Many Pakistani observers took to social media including Twitter to express their concerns over the slowdown of remittance inflow…reports Mahua Venkitesh

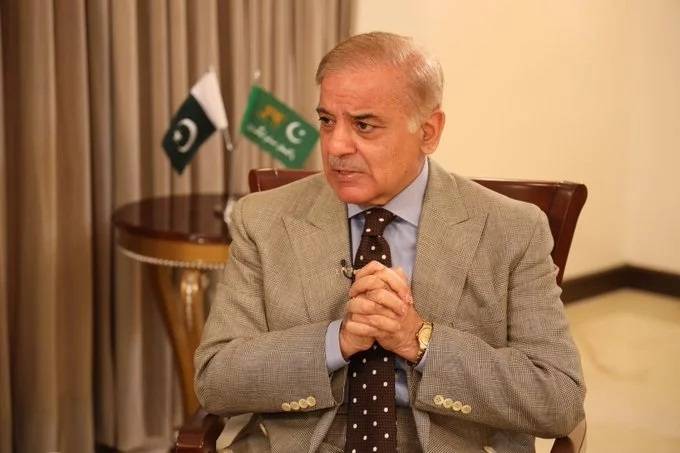

Amid yawning current account deficit (CAD) — the difference between inflow and outflow of foreign currency, Pakistan received lower remittances in May. This will lead to fresh concerns for Pakistan Prime Minister Shehbaz Sharif and his team as Islamabad has urgently sought a bailout package from the International Monetary Fund (IMF).

The IMF has already asked Pakistan to control its ballooning CAD, which is under pressure due to the surge in commodity prices including oil.

State Bank of Pakistan (SBP) data showed that remittances in May stood at $2.3 billion compared to $2.5 billion in the same month in the previous year. Remittances flowed in primarily from Saudi Arabia, UAE, the UK and the US.

Remittances comprise an important source of inflow of foreign currency, boosting the overall economic growth. In case the trend continues, it could even lead to deepening balance of payment crisis pushing inflation further.

A press statement issued by SBP said that in growth terms remittances decreased by 25.4 per cent on a month-on-month basis while the drop in 6.9 per cent on a year-on-year basis, “largely reflecting the usual seasonal post Eid decline and associated long holiday.”

Analysts said that it may reflect a larger malaise in the economy. “Though the country’s central bank has said that it is a post Eid trend, it is something that will be monitored in the coming weeks. The rising political instability is a cause for concern and there is a possibility that remittances have slowed down due to this,” an analyst told India Narrative.

Many Pakistani observers took to social media including Twitter to express their concerns over the slowdown of remittance inflow.

“Remittances declined to only $2.3mn in May, witnessed 25% dip from last last. People have stopped sending money to Pakistan under this imported regime,” Muzzammil Aslam, Pakistan Tehreek-e-Insaaf’s (PTI) spokesperson on economy tweeted.

Ratings agency Moody’s has now downgraded Pakistan’s outlook from “stable” to “negative” indicating that the country’s CAD will continue to be under pressure in 2022-23 amid high import bills on commodities.

A chunk of remittances, however, may have come into the country through informal channels.

Cumulatively the country’s central bank data showed that at $ 28.4 billion, remittances have grown by 6.3 per cent year on year during the first 11 months of this financial year.