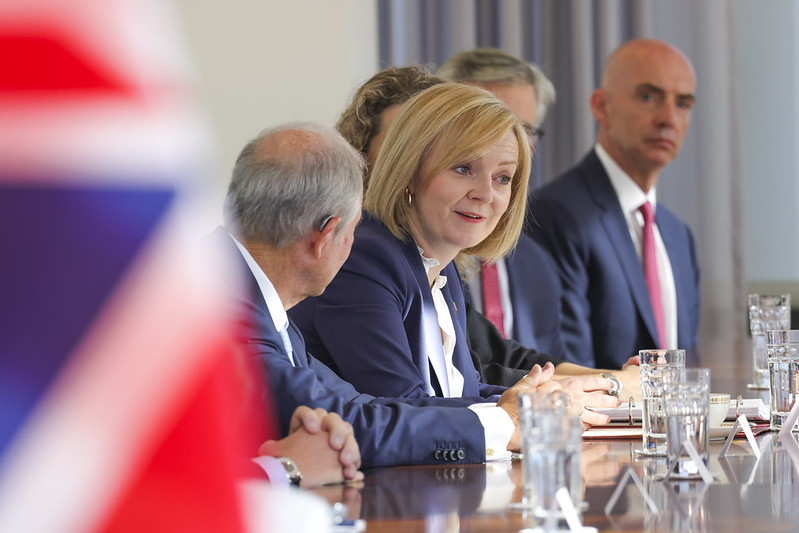

Truss – elected as prime minister by party members but not the broader public – is seeking to jolt the economy out of a decade of stagnant growth with a 1980s-style plan to cut taxes and regulation, much of it funded by vast government borrowing…reports Asian Lite News

Prime Minister Liz Truss has refused to rule out cutting benefit payments by less than soaring inflation to help fund her tax-cutting growth plan in what is likely to spark the next political rebellion over her economic plans.

Truss and her finance minister Kwasi Kwarteng are racing to set out how they will pay for more than £40 billion of tax cuts announced last month, sparking turmoil in financial markets as they did not say how they would pay for them.

Already the government has been forced to reverse its plan to scrap the highest rate of income tax to appease Conservative Party lawmakers who saw it as a gift to the rich during a cost-of-living crisis.

Late on Monday, Kwarteng also agreed to bring forward publication of the government’s fuller plan to cut debt, alongside forecasts for economic growth and the public finances. Truss indicated the plan could include restrictions on welfare benefit increases.

Asked if benefits would rise in line with inflation, which came in at 9.9% in August, Truss told the BBC: “We are going to have to make decisions about how we bring back down debt as a proportion of GDP in the medium term.”

“We have to look at these issues in the round. We have to be fiscally responsible.”

Truss – elected as prime minister by party members but not the broader public – is seeking to jolt the economy out of a decade of stagnant growth with a 1980s-style plan to cut taxes and regulation, much of it funded by vast government borrowing.

But she does so at one of the most difficult times for the economy, with the government having to spend tens of billions of pounds to subsidise energy bills and consumers reining in spending ahead of what is expected to be a difficult winter.

Investors have taken fright at the government’s plan, hammering the value of British assets to such an extent that the Bank of England had to intervene to shore up markets.

Damian Green, a former senior minister in the government of Theresa May and part of the centrist faction of the Conservative Party, indicated he would oppose any efforts to raise welfare in line with average earnings instead of inflation.

Asked by the BBC if the government could win a parliamentary vote on the move, he said: “Probably not. I think there will be many of my colleagues who think that when you’re reaching for spending cuts, benefit payments are not the way to do it.”

Penny Mordaunt, leader of the House of Commons, also said it made sense to keep welfare payments in line with inflation. “That’s what I voted for before and so have a lot of my colleagues,” she told Times Radio.

Markets have stabilised since the BoE action last week. Investors also took some comfort from the government’s decisions not to scrap the top rate of tax and bring forward the publishing date for its next fiscal plan from Nov. 23.

British government borrowing costs fell again in early trade on Tuesday but remain higher than before Kwarteng’s mini-budget announcement on Sept. 23 for maturities not covered by the BoE’s emergency plan to buy longer-dated gilts.

Mel Stride, head of the Treasury Committee in parliament, welcomed the move to bring forward the announcement of fuller budget details. He said it would help if they were published before the next BoE rate announcement on Nov. 3.

ALSO READ-Truss, Kwasi on damage control mode