The anti-China sentiment in Myanmar is strong as armed militias opposed to the military rule have been targeting Chinese projects….reports Asian Lite News

Chinese power companies are shutting down operations in Myanmar due to financial problems faced by the ostracised Myanmar military junta which is unable to pay dues to the power companies.

The Myanmar military, also called Tatmadaw, which seized power from the democratically elected government of President Aung San Suu Kyi in February 2021 faces a stringent global boycott. It also faces a drain on its resources as it continues to fight the People’s Defence Force (PDF) – a coalition of pro-democracy forces.

A report in The Irrawaddy says that three of the four China-backed liquefied natural gas (LNG) power plants in the strategically located Kyaukphyu township in western Myanmar have stopped work. The third power plant came to a stop recently after working intermittently since 2022.

Two power plants, which had stopped operations last year, have been dismantled and removed. All three were operated by a Hong Kong-listed power generation company – VPower, which continues to operate other plants in Myanmar.

The company’s fortunes fell after the military coup. The financial and economic woes that followed the coup include a banking crisis, shortage of funds with the power ministry and the decline in Myanmar’s currency Kyat against the US dollar.

Now these problems are hitting the China-Myanmar Economic Corridor (CMEC).

The South-East Asian country’s power ministry says that it can pay the Chinese power companies only in Kyats while power purchase agreements had mentioned dollar payments. VPower had signed the agreements with Suu Kyi’s government – the National League for Democracy (NLD) as far back as 2015.

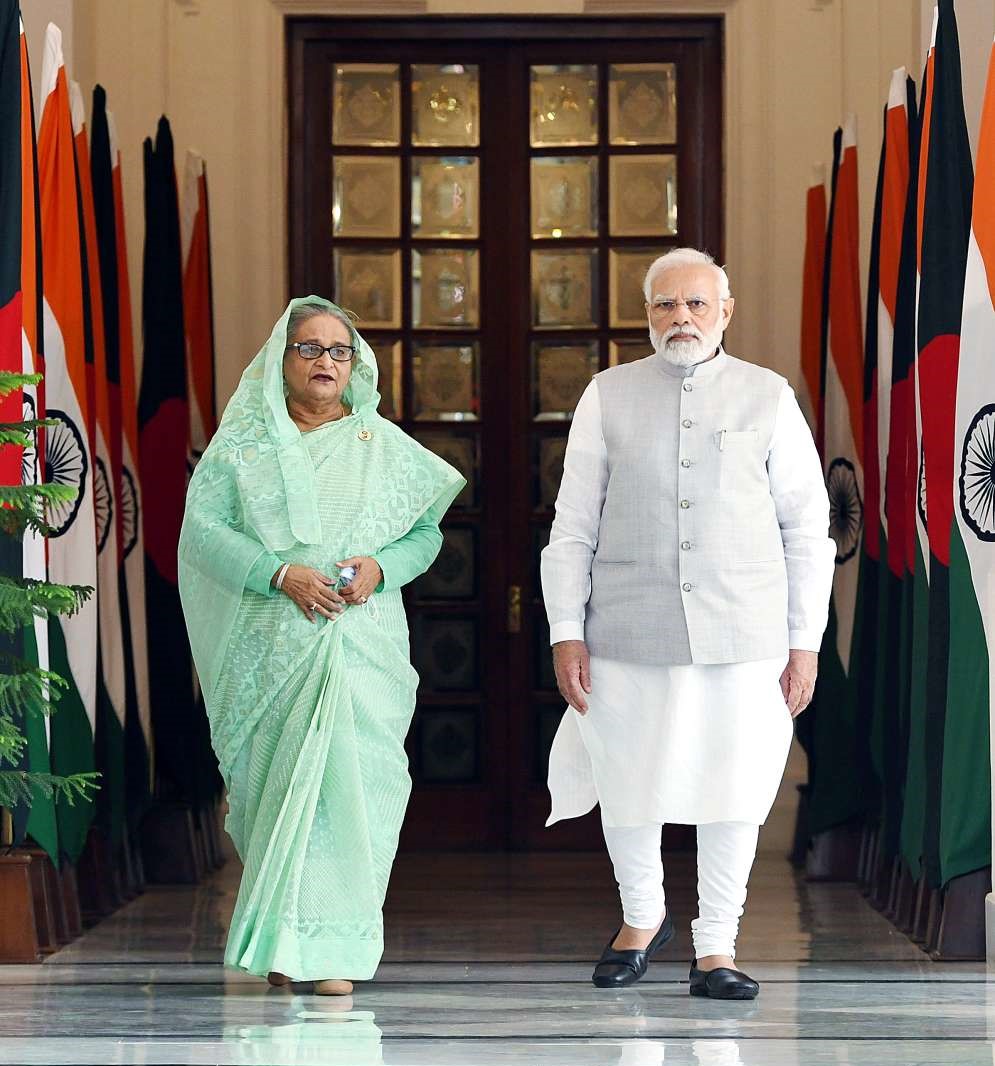

Myanmar’s Kyaukphyu is located in Rakhine state bordering both India and Bangladesh. Kyaukphyu looks into the Bay of Bengal, making it an important port for China to pledge big investments to Naypyitaw – power plants and special economic zones along with plans to establish trade networks with Europe and the Gulf countries through an alternate route to the Strait of Malacca.

Even though China has been pushing its mega infrastructure projects in a big way in Asia, it also faces backlash from local communities as well as declining profits. The anti-China sentiment in Myanmar is strong as armed militias opposed to the military rule have been targeting Chinese projects. The local Myanmar people consider China as an enemy for helping prop up the junta regime.

Chinese power companies are facing similar problems in Pakistan as well.

In Pakistan issues include terror attacks on Chinese hydro-power projects in Pakistan’s northern provinces as well as non-payment of dues by Islamabad. Other problems include Pakistan’s incapacity to import coal for the power plants after which Chinese producers have cut down on power generation and told Islamabad that they consider the government a defaulter.

Will reduced power generation in the deep-sea port of Kyaukphyu put a speed-breaker on China’s dreams of developing a major trade way into the Indian Ocean from Myanmar? Will it also impact its plans of bypassing the Strait of Malacca and take the sheen off the ambitious Belt and Road Initiative (BRI) projects in an unstable and violence-prone Myanmar?

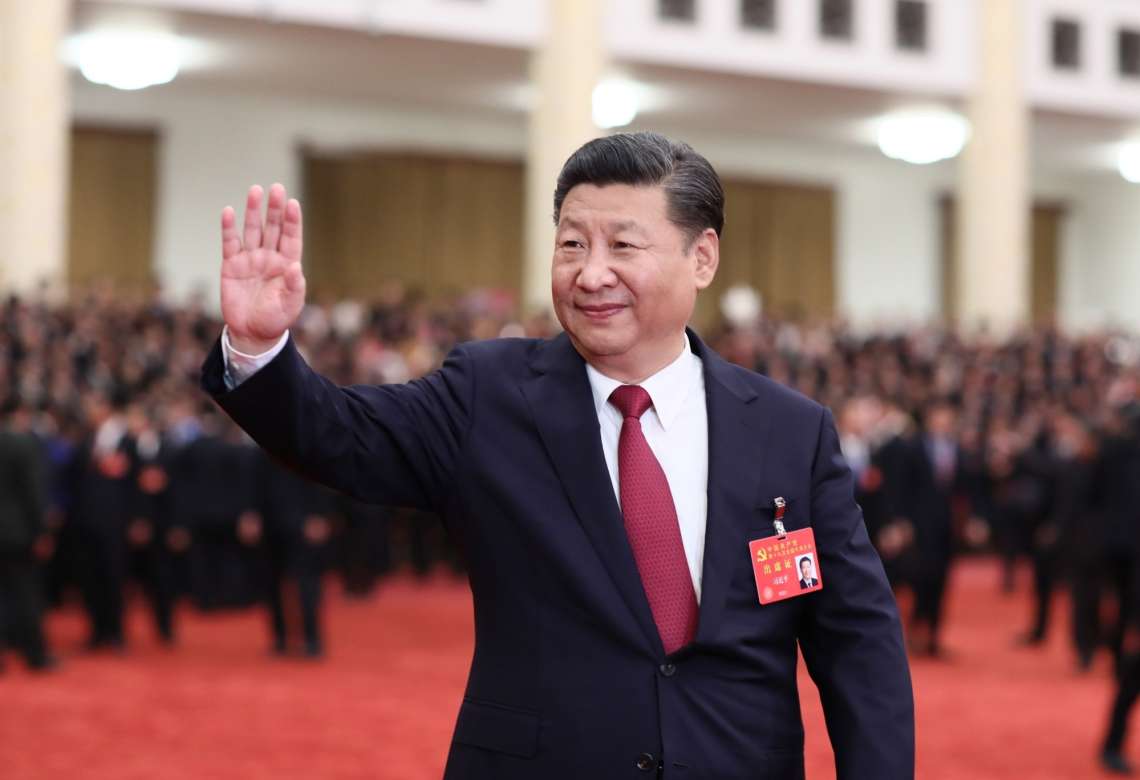

China’s economy losing steam

With worsening economic imbalances, China’s economy continues to lose momentum. China’s retail sales in June fell to 3.1 per cent from a 12.7 per cent increase in May, according to the National Bureau of Statistics (NBS) report, Khabar Hub reported.

Disappointing June data, including low retail sales, falling export orders and slow industrial production indicate stalled economic recovery the report from the Nepal digital news outlet said. Though industrial output growth quickened to 4.4 per cent in June from 3.5 per cent in May, the demand remained tepid. Even though investment by state-owned enterprises grew by 8.1 per cent in the first six months of 2023, private fixed-asset investment shrank by 0.2 per cent, indicating weak private business confidence, Khabar Hub reported.

China’s exports fell by 12.4 per cent in June, the highest drop in three years, while imports fell by 6.8 per cent.

China’s foreign trade is likely to face more headwinds in the second half of the year, due to high inflation in developed countries and geopolitical situation.

Foreign Direct Investment (FDI) inflows also dropped by 5.6 per cent in the first five months of the year, Khabar Hub reported.

The perception that “doing business in China has become much riskier” is choking the flow of capital into the country.

Xi Jinping’s policy to rebalance the economy away from debt-driven investment towards domestic consumption has not been successful due to the inability of the leadership to expand social welfare and health care provisions, leading to high levels of precautionary savings.

China’s equity market has been underperforming compared to other global markets this year, suggesting that weak growth prospects and lack of policy stimulus have already been fully priced, Khabar Hub reported.

Chinese stocks have fallen more than 20 per cent from their peak in late January.

China’s IPO applications slumped by a third in the first half of 2023, as volatility in earnings, a slowing economy and tighter regulatory scrutiny deterred companies.

The zero rate of inflation in June and falling factory-gate prices have fueled concerns about the risk of deflation, Khabar Hub reported.

Domestic travel spending during the June holiday this year for the dragon-boat festival was lower than pre-pandemic levels.

Car sales and residential real estate sales declined despite the traditionally busy season.

Expansion in the services industry has slowed as well. The revenue of the service sector, which is dominated by small, midsized and individual businesses, has fallen substantially.

This has made this sector cautious about hiring and expansion since the removal of zero-Covid restrictions, Khabar Hub reported.

If the economy continues to lose momentum in the long term, the unemployment problem is likely to get more serious, which would challenge the social stability in the country.

Xi Jinping’s emphasis on state-owned enterprises at the expense of the private sector is unlikely to revitalise economic growth as the productivity of these corporations is much lower than that of private firms in China.

Xi Jinping’s policy to rebalance the economy away from debt-driven investment towards domestic consumption has not been successful due to the inability of the leadership to expand social welfare and health care provisions, leading to high levels of precautionary savings.

Due to the pessimism among the population regarding the state of the economy, domestic consumption has remained weak.

Local governments are themselves under financing pressure.

They had come to rely on land sales for revenue, but that source of revenue is also drying up due to the housing downturn, Khabar Hub reported.

The Chinese economy is likely to face an extended period of weak growth due to the loss of demographic dividend, pushing away from capital-intensive growth, and a gradual deceleration in productivity growth.

The government’s ‘Common Prosperity’ policy and efforts to increase consumption are not backed by structural economic reforms, which have been stalled due to the high total debt of the country, estimated at around 350 per cent of GDP, Khabar Hub reported.

It is becoming more difficult for the Xi Jinping-led government to find a solution to the slowing economy. (ANI)