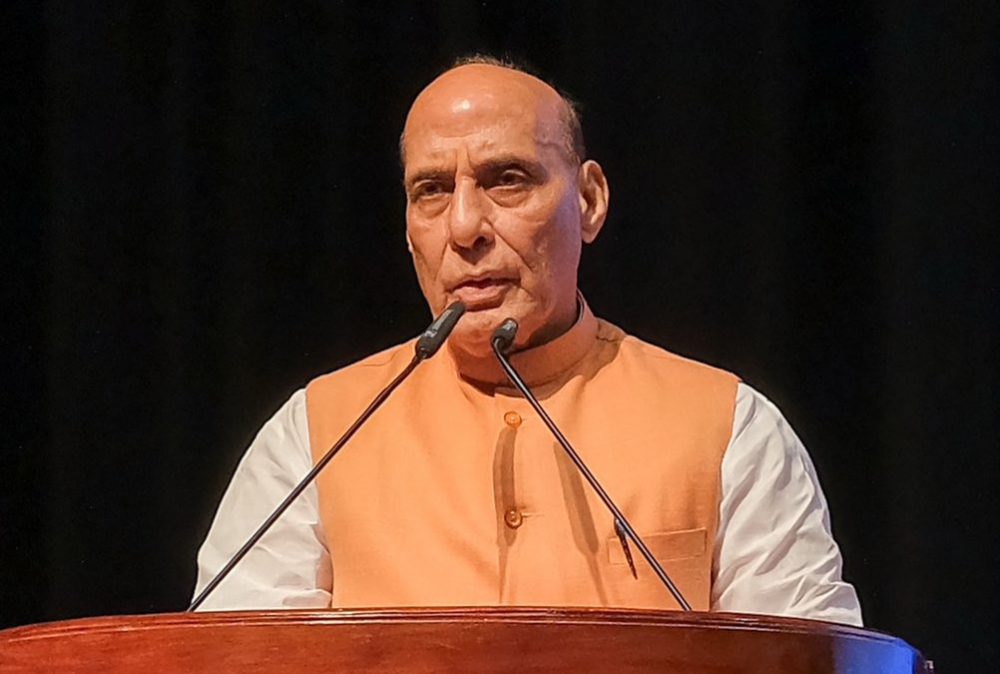

Sudhir asked builders to learn from the experience of UAE real estate companies and explore opportunities for partnership…reports Asian Lite News

UAE sovereign wealth funds have invested more than $10 billion in India across renewable energy, telecom, road infrastructure among other sectors, the Indian envoy said during an event in Abu Dhabi.

At the three-day annual conference of Confederation of Real Estate Developers’ Associations of India (CREDAI), Sunjay Sudhir, Ambassador of India to UAE, underlined that bilateral relations have been accelerating with a surge in two-way investments. “We have made rapid strides in bilateral relations since 2014,” he said.

Bilateral trade has continued to strengthen with the signing of the Comprehensive Economic Partnership Agreement (CEPA) in February 2022. “The India-UAE partnership is accelerating fast. We see this reflected in investments made in India by leading UAE companies in the last several years. In the last five years alone, more than $10 billion have been invested by UAE sovereign wealth funds across renewable energy, telecom, road infrastructure, affordable housing and startups,” Sudhir said.

Sudhir asked builders to learn from the experience of UAE real estate companies and explore opportunities for partnership. “Our bilateral relations offer you the opportunity to partner with UAE companies in a big way and also to learn from their experiences,” Sudhir said and noted that Indian companies were investing in UAE in a big way across many sectors, including energy.

Meanwhile, CREDAI members pledged to be carbon neutral by 2050. “When the entire world is waking up to the need for green real estate, as an industry leader, we need to walk the talk by evaluating and exploring newer ways to reduce, and reuse waste through recycling,” said Harsh Vardhan Patodia, president, CREDAI.

CREDAI also announced a slew of measures, including collaboration with HDFC to empower tier-2 and 3 cities with a $3 billion fund. The body will partner with India’s first and largest integrated incubator and accelerator for startups – Venture Catalysts & NeoVon – to set up a $100 million Spyre VC Proptech Fund.

“India is a start-up hub, and a lot of new-age start-ups are finding solutions to real-world problems more swiftly and effectively. Our Sphyre VC fund will bring together a lot of young leaders who will help us in bringing sustainable realty to life,” Boman Irani, president-elect, CREDAI, said.

Satish Magar, chairman, CREDAI, pointed out that the real estate ecosystem in India has witnessed the “best year in decades” on the back of pent-up demand post-Covid-19 and positive consumer sentiment.

ALSO READ-Abu Dhabi real estate transactions over AED21.04bn in Q3 2022