The UAE recorded the second-highest increase in the number of new foreign investment projects around the world after the US, which came in first place….reports Asian Lite News

A recent report issued by the United Nations Conference on Trade and Development (UNCTAD) has unveiled a noticeable increase in new foreign investment projects in the UAE during the year 2023, explaining that the number of these projects increased by 28 percent compared to 2022.

The report stated that the UAE recorded the second-highest increase in the number of new foreign investment projects around the world after the US, which came in first place.

The report, entitled“ Investment Trends Monitor” confirmed that the UAE has continued to maintain its global attractiveness in attracting foreign direct investment flows, despite the decline of these flows in many regions of the world.

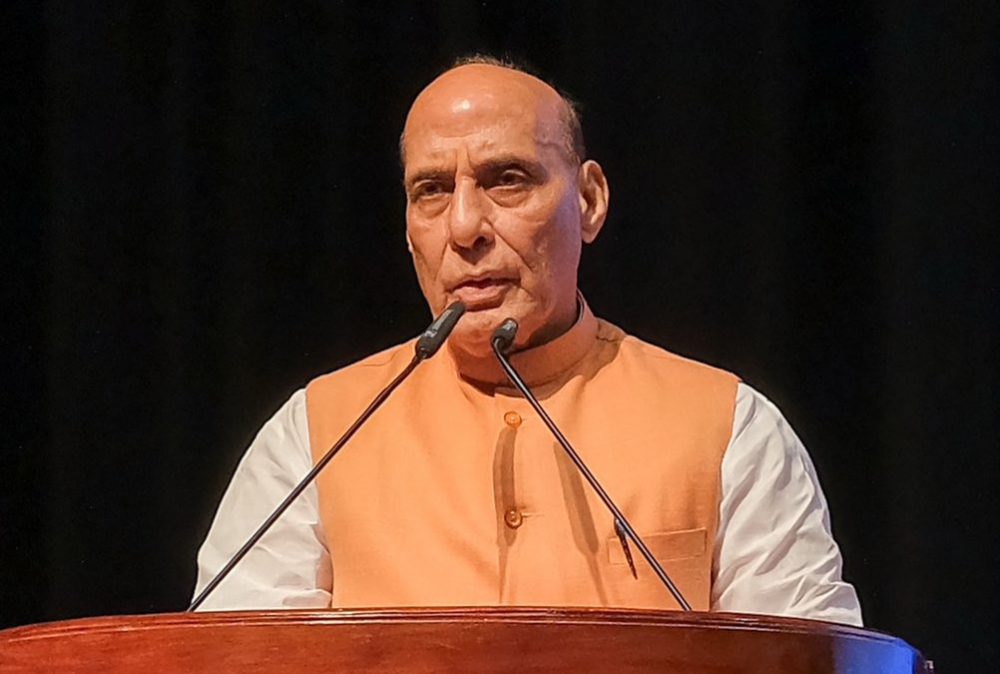

Dr. Thani bin Ahmed Al Zeyoudi, Minister of State for Foreign Trade, emphasised that the UAE is benefiting from the forward-looking vision of its leadership by enhancing investment and trade openness globally. The country is also focused on improving the business environment to attract foreign direct investment, entrepreneurs, international talents, and creative individuals seeking an environment supportive of innovation and sustainable economic growth.

He noted that the UAE’s record foreign direct investment projects, as highlighted in the UNCTAD report, demonstrate the country’s growing stature as a global business hub, attracting creative ideas and investments from around the world. Al Zeyoudi also emphasised that these numbers signify the remarkable recovery of the national economy, surpassing global benchmarks in economic growth, non-oil foreign trade, and the attraction of foreign direct investment. This underscores the increasing confidence of the global business community in the UAE’s economy, policies, legislative environment, and commitment to sustainable growth.

Global FDI flows settle at around $1.37t

The global foreign direct investment (FDI) had a modest increase of over 3% to reach an estimated $1.37 trillion in 2023, defying expectations as recession fears early in the year receded, and financial markets performed well.

Global FDI flows increased, but economic uncertainty and higher interest rates affected global investment. The headline increase was mainly due to higher values in a few European conduit economies; excluding these conduits, global FDI flows were 18 percent lower, as per United Nations Conference on Trade and Development’s (UNCTAD) Global Investment Trends Monitor.

In developed countries, FDI in the European Union jumped from negative US$150 billion in 2022 to positive $141 billion because of large swings in Luxembourg and the Netherlands. Excluding those two countries, inflows to the rest of the EU were 23 percent down, with declines in several large recipients. Inflows in other developed countries also stagnated, with zero growth in North America and declines elsewhere.

FDI flows to developing countries fell by 9 percent, to $841 billion, with declining or stagnating flows in most regions. FDI decreased by 12 percent in developing Asia and by 1 percent in Africa. It was stable in Latin America and the Caribbean as Central America bucked the trend.

UAE’s global economic partnerships

Abdullah bin Touq Al Marri, Minister of Economy, affirmed that the United Arab Emirates has adopted a constructive approach to enhance economic openness to the world, build partnerships, and strengthen cooperation with strategic markets to consolidate the country’s position as a global economic hub.

This came during the “BRICS in Expansion” session that took place at World Economic Forum (WEF) in Davos, Switzerland.

“The UAE has participated in more than 18 joint economic committees with 18 countries at regional and global levels over the past three years, including BRICS member countries such as China and Russia to enhance economic ties and develop plans to encourage economic and investment cooperation.”

He said, “Joining BRICS aims at creating new opportunities for exporters, and manufacturers, globally. We seek to accelerate international trade, guarantee market access, facilitate the integration of companies into global value chains, and increase investment flows.”

Bin Touq stated, “Joining BRICS will support the UAE’s plans to further diversify its national economy and enhance its competitiveness on both regional and global levels. The step will increase the non-oil national exports and develop new partnerships in various economic sectors, in addition to increasing foreign direct investment flows to the UAE. BRICS countries represent a significant source of foreign investment in sectors such as transportation, financial services, technology, and clean energy. This, in turn, provides more job opportunities, enhances mutual investments among member countries, and simultaneously the UAE offers the BRICKS countries multiple benefits due to its strategic location, and business-friendly environment.”

Bin Touq said that the UAE’s economy is growing rapidly, thanks to the innovative initiatives, policies, and strategies adopted by the country. The UAE GPD grew by 7.9 percent in 2022 and the non-oil GDP grew by 5.9 percent during the first half of 2023, in addition to this, the UAE witnessed the highest FDI inflows in 2022, totalling AED84 billion (US$23 billion).

Bin Touq affirmed the pivotal role of the UAE in promoting sustainable economic development globally. The country is connected to over 400 cities worldwide through direct flights, and it owns the largest shipping lines spanning 88 ports globally. The business environment in the UAE provides an ideal climate for establishing and developing businesses.

ALSO READ-Time Ticking: UAE Warns US of Wider Mideast Crisis