Looking ahead, analysts are expecting the economy to face stiff headwinds in the ‘Year of the Dragon’…reports Asian Lite News

Amid falling growth rates, low business sentiment, and international investors pulling out due to the crisis-stricken property market, subdued export earnings, and crackdowns on private industry, China is currently facing a critical moment to revive its economy, Al Jazeera reported, citing the analysis of several experts.

In 2023, China was able to narrowly beat its economic growth target of 5 per cent, one of its lowest benchmarks in decades. Looking ahead, analysts are expecting the economy to face stiff headwinds in the ‘Year of the Dragon’.

As business sentiment continues to falter, economists broadly agree that Beijing needs to roll out measures to stimulate more domestic consumption.

While some analysts are calling for radical measures to jolt China’s economy, expectations are subdued owing to Beijing’s aversion to broad-based social spending, according to Al Jazeera. On the other hand, some experts see grounds for optimism beyond the current strains.

China is experiencing its longest deflationary run since the 2008 Global Financial Crisis. Consumer prices fell in January for a fourth straight month and declines look likely to extend into 2024.

“China didn’t see the boost most people expected after COVID restrictions were removed in late 2022,” Kevin P Gallagher, the director of the Boston University Global Development Policy Centre, told Al Jazeera. “Authorities are now keenly aware of the threat of falling prices.”

Falling prices risk turning into a self-reinforcing cycle if households and businesses postpone purchases in the hope that goods will keep getting cheaper. Deflation also squeezes debtors as the real cost of borrowed money rises.

In China’s case, where the debt-to-GDP ratio, including local government liabilities, reached 110 per cent in 2022, the situation poses a growing headache for policymakers.

Notably, in recent months, Beijing authorities have ramped up support measures to try and stem falling prices – mortgage rates on home purchases have been lowered, and banks have been allowed to hold smaller cash reserves to spur increased lending, Al Jazeera reported.

Much of China’s deflationary woes can be traced back to its beleaguered real-estate sector, which accounts for 20-30 per cent of GDP.

After the 2008 Global Financial Crisis, local governments encouraged a debt-fueled construction boom to boost growth. But after decades of rapid urbanisation, housing supply has run ahead of demand.

Amid several high-profile developer defaults, including the failure of Evergrande Group, new home sales fell by 10-15 per cent in China last year, according to the Fitch Ratings agency.

In turn, Chinese households have become cautious about spending money, especially on property, while a weak social safety net encourages families to save for emergencies.

In 2022, household consumption accounted for just 38 per cent of China’s GDP. On the other hand, private spending made up 68 per cent of the GDP in the United States that same year.

“Households ran down savings during the pandemic,” Sheana Yue, a China economist at Capital Economics said. “The real-estate crash undermined consumer confidence even further. China also has an ageing population, and, typically, spending declines with age.”

The upshot is that gross national savings exceeded 40 per cent in 2023, more than double the US level.

“Looking ahead, getting people to spend their savings won’t be easy. For decades, economists have encouraged the government to rebalance the economy away from investment in favour of consumption,” Yue said.

At 42 per cent of GDP, China’s rate of investment dwarfs that of other emerging economies, let alone advanced economies – which average 18-20 per cent. In addition to housing stock, Beijing has invested heavily in roads, bridges and train lines.

As with housing, however, years of overinvestment have resulted in spare capacity. Revenues at China Railway, for instance, regularly fall short of costs. At the end of 2022, the state-backed agency was 6.11 trillion yuan (USD 886 billion) in debt.

“We’re seeing the limitations of China’s capital-intensive infrastructure model,” Yue said. “And given that interest rates are already quite low, Beijing will need to start stimulating consumption to generate high and stable growth.”

Yue said policymakers should remove incentives to hoard savings by spending more on education, healthcare, and pension provisions.

Analysts expect the National People’s Congress–China’s rubber-stamp parliament — to again set an annual growth target of about 5 per cent when it meets in March, as reported by Al Jazeera.

While many economists have exhorted Beijing to stimulate growth through household transfers, Victor Shih, an expert on the Chinese economy at the University of California, San Diego, expects investment-driven growth to continue to hold sway.

“Marxist ideology, which valorises industrial production, remains the fundamental basis for policymaking in Beijing,” Shih said.

“In all likelihood, the government will continue to subsidise manufacturing. Consumption, by contrast, is viewed as indulgent,” Shih added. “There are 1.4 billion people in China, so comprehensive social assistance would be extremely expensive, especially in a deflationary context.”

Shih said Beijing could raise household consumption by urging companies to pay higher wages but that “China’s manufacturing edge is partly based on subdued worker income”.

As such, “higher wages would undermine Chinese exports, which is an important source of output,” he said.

“I don’t think the government will shift budgetary priorities in favour of the Chinese people… which will likely result in a period of economic weakness.”

Gary Ng, a senior Asia Pacific economist at Natixis in Hong Kong, said that Beijing has other strategic priorities.

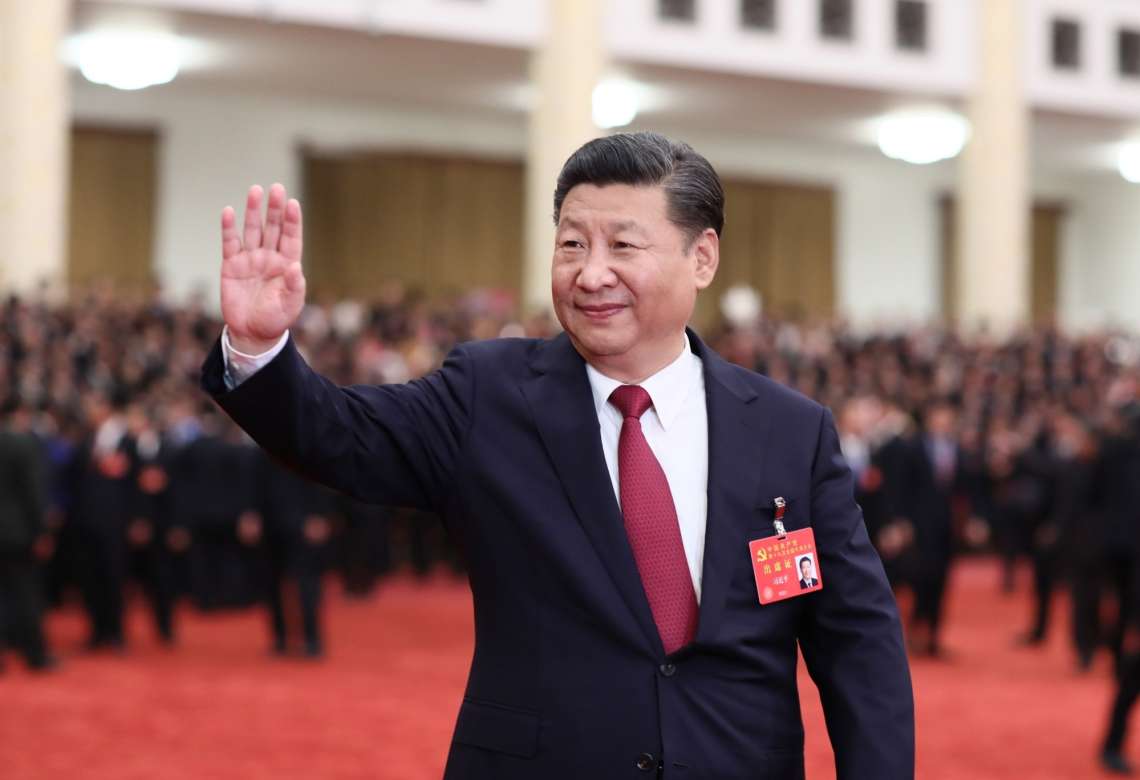

“President Xi [Jinping] appears less keen on stimulating rapid growth than he is on optimising the economy for security and resilience,” Ng said.

In recent years, Beijing has invested heavily in strategic industries like artificial intelligence and advanced computer chips.

By moulding industrial policy on the basis of national security, Beijing has set its sights on reducing its reliance on foreign technology and supporting its long-term geopolitical ambitions.

At the same time, Ng said, “Beijing has shown a new willingness to invest in more consumer-facing tech sectors, like renewable energy and electric vehicles.”

“Unlike property, these industries have the capacity to create jobs and promote economic self-sufficiency,” he said.

Ng also stressed that economic transformation takes time and that “there’s no magic pill for lightning-quick growth”.

“Investment in high-tech sectors should, slowly, reform China’s economic base,” he said. “Incidentally, private consumption is already on an upward trend.”

Gallagher, of Boston University, said China’s economic growth trajectory is healthier than sometimes portrayed.

“It’s easy to forget about China’s economic development since the 1990s. Growth has slowed from high levels lately but it still tallied at 5.2 per cent last year,” Gallagher said. “Forecasts are equally solid for this year.”

“Hawks have been predicting the demise of China’s growth model for decades,” Gallagher added. “It is true, however, that to build on China’s remarkable success, Beijing has to shake off its timidity about the investment-consumption pivot.”

Gallagher said 2024 is likely to underscore the urgency of reform amid the possibility of Donald Trump’s return to White House, who in his previous term had unleashed a strong trade war against China, Al Jazeera reported.

“If Donald Trump is re-elected (in the US) and chooses to engage in a new trade war, Beijing will want to be more self-reliant. The Year of the Dragon could be ideal for China to step up its efforts to unleash domestic consumption,” he said. (ANI)

ALSO READ-US, EU Sanctions Extend to China Firms Supporting Ukraine War