While the central bank has said that $5 billion of the total amount will be rolled over, it would still need to repay $3 billion. But at the end of January, it had foreign exchange reserves of mere $3.09 billion…reports Mahua Venkatesh

Worries for Pakistan have risen as the ongoing ninth review of the loan package under the Extended Fund Facility of the International Monetary Fund is slated to end today and the two sides are yet to reach an agreement. Pakistan urgently needs to resume the loan programme, else it defaults.

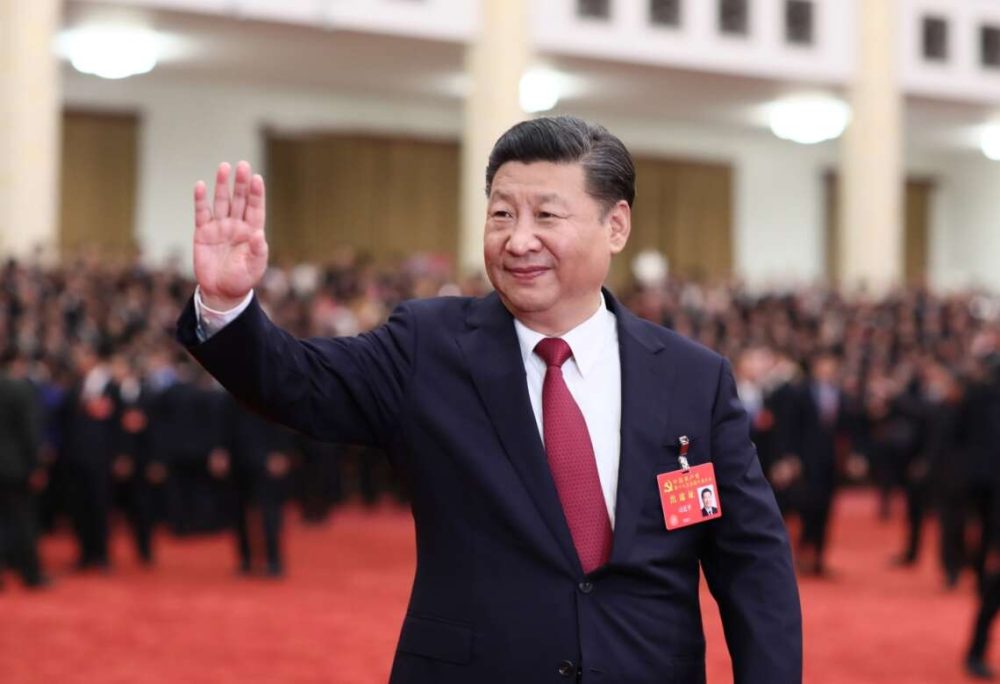

The News, a local media organisation, reported that differences persist over external financing requirements and power sector losses. The IMF will handover the draft memorandum of economic and financial policies (MEFP) to the Shehbaz Sharif government only after the two reach an agreement.

Quoting unnamed Pakistani “authorities” the newspaper said that “the IMF mission had changed its working style – they will finalise the agreement first and then share the MEFP with Pakistan today.”

An analyst, however, told India Narrative that the pain for Pakistan will not be over even if the two strike an agreement. “It is a question of time before it once again faces a crisis situation and fears of default,” he said.

Why?

Take a look at simple calculations. Pakistan will be required to repay about $22 billion in foreign debt along with interests in the next 12 months, the State Bank of Pakistan (SBP) – the country’s central bank, data showed. In the next three months, the repayment amount will crawl up to $8 billion. While the central bank has said that $5 billion of the total amount will be rolled over, it would still need to repay $3 billion. But at the end of January, it had foreign exchange reserves of mere $3.09 billion.

The IMF revived the $6 billion loan package late last year but the programme was halted after the country’s Finance Minister Ishaq Dar reversed the policies reducing fuel prices.

The country will go to polls this year. With soaring inflation and acute shortage of goods including food items, the Shehbaz Sharif government will find it tough to navigate through.

The country’s banks are issuing limited letters of credit in a bid to save forex. This is leading to severe strain in the supply chain network. Only essential food items and medicines are now being imported.

The South Asian nation has already taken 22 loan packages in the last 70 years, “yet achieved no lasting solution,” the Pakistan Institute of Development Economics (PIDE) analysis published in 2021 said.

Earlier, Pakistan Prime Minister Sharif termed the IMF riders for continuation of the financial assistance programme as “beyond imagination”.

“I will not go into the details but will only say that our economic challenge is unimaginable. The conditions we will have to agree to with the IMF are beyond imagination. But we will have to agree with the conditions,” Sharif said in televised comments.

Pakistan, given its current situation, will find it difficult to avoid a default. At most it can delay it.

(The content is being carried under an arrangement with indianarrative.com)