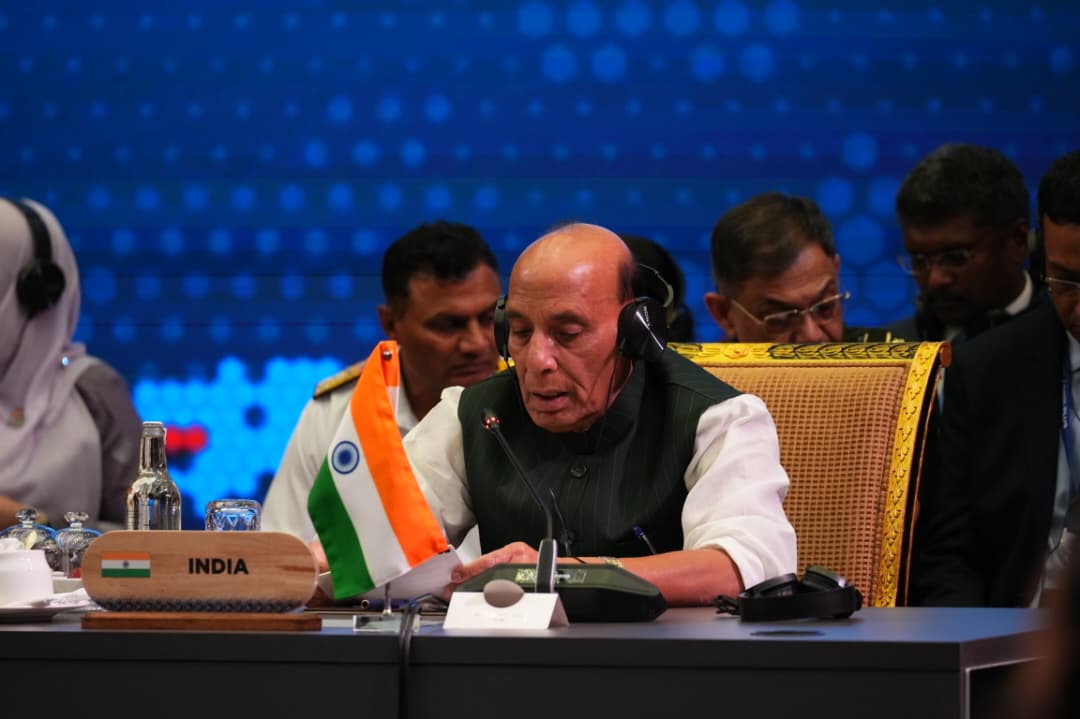

Finance Minister Nirmala Sitharaman announced major income-tax reforms in Budget 2024, simplifying tax laws, boosting compliance, and fostering economic growth.

Finance Minister Nirmala Sitharaman has announced a significant set of income-tax reforms for the fiscal year 2024-25, aimed at simplifying tax laws, promoting compliance, and fostering economic growth.

The finance minister highlighted the strong adoption of the simplified corporate tax regime, which now accounts for 58 per cent of corporate tax revenue in 2022-23.

And two-thirds of the personal tax filers are choosing the new tax regime. The government is working on a comprehensive review of the Income Tax Act, which will be completed in the next six months.

The FM has given some relief to taxpayers by hiking tax slabs for personal income tax. The new tax slab will now have nil tax up to an income of Rs 3 lakh, like the previous year.

But now income between Rs 3-7 lakh will attract a tax rate of 5 per cent, earlier 5 per cent tax was applied on income of between Rs 3-6 lakhs.

Income of between Rs 7-10 lakh will now be taxed at 10 per cent earlier it was for income of between Rs 6-9 lakhs.

Income between Rs 10-12 lakh will now be taxed at 15 per cent, earlier it was for income between 9-12 lakhs.

Tax on income between 12-15 lakh will remain same at 20 percent and income above Rs 15 lakh will also remain constant at 30 per cent.

The finance minister has also given relief on standard deduction which has been hiked from Rs 50,000 currently to Rs 75,000 now. Deduction from family pension of Rs 15,000 is increased to Rs 25,000 under the new tax regime.

The FM has also announced to increase the amount of deduction by an employer in respect of his contribution to the pension scheme under section 80CCD, from 10 per cent to the extent of 14 per cent of the salary of the employee.

This means a non-government employee in the new tax regime will now be allowed a deduction of an amount not exceeding 14 per cent of the employee’s salary in place of 10 per cent earlier.

Additional measures announced to ease the tax burden on individuals and businesses include merging the existing tax exemption regimes for charities, reducing the TDS rate for e-commerce operators to 0.1 per cent from the erstwhile 1 per cent, and allowing TCS credit against TDS deducted on salaries.

To streamline tax administration and reduce litigation, the FM has announced simplification of reopening and reassessment procedures. The standard operating procedures (SOPs) for TDS defaults are rationalized and compounding guidelines are issued.

A simpler tax regime is introduced for foreign shipping companies operating domestic cruises in the country. Income generated from buybacks will now be taxed, and the penalty for non-reporting of movable assets valued at Rs 20 lakhs is being removed.

Furthermore, the equalization levy, a tax on digital transactions is withdrawn. (ANI)

ALSO READ: BUDGET 2024: Nirmala Breaks Morarji’s Record