NatWest remains 55% taxpayer-owned after receiving a £45bn bailout at the height of the 2008 financial crisis…reports Asian Lite News.

National Westminster Bank on Thursday pleaded guilty to the charges of alleged money laundering of nearly £400m by one customer.

NatWest said “we deeply regret” failing to “adequately monitor and therefore prevent money laundering by one of our customers between 2012 and 2016”, the BBC reported.

The state-backed NatWest, is the first British lender to admit such an offence. Also, the case marks the first criminal prosecution brought by the FCA under the 2007 Money Laundering Regulations (MLR), the complianceweek reported.

Lawyers told a court hearing that NatWest faces a large fine, the BBC reported.

The case was brought by the Financial Conduct Authority (FCA) which alleged the bank failed to monitor suspect activity by a client that deposited about £365m in its accounts over five years, of which £264m was in cash.

The FCA said NatWest failed to adhere to the requirements of anti-money laundering legislation in relation to Fowler Oldfield Ltd’s account between 7 November 2013 and 23 June 2016.

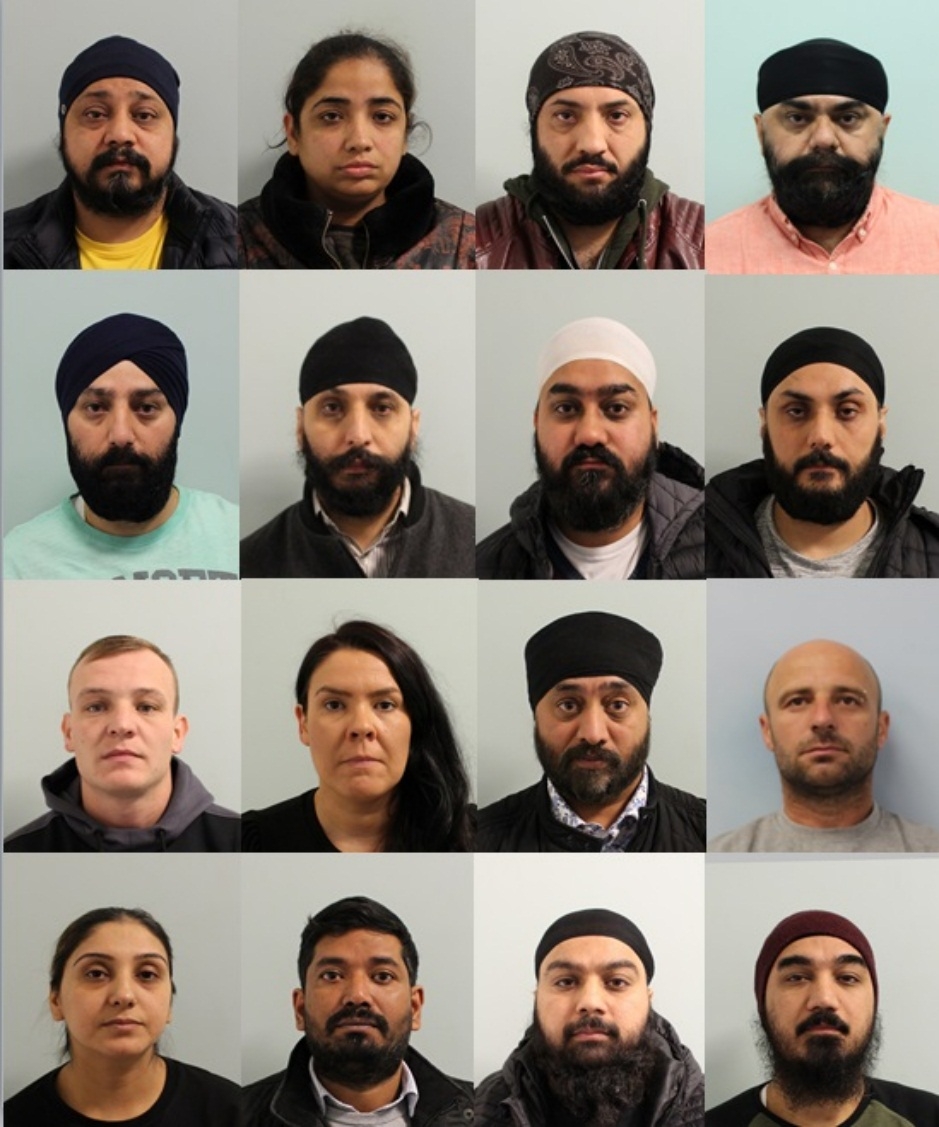

Fowler Oldfield was a century-old jeweller based in Bradford, and was shut down following a police raid in 2016.

FCA prosecutor Clare Montgomery QC told Westminster magistrates that when Fowler Oldfield was taken on as a client by NatWest, its predicted turnover was said to be £15m per annum. However, it deposited £365m over the space of almost five years.

NatWest remains 55% taxpayer-owned after receiving a £45bn bailout at the height of the 2008 financial crisis.

“NatWest has a vital part to play in detecting and preventing financial crime and we take extremely seriously our responsibility to prevent money laundering by third parties,” the BBC quoted Chief executive Alison Rose as saying.

“In the years since this case, we have invested significant resources and continue to enhance our efforts to effectively combat financial crime.”

ALSO READ-NIZAM’S BRITISH BOUNTY: Descendants ready for legal battle

READ MORE-From filling envelopes to successful businesswoman