria, measles, mumps, and rubella to be used by the immunisation programmes across 170 countries.

Recently, the government of India extended support to pharma companies using the Production Linked Incentive (PLI) scheme to ensure self-reliance through enhanced domestic manufacturing capacity for high-value products.

The PLI schemes are for bulk drugs and pharmaceutical manufacturing, together accounting for an outlay of around USD 2.7 billion. Another important aspect of the pharma landscape in India is the stress on the welfare of the masses using its legislative provisions. Recently, the Indian Patent Office rejected the request for an extension of a patent by Johnson & Johnson for a TB drug on multiple grounds. This rejection is important in two respects. First, Indian manufacturers can produce a generic version of this anti-TB drug since the patent period has expired. Second, it allows the availability of a cheaper version of the drug, thus, strengthening India’s muscle power in combat against TB.

According to the legal scholar late Prof. Basheer, apart from providing a 20-year monopoly, Indian patent laws also come with the responsibility for the patentees to work for the public welfare ensuring that patented drugs are available in adequate quantities and prices. India’s public interest-oriented stance on drug patents has been at crossroads with the big pharmaceutical companies of the West, especially the US. These companies seek to do away with various aspects of the Indian Patent Act, the 1970s which they find a hurdle in establishing their monopoly and rent-seeking behaviour.

While the US pharma companies are against the Form 27 of IPA, 1970 which requires details on patent working in India, experts9 believe that information on working of a patent is essential to enquire if the act is successful in promoting innovation as well as public health.

In its practice, India has refused to grant secondary and ever-greening patents on slight modifications of the extant drugs, or new uses of existing medicines, and combinations of existing substances, much to the annoyance of big pharmas10. The big pharmas have often projected their monopoly interests as the acceptable international IP norms, and continue to pressurise the US government to act against India11. As per Brook Baker12, Professor at the North-eastern University, Indian patent laws focus on balancing producer as well as consumer interests. He has often called out the big pharmaceutical companies of the US for lobbying against India with their “disinformation campaigns” blaming India for discriminating against the US companies. Contrary to the propaganda, according to the Prof. Baker, India’s patent policies are in tandem with both domestic legislation as well as international norms laid by TRIPS.

Interestingly, the pharma industry in India is operating in a self-sustained model setup, ensuring that demand for drugs meets its supply. To put into perspective, India is keen on the promotion of the production of generic drugs. Now to ensure this supply meets the demand for generic drugs, the Indian government started PM Bhartiya Janaushadhi Pariyojana (PMBJP), in which Janaudhadi kendras (shops) sell generic drugs at affordable prices to the masses. By the end of 2022, more than 8,500 kendras were functional nationwide. Apart from reducing the out-of-pocket expenditure of the people, these kendras or medicine stores help create awareness about generic medicines, thus expanding the market for generic drug manufacturers and providing employment to entrepreneurs engaging in the establishment of kendras.

With the current valuation of USD 50 billion, the congenial government policies and the robust R&D expansion in the pharma sector are expected to lead to the path of resilient growth not just in volume but in value as well. The commitment of both the government and the pharma sector to ensure the abundant availability of quality medicines at reasonable prices provides India an opportunity to play a leading role in the global market with the special concern of welfare of masses.