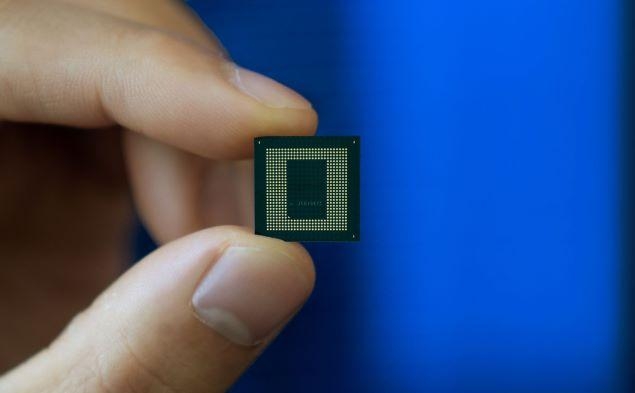

Samsung Electronics kept the largest share of 42.8 per cent in the DRAM market, unchanged from the previous quarter…reports Asian Lite News

Samsung Electronics retained its top spot in the global memory chip market in the first quarter (Q1) despite lacklustre earnings amid the chip glut, a report showed on Sunday.

SK hynix Inc, on the other hand, was pushed back to third place from number 2 compared with a year earlier, due largely to the output cut that came before Samsung, according to the market tracker Omdia.

Samsung Electronics kept the largest share of 42.8 per cent in the DRAM market, unchanged from the previous quarter, reports Yonhap News Agency.

Samsung’s DRAM revenue amounted to $4.01 billion in the January-March period, a 61.2 per cent fall from the previous year’s $10.35 billion, Omdia said. Compared with three months earlier, the revenue sank 25.2 per cent.

The DRAM market share of SK hynix stood at 24.7 per cent in Q1, down 2.3 percentage points from the previous quarter.

SK hynix was dragged down by one spot to third place, and Micron Technology Inc took over the second spot with 27.2 per cent.

SK hynix, which makes most of its profit from selling memory chips, reported an operating loss of $2.5 billion for the three-month period, swinging to the red from a year earlier.

“SK hynix had preemptively begun to reduce production as DRAM prices fell sharply in the first quarter, which led to a decrease in shipments and a temporary decline in the market share,” an industry source said.

Samsung Electronics also maintained the top place in the NAND flash market, with the percentage inching up 0.4 percentage point to 34.3 per cent despite the sharp fall in the quarterly revenue in the segment.

Its NAND flash revenue more than halved to $2.99 billion in the first quarter, compared with $6.33 billion from a year earlier.

SK hynix placed fourth with 16.8 per cent in the first-quarter NAND flash market, down from the third spot from three months earlier.

Analysts are increasingly betting on the theory that the two tech giants are bottoming out, citing the second-quarter losses that have narrowed down from the previous quarter.

Samsung’s Device Solutions unit in charge of semiconductors reported 4.36 trillion won ($3.33 billion) in operating loss for the April-June period, narrowing from 4.58 trillion won from the previous quarter.

SK hynix posted 2.88 trillion won in the second-quarter operating loss, compared with the operating loss of 3.4 trillion won in the first quarter.

Samsung and SK hynix said in their recent earnings calls that they plan to focus on advanced high-bandwidth memory (HBM) and double data rate 5 (DDR5) memory chips that are in higher demand.

The DDR5 is the next generation of PC main memory with higher speed and bigger memory.

An HBM chip is suited for high-performance computing systems, such as artificial intelligence-driven data analytics and state-of-the-art graphics systems.