Apart from strengthening the external balance, a decline in oil prices also leads to lower prices of petrol, diesel and LPG in the domestic market which eases inflation in the country….reports Asian Lite News

India stands to gain as oil prices have fallen by over 4$ a barrel this week to a four-month low in the international market following the OPEC+ cartel’s plan to allow an increase in production this year while an increase in the US crude stockpiles has added to bearish sentiments.

The benchmark Brent oil futures for August edged lower to $77.50, on Wednesday, while July crude oil futures on WTI (West Texas Intermediate) were at $73.22.

Oil prices have now fallen below $80 a barrel for the first time since February 7. This augurs well for the Indian economy as the country imports around 85 per cent of its crude requirement and any decline in oil prices leads to a reduction in the country’s import bill. This in turn leads to a lowering of the current account deficit (CAD) and a strengthening of the rupee.

Apart from strengthening the external balance, a decline in oil prices also leads to lower prices of petrol, diesel and LPG in the domestic market which eases inflation in the country.

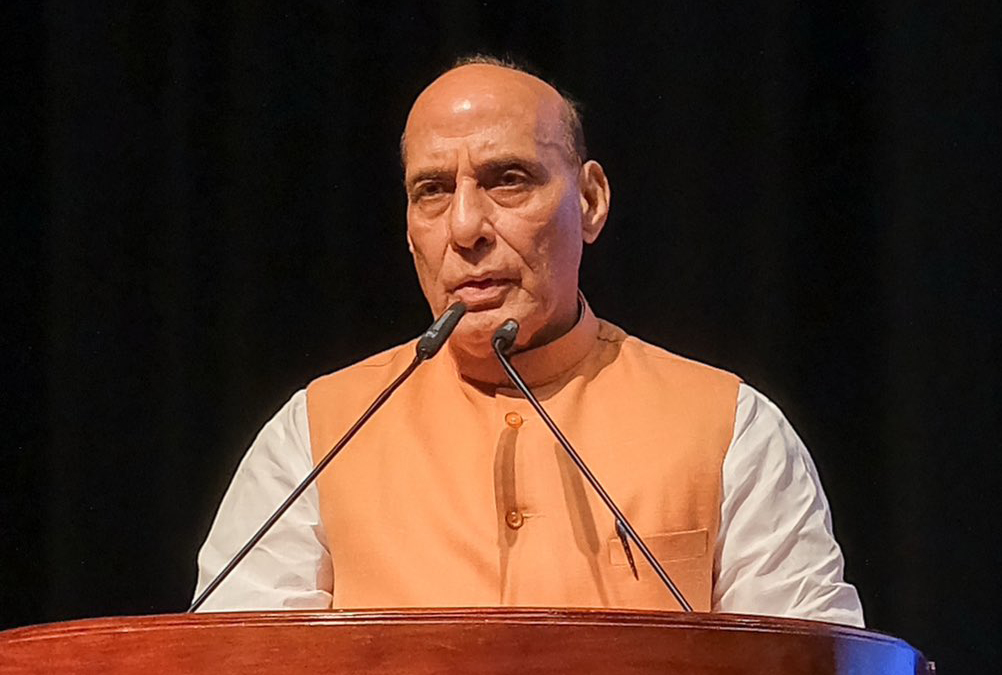

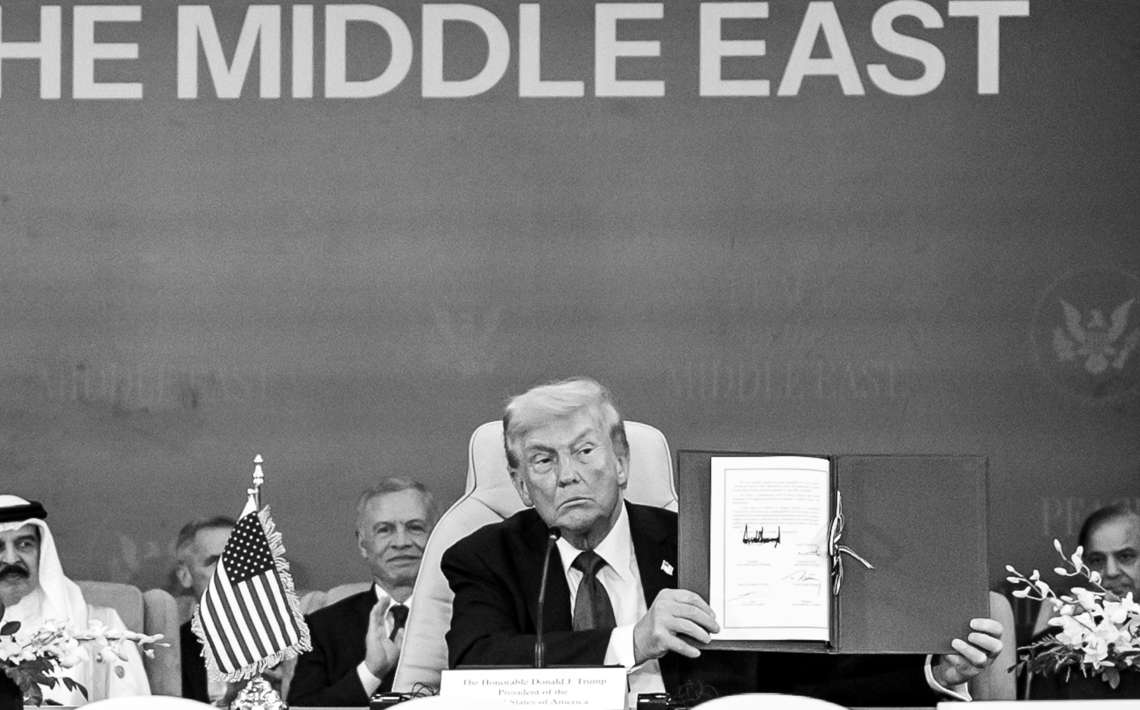

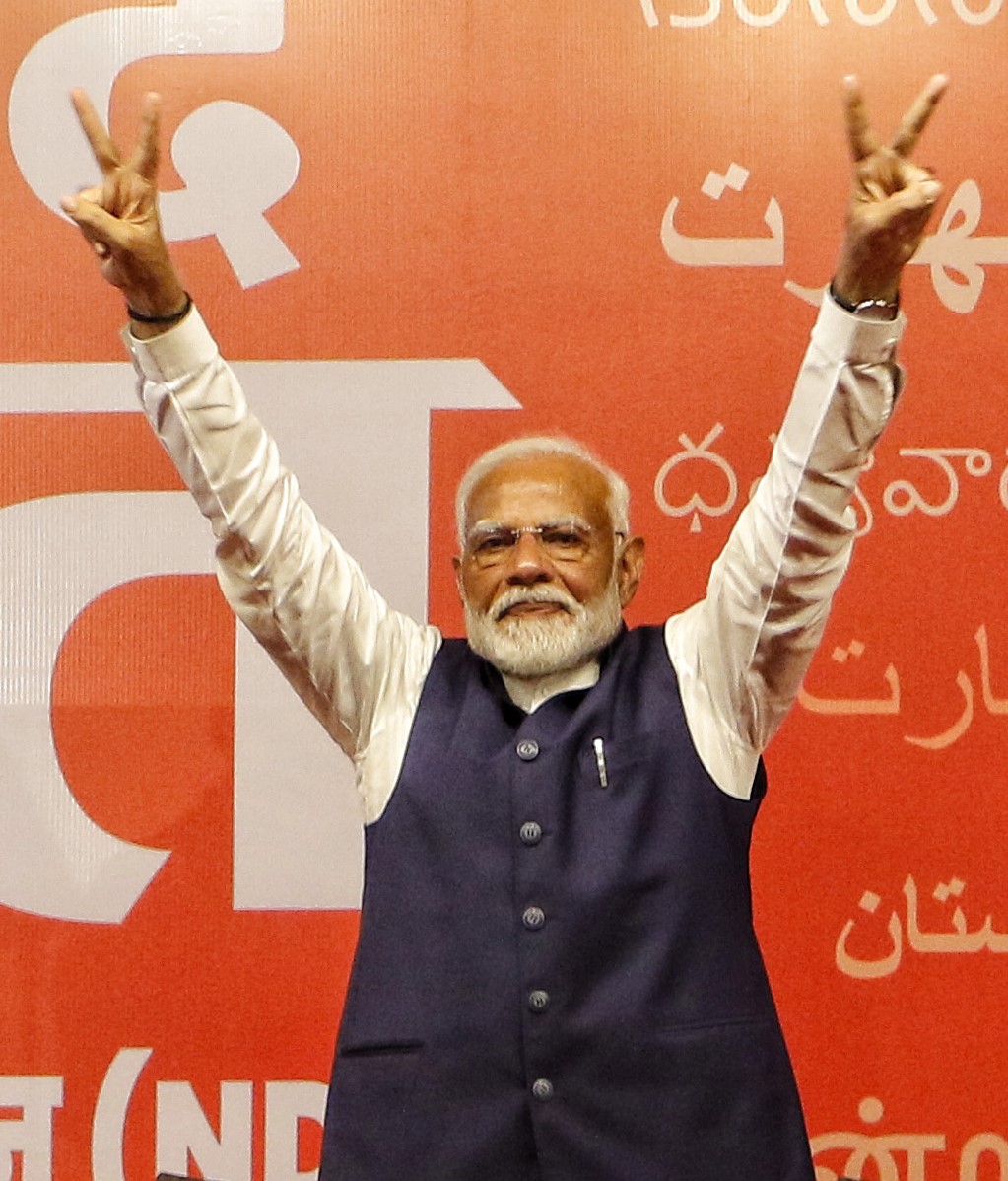

The Government has also helped to reduce the country’s oil import bill by allowing the oil companies to buy Russian crude at discounted prices despite Western pressures in the wake of the Ukraine war. The Narendra Modi government has stood firm in maintaining its ties with Russia despite the sanctions against Moscow imposed by the USA and Europe.

Russia has now emerged as the largest supplier of crude oil to India replacing Iraq and Saudi Arabia which occupied the top slot earlier. India has in fact become the largest purchaser of Russia’s seaborne oil which accounted for close to 38 per cent of India’s total oil imports in April.

According to an ICRA report, the price of oil imports from Russia was 16.4 per cent and 15.6 per cent lower than the corresponding levels from the Gulf countries in FY2023 and 11 months of FY2024, respectively.

India’s strategy of continuing to buy cheap oil from Russia has resulted in the saving of around $7.9 billion in the country’s oil import bill during the first 11 months of the fiscal year 2022-23 and also helped the country to lower its current account deficit.

Since India is the third largest importer of crude in the world, these large purchases of Russian oil have also helped to keep prices in the world market at more reasonable levels which has benefited other countries as well.

Data compiled by the Ministry of Commerce and Industry shows that in volume terms, the share of crude petroleum imported from Russia jumped to 36 per cent in 11 months of FY2024 from 2 per cent in FY2022, while that from West Asian countries (Saudi Arabia, the UAE and Kuwait) fell to 23 per cent from 34 per cent. The discounts on Russian oil generated huge savings in the oil import bill.

ALSO READ: ‘Modi 3.0 to Maintain Policies Amid Hurdles’