Pakistan’s overall debt burden surged to PKR 63.390 trillion including PKR 40.956 trillion in domestic loans and PKR 22.434 trillion in international loans…reports Asian Lite News

The total debt burden on Pakistan has risen to a whopping 63,399 trillion Pakistani Rupees (PKR) by the end of November last year in the financial year 2023-24, ARY News reported on Friday citing an official report.

According to details, the country’s total debt increased by over 12.430 trillion PKR during the tenure of the PDM and the caretaker government.

Pakistan’s overall debt burden surged to PKR 63.390 trillion including PKR 40.956 trillion in domestic loans and PKR 22.434 trillion in international loans.

The report further said the country’s overall debt stood at PKR 50.959 trillion in November 2022. The burden of the loan was recorded at PKR 63.390 trillion in November 2023, ARY News reported.

Earlier, Pakistan assured the International Monetary Fund (IMF) of the fresh loan programme, according to ARY News.

According to the Memorandum of Economic and Financial Table (MEFPT), Pakistan has assured to increase Pakistan’s foreign reserves to USD 13.6 billion in FY2024-25 to avail of the new loan programme from the international lender.

Pakistan will seek a rollover of USD 6.34 billion loan in the next financial year, while the foreign investment will be jacked up by 1.31 billion, the MEFPT stated.

Recently, a World Bank report stated that Pakistan’s economic development is limited to the elite which resulted in the country lagging behind its fellow countries in the wake of the economic crisis in Pakistan, Pak Vernacular media reported.

World Bank Country Director for Pakistan, Najy Benhassine noted that Pakistan’s economic model has become “ineffective” and said that poverty has started to increase again, the significant reduction in poverty in the past is resurfacing, the sentiment is growing towards changing the policy and that economic development in Pakistan is not sustainable.

Meanwhile, Pakistan has formally requested fresh loans amounting to USD 600 million from two Chinese banks, signalling a critical step in its ongoing negotiations with the International Monetary Fund (IMF) for the release of the second tranche of a USD 3 billion bailout package, The News International reported.

As reported by a local newspaper, the Pakistani government is actively engaged in discussions with the Industrial and Commercial Bank of China (ICBC) and the Bank of China, seeking a combined loan of USD 600 million. Each bank has been approached to provide USD 300 million in financing. The negotiations have progressed significantly, with expectations that the loans will be secured by the next month, according to the report.

Notably, under the terms of the USD 3 billion IMF bailout deal, Pakistan has committed to adopting a market-based exchange rate regime. (ANI)

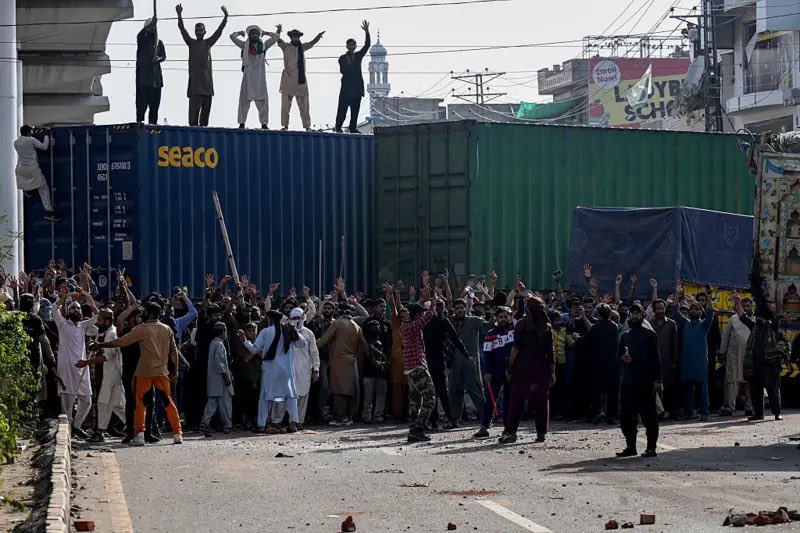

ALSO READ: Pakistan Repatriates Over 500,000 Afghan Immigrants