Raimondo’s trip which encompasses visits to Beijing and Shanghai from August 27 to August 30…reports Asia Lite News

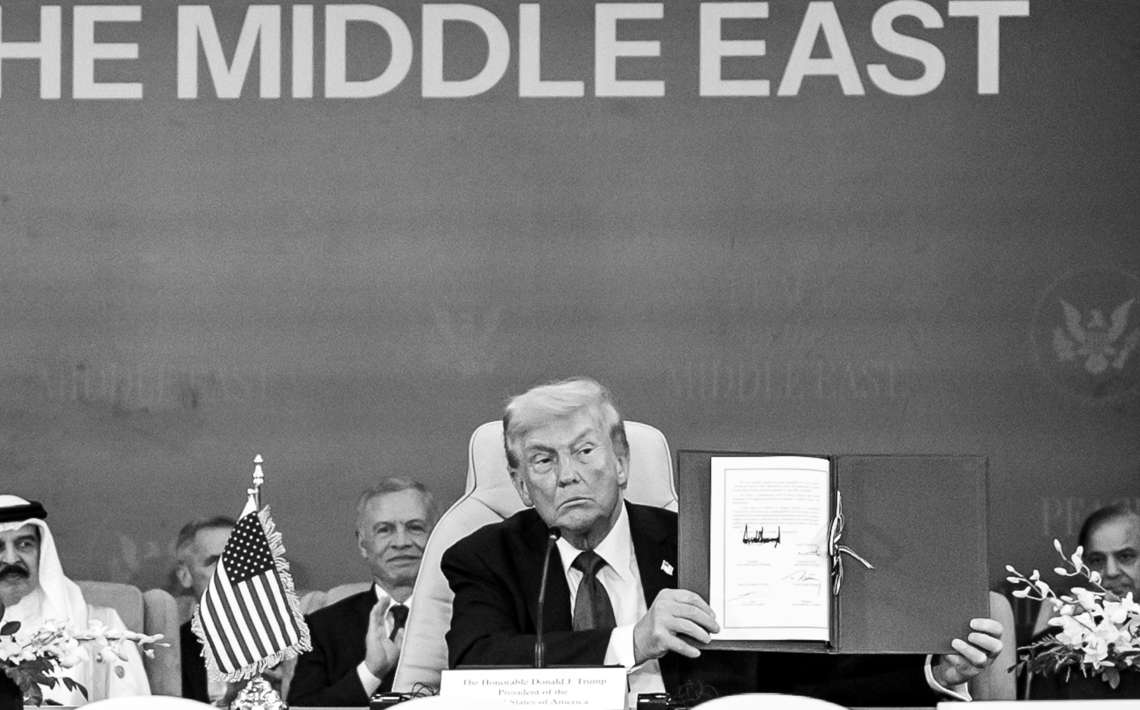

US Commerce Secretary Gina Raimondo is scheduled to embark on a visit to China next week, a pivotal moment for both Beijing and Washington’s diplomatic ties.

Raimondo’s trip which encompasses visits to Beijing and Shanghai from August 27 to August 30, follows a series of recent trips made by key figures from the Biden administration, including Secretary of State Antony Blinken, Treasury Secretary Janet Yellen, and Climate Envoy John Kerry.

The US Commerce Department disclosed on Tuesday that Secretary Raimondo anticipates engaging in productive dialogues concerning the US-China commercial relationship, the challenges encountered by US businesses, and potential collaborative avenues. Throughout her visit, she will hold meetings with senior officials from the Chinese government as well as leaders of American businesses, the department outlined.

The Wall Street Journal last week reported that investors fearing a ‘Lehman moment’ in China are threatening the solvency of the country’s financial system.

The American business and economic-focused daily said that signs of financial stress at a large asset manager in China are making investors nervous about contagion from the country’s slumping property sector, rekindling a debate over whether a “Lehman moment” could occur in the world’s second-largest economy.

According to CNN Business- at least three Chinese companies had in separate stock exchange filings in recent weeks stated that the Chinese firm Zhongrong Trust had failed to pay the interest and principal on several investment products with the missing scale of payments exceeding 110 million yuan ($15 million).

CNN said videos uploaded on social media app Douyin and WeChat showed demonstrators outside Zhongrong’s office and held protests demanding payments related to investment products issued by the company, which is one of thousands of wealth management firms in China.

The term ‘Lehman moment’ refers to the catastrophic event in September 2008 in which Lehman Brothers, then the eighth-largest investment bank in the United States filed for bankruptcy, triggering a domino effect that sent shockwaves throughout the global financial system, resulting in the worst economic crisis since the Great Depression.

China’s financial system, one of the world’s largest, has been under scrutiny recently due to a series of challenges, including a property market slowdown, regulatory crackdowns on tech giants, and concerns about rising debt levels.

The August 18 Wall Street Journal report highlights that these factors have raised concerns among investors that a similar systemic crisis might be looming.