The Turkish leader has been steadfast in pushing for low-interest rates, which he insists will fight inflation. But such a model is disputed by several economists….reports Asian Lite News

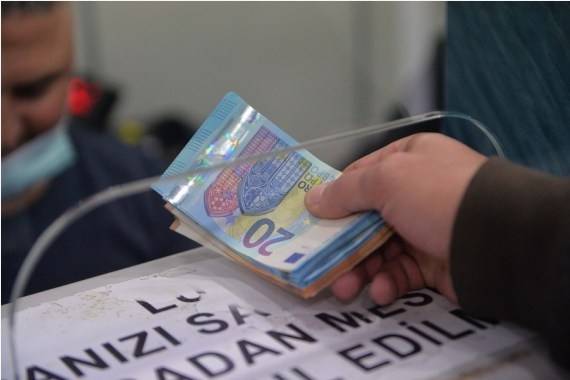

The free fall of the Turkish lira, which had continued throughout most of the year, has come to a halt after Turkish President Recep Tayyip Erdogan announced plans to protect lira deposits and stop panic dollarisation.

The government’s plan has managed to support the embattled currency at the eleventh hour. From an all-time low of 18.35 liras per US dollar, it traded at around 12.22 liras against the greenback on Wednesday, according to the country’s central bank.

However, economists said the currency turmoil, which has marked this year, has left the country’s economy vulnerable to further shocks in 2022, especially high inflation, Xinhua news agency reported.

Prior to the policy shift, the central bank had made consecutive interest cuts, which many economists believed contributed to the devaluation of the Turkish currency. Since January, the lira has lost nearly 60 per cent of its value, while the annual inflation was 21.3 per cent in December. In fact, the currency is still significantly lower compared to the same period in 2020 despite the recent rebound.

The Turkish leader has been steadfast in pushing for low-interest rates, which he insists will fight inflation. But such a model is disputed by several economists.

The crash of the lira in the last two months significantly drove prices of essential goods, food and utilities higher, thus bringing down the living standards of households. To address some of the concerns, the Turkish government has increased the minimum wage for millions of workers by a whopping 50 per cent for 2022.

ALSO READ: Afghan airports: Taliban deny deal with Turkey, Qatar

Economists are divided on Erdogan’s currency plans and the economic outlook in general for 2022. Some have seen his rescue plan as a veiled interest rate hike.

Turkish economist and writer, Mustafa Sonmez said the measures have failed to stop citizens from buying hard currencies to save their spending against rampant inflation.

“The plan has not encouraged citizens to sell their hard currencies. On the contrary, deposits in $ have increased by $2 billion according to the Banking Regulation and Supervision Agency’s figures,” he told Xinhua.

Sonmez stressed that Erdogan’s insistence on low-interest rates has put a serious burden on the already low foreign currency reserves of the central bank ahead of foreign debt repayments due in 2022.

Meanwhile, Emre Alkin, a finance expert and Istanbul-based scholar, said the government delivered on its promise to reverse the depreciation of the lira with its string of financial measures.

“It seems that a segment of the population has faith in this new lira-denominated deposit system,” he said, refuting criticism that it is a veiled interest rate hike.

He qualified the government scheme as “rational” in the aftermath of currency turmoil and current financial circumstances.

But Alkin called on the government to address other urgent economic issues such as banks’ bad credit loans, public debt, high prices and especially rising inflation.

“One should not think that these problems will be resolved on their own with only the revaluation of the lira,” he added.

The Turkish gross domestic product is expected to grow by 9 per cent in 2021. But high inflation has cast a long shadow over the prospect of the country’s economy.