Goyal will co-chair the eleventh meeting of the India-UAE High-Level Task Force on Investments with Sheikh Hamed Bin Zayed Al Nahyan, Managing Director of Abu Dhabi Investment Authority….reports Asian Lite News

NPCI International Payments Ltd, a branch of India’s National Payment Corporation, will collaborate with Al Etihad Payments in Abu Dhabi to enable cross-border transactions.

The memorandum of understanding (MoU) aims to develop a domestic card scheme in the UAE using India’s RuPay debit and credit card technology. The agreement will be signed in the presence of Commerce and Industry Minister Piyush Goyal during his visit to Abu Dhabi from October 5 to October 6.

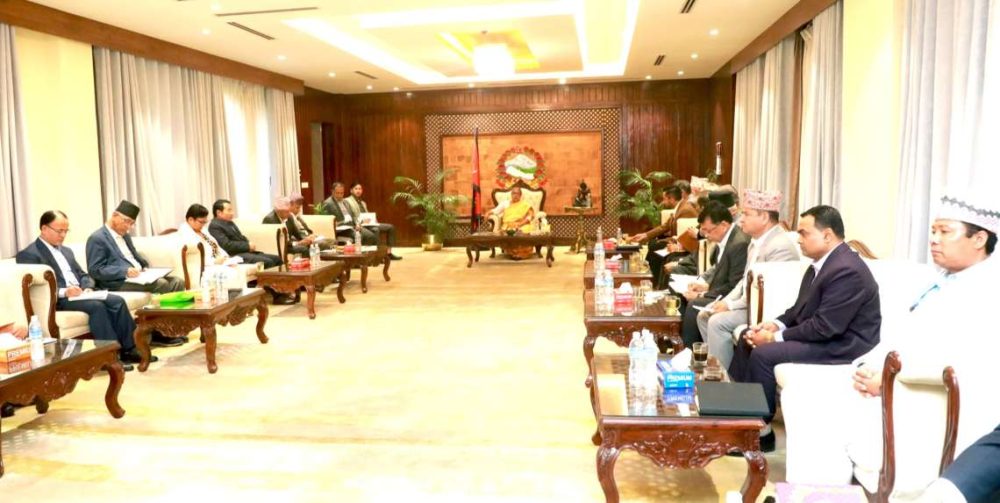

Goyal will co-chair the eleventh meeting of the India-UAE High-Level Task Force on Investments with Sheikh Hamed Bin Zayed Al Nahyan, Managing Director of Abu Dhabi Investment Authority. The meeting will include key figures from both countries, such as Mohamed Hassan Alsuwaidi, Thani bin Ahmed Al Zeyoudi, Khaled Mohamed Balama, and the ambassadors of the UAE and India.

During his visit, Goyal will also hold bilateral meetings with Khaldoon Al Mubarak, CEO and MD of Mubadala, as well as engage with members of the UAE-India Business Council, prominent business leaders from both nations, and major food importers in the GCC and Egypt.

Notably, NPCI has previously entered into agreements with Lyra in France in 2022 and Singapore’s PayNow in 2023 to facilitate cross-border transactions. UPI, developed by NPCI, is gaining international recognition, with countries like the UAE, Bhutan, and Nepal already adopting the payment system. NPCI International is actively exploring opportunities to expand UPI services into the United States, European countries, and West Asia, further promoting this instant real-time payment system.