“Xi continued with crackdowns on the country’s private sector at a time when it needs nurturing and encouragement to support the economy,” a business captain said, a report by Mahua Venkatesh

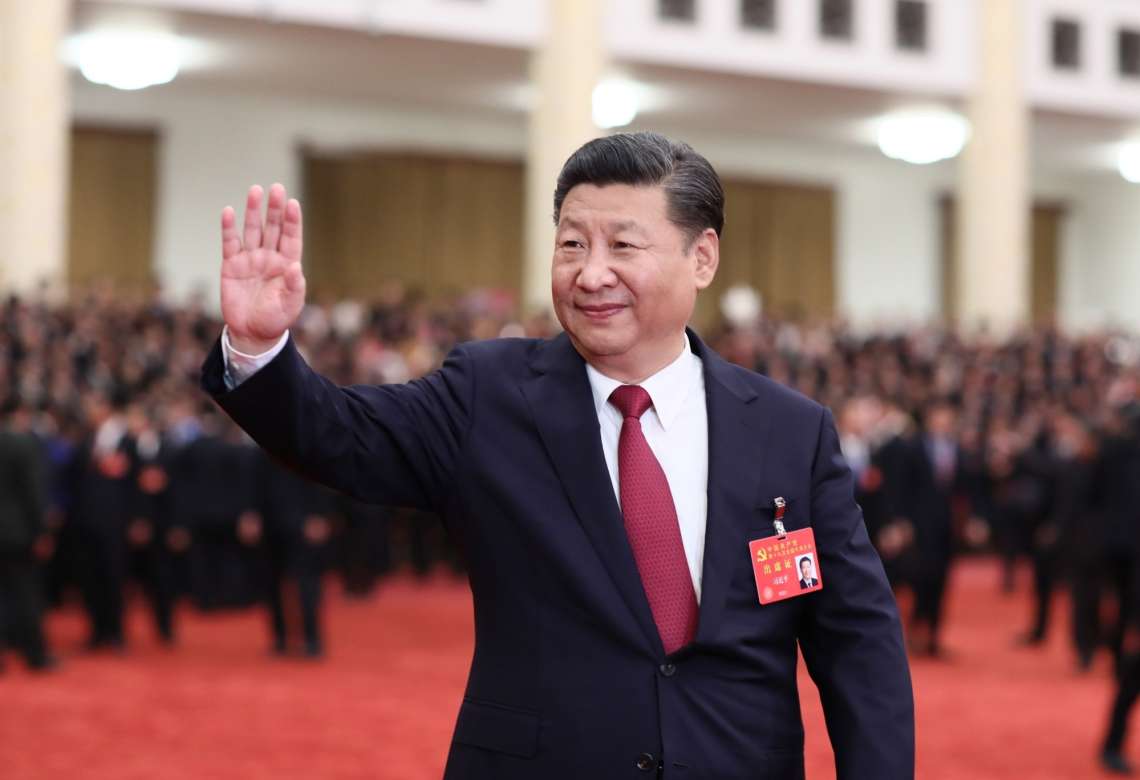

Policy uncertainty along with Beijing’s zero Covid approach and Chinese President Xi Jinping’s call for “common prosperity” have started to dent business sentiments in the country. The world’s second largest economy, known for its pro-business and pro-investment policy and a haven for investors until the outbreak of the Covid-19 pandemic is now fast losing steam as more and more investors are starting to feel unsure about their future.

Management and consultancy firm Gartner in a recent report revealed that a third of supply chain leaders were planning “to move at least some of their manufacturing out of China before 2023. Coronavirus-related sales slumps and supply chain disruption, as well as rising production costs, have also hastened the exodus”.

Though, the trend had started in 2020 when the stringent lockdowns in China hit the global supply chain network, companies have got more active now, an analyst said.

South China Morning Post recently said that “policy U-turns and a heavy-handed, unpredictable coronavirus control strategy are fraying the nerves of China’s business community”.

Business leaders said the policy environment in China has dramatically changed in the last two years since the outbreak of the pandemic. Just when the country’s economy was bouncing back from Covid-19-induced lockdowns and the aftermath, Xi’s ugly face-off with Chinese icon and self-made billionaire entrepreneur Jack Ma grabbed headlines.

“It did not stop there. Xi continued with crackdowns on the country’s private sector at a time when it needs nurturing and encouragement to support the economy. It came as a shock to the world,” a business captain living there told India Narrative.

Amid deepening economic crisis, Chinese Premier Li Keqiang recently addressed an unprecedented national video teleconference aimed at stabilising the economy and boosting business sentiments. The move is clearly an indication that Beijing is slipping into a panic mode.

“But despite the thrust on the economy, the country has made it clear that it will adhere to the zero Covid policy, especially now when most other countries are adopting more pragmatic measures to deal with the pandemic,” the business leader quoted earlier said.

India woos investors

India, with an eye on the $5 trillion economy, is aggressively wooing foreign investors amid the geopolitical shifts and supply chain disruptions. Sources said that nodal ministries, state governments and authorities dealing with investments have been advised to take all necessary measures, to “handhold” foreign investors. The “Aatmanirbhar Bharat” plank is now being pitched as “Make in India for the World” after Prime Minister Narendra Modi personally held a series of meetings with Japanese investors in Tokyo recently.

“In the new emerging geopolitical order, India has positioned itself as a credible, dependable voice. Now the thrust is on the economy. The government is doing all that it can to facilitate and expedite investments,” a government source told India Narrative.

He also said India will continue to be guided by its strategic autonomy “with a firm focus on growth” amid the global turmoil and disruption of the supply chain network.

India recorded its highest foreign direct investment of $83.57 billion in 2021-22.

Modi, during his two day visit to Tokyo to attend the QUAD summit, held meetings with more than 30 Japanese CEOs and top executives and invited them to invest in India. The Prime Minister also highlighted investment opportunities under the Production Linked Incentive (PLI) scheme.

Last month, a large group of business leaders from South Korea visited Shimla to explore investment opportunities, something that surprisingly failed to hit the headlines.

Several South Korean companies have started the groundwork for setting up semiconductor manufacturing facilities in India. That apart, investors, not just South Koreans but a host of others primarily from the Asian economies have begun to explore possibilities for setting up manufacturing bases for electric vehicles (EV), EV components, pharmaceuticals, medical devices, renewable energy, agro and food processing, among others.

Inflow of Korean FDI into India is estimated at $1 billion annually, driven mainly by large companies and their suppliers in the field of automobiles, electronics and steel. But a host of small and medium companies are now increasingly pinning hopes of entering the Indian market.

“Further investments in chemicals and steel are currently being considered and small and medium-sized enterprises are also increasingly knocking the Indian market,” South Korea’s Ambassador to India, Chang Jae-bok said last week.

Maharashtra, New Delhi, Karnataka, Gujarat, Tamil Nadu, Haryana, Andhra Pradesh are among the top states that received the highest FDI.

Finance Minister Nirmala Sitharaman has already announced an outlay of Rs 1.97 lakh crore for the PLI schemes across 14 key sectors that is expected to create 60 lakh new jobs.

Investment commitments of Rs 2.34 lakh crore have been made under the programme.

“The Covid-19 pandemic, global tensions and disruptive challenges to stability and security in the Indo-Pacific region have underlined the need for building resilient supply chains, a human-centric development model and stable and strong international economic relations, capable of resisting coercion and exploitation,” Modi said in Tokyo.

Bottomline: The government now wants foreign investors to cash in on India’s Aatmanirbhar Bharat or the self reliance plank and set up manufacturing facilities in the country, which in turn will generate jobs while boosting overall economic growth.

(The content is being carried under an arrangement with indianarrative.com)