With the China’s economy showing signs of upliftment with a projected 5% growth rate in 2023 the government wants to take baby steps towards any possible revival. Beijing knows that problem in hand ($12.6 trillion debt) is bigger than the solution provided but if the coffers are opened up in a haste the economy may go bust …. writes Rakesh Sharma

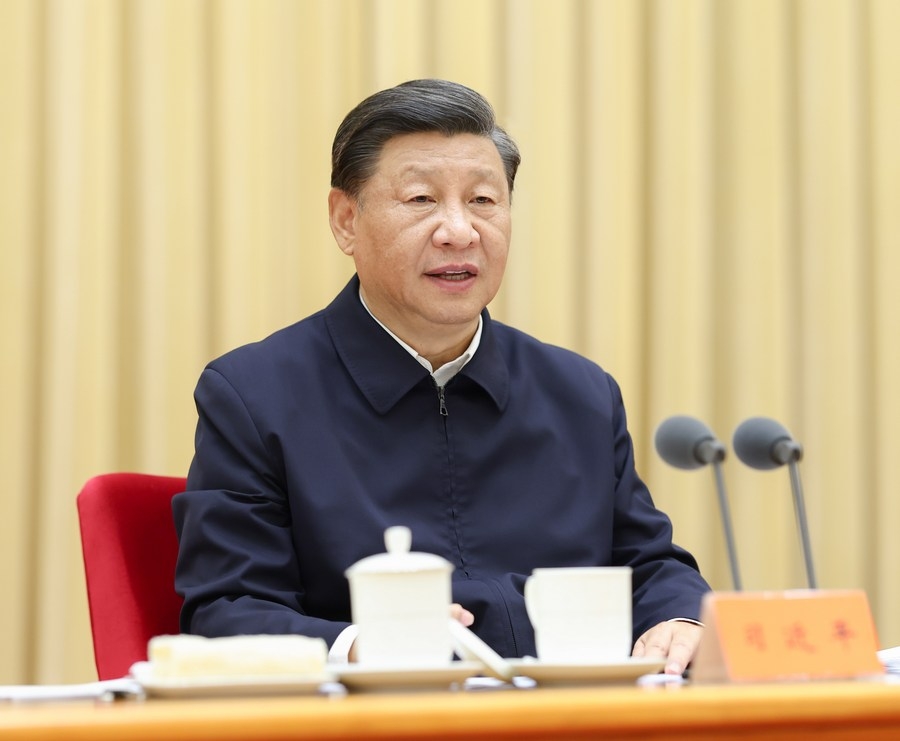

Xi Jinping has come to the rescue of its ailing economy by unleashing a stimulus package of one trillion yuan (135 billion dollars). The funds would be channelled down to local governments choked under the heavy pressure of debit of around 92 trillion yuan ($12.6 trillion dollars) sovereign bonds. Now, the question arises is: Is this too little too late? Or was this a gimmick to buy some more time for revival?

The Chinese lawmakers also cleared a bill that allows local governments to allocate part of their 2024 bond issuance quotas, which was not set yet. All these initiatives are the result of pre[1]planning done by the local governments to resolve the risks related to debt accumulation.

Whatever the proceeds the government will raise, half of them will be utilized in projects such as disaster management/relief and water infrastructure, with an intention to ease the slowing down of the economy.

With China’s economy showing signs of upliftment with a projected 5% growth rate in 2023 the government wants to take baby steps towards any possible revival. Beijing knows that the problem at hand ($12.6 trillion debt) is bigger than the solution provided but if the coffers are opened up in haste the economy may go bust.

The biggest challenge in front is the reshaping of the property sector in China, which makes up 30% of the country’s GDP. The government’s Three Red Lines policy has backfired as some of the country’s biggest property developers, like Evergrande and Country Garden, have taken huge debts from banks to build houses that have no takers and now these developers may turn bank defaulters due to non-payment. Again, with the loan defaulters increasing the Chinese banks too may buckle down under pressure. The shadow banking system of China is worth nearly $3 trillion and is currently experiencing the aftershocks of the bursting of the country’s property bubble.

China has many problems on hand but Xi’s gesture has shown a ray of hope. Zhu Min, former deputy governor of the People’s Bank of China, in his address to the media, informed that the government’s plan would have a “big impact” as it is following a structured approach. He argued that the stimulus package was clearly targeted at certain sectors that may come in handy in improving China’s competitiveness over the long run. The governments seem to have taken notice of loopholes in the system and this has given confidence to the investors and foreign forms that soon everything would fall in place.

“Top policymakers demonstrated their focus on the economy and financial market via various gestures today, which may help restore confidence to some degree,” analysts at Goldman Sachs said. The concern however remains what difference will the stimulus package will make and does it have the impact to address China’s underlying problems, primarily the property market and low levels of domestic consumption.

The experts also sense that Xi’s late intervention is actually not enough. China was already due for its yearly quota for bond issuance due to its large ongoing support for the economy. If the issuance had been delayed any further, central government funding was projected to fall sharply. This clearly indicates that though the investment is enough to maintain levels of government support, it cannot increase it.

Mark Williams, chief Asia economist at Capital Economics, resonating his views on the matter said: “The additional fiscal support approved today is the intervention we had been expecting and that was needed to prevent an abrupt fiscal tightening in China in the closing weeks of the year.”

“The new financing should sustain fiscal activity, but it won’t give it much of a boost. If all the new central government bonds are issued by the end of December, total government bond issuance in Q4 will still be lower than it was in Q3,” he further added.

The local governments have been directed to complete the issuance of the 2023 quota of 3.8 trillion yuan in special local bonds by September to fund infrastructure projects. Beijing has still not disclosed the size and amount of local governments’ 2024 frontloaded bond quotas.

Finally, this liquidity injection by Xi’s government looks more like a temporary solution and more is needed to reinvigorate China’s economy.