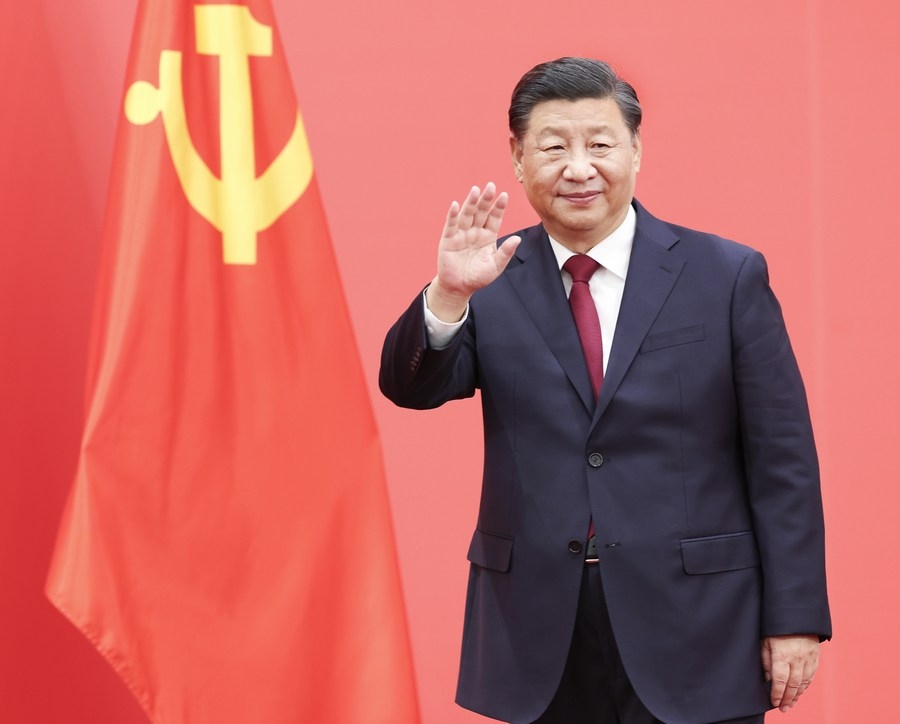

China is a major African trade partner and from 2012 to 2017, Chinese loans to countries in sub-Saharan Africa grew tenfold to more than $10bn per year..reports Asian Lite News

Witnessing the living example of Sri Lanka’s economic crisis, African countries, which are caught in China’s soft loan trap, are fearing that Beijing won’t bail them out, Pardafas.com reported.

China’s offer to ease Sri Lanka’s financial woes with a two-year moratorium on its debt repayments has shocked Sri Lanka and the global community with financial experts stating that the debt relief offered by China to Sri Lanka still falls short of the overall burden on the country. The Export-Import Bank of China has offered to ease Sri Lanka’s financial woes with a two-year moratorium on its debt repayments, according to a reviewed letter.

The economic meltdown and toppling of the Rajapaksa family regime in Sri Lanka has infused fear among South Africa countries.

According to Sri Lanka-based Daily Financial Times, experts and analysts opined that EXIM Bank’s outstanding debt is only $4,023 million whereas Sri Lanka owes a further $3,000 million to China including $2,950 million to China Development Bank (CDB).

This moratorium would enable Sri Lanka to seek a 2.9 billion US dollars loan from the International Monetary Fund, the Export-Import Bank of China said. China’s 2-year moratorium on debt payments is not in parity with IMF’s debt sustainability analysis of Sri Lanka with a 10-year debt moratorium and restructuring period of 15 years. Chinese EXIM banks have expressed their willingness to offer a 2-year debt moratorium. This would spell further economic pain for the Island nation.

According to analysts, “Ideally China, if it wants to live up to what it claims to be to Sri Lanka, it should give a broader expression of support in terms of debt relief. “Others opined that Sri Lanka will have to deal separately with CDB since it is categorized under “Commercial” creditors. The Export-Import Bank of China has offered to ease Sri Lanka’s financial woes with a two-year moratorium on its debt repayments, according to a reviewed letter.

China’s efforts to take advantage of its Belt and Road Initiative (BRI) to widen its economic and geopolitical clout has put at risk the already burdening yet developing countries having unsustainable debt by increasing their dependency on Communist China.

The media reports revealed that South Africa countries are worried about a vicious cycle of downgrades by the rating agencies, and rising trade imbalances.

Sri Lanka owes at least $7 billion to China in debt including loans from the Chinese Development Bank with the numbers reaching another level if private debt is also included. The Chinese high interest money was used to build unsustainable white elephant projects all over the country including Hambantota port, Mattala Rajapaksa International Airport and Norocholai power station.

The economic crisis in Sri Lanka is a lesson to Nepal, Bangladesh, Maldives and Myanmar and many African countries which have often fallen into Beijing’s debt trap. China’s efforts to take advantage of its Belt and Road Initiative (BRI) to widen its economic and geopolitical clout has put at risk the already burdening yet developing countries having unsustainable debt by increasing their dependency on Communist China.

China is a major African trade partner and from 2012 to 2017, Chinese loans to countries in sub-Saharan Africa grew tenfold to more than $10bn per year. From 2012 to 2017, Chinese loans to countries in sub-Saharan Africa grew tenfold to more than $10bn per year, it reported.

London-based international affairs policy institute Chatham House stated that 22 low-income African countries are either already in debt distress or at high risk of debt distress.

Chatham House in its recent report said that Africa’s total external debt increased more than fivefold between 2000 and 2020 to $696 billion – with Chinese lenders accounting for 12 per cent. “China did not cause African debt distress in most cases, but it is key to finding a solution,” it said.

An estimated 20 percent of African governments’ external debt is owed to China, according to the Jubilee Debt Campaign, a charity that wants the debts of developing countries to be written off. Around 40 percent of African countries are in debt distress compared with 2013, when 20 percent of African countries were at high risk of debt distress, World Finance reported.

Meanwhile, China has refuted accusations that its loans to African countries have created a “debt trap”, saying multilateral lenders and commercial creditors should carry the biggest blame for Africa’s debt troubles. Foreign Minister Qin Gang recently said that China’s projects and cooperation in Africa have contributed to the development of Africa and the improvement of people’s livelihood.”

In Africa, Ghana is facing debt troubles and has defaulted on its loan obligations, while Kenya plans to renegotiate the $5 billion in Chinese loans that it took to build a railway. Nairobi has asked China Exim Bank to extend the maturity period from 20 years to up to 50 years. Zambia, which in 2020 became the first African nation to default on loans, is renegotiating loan terms for its foreign debt, including borrowings from China.

ALSO READ-Pope’s Africa trip spotlights conflict, church’s future