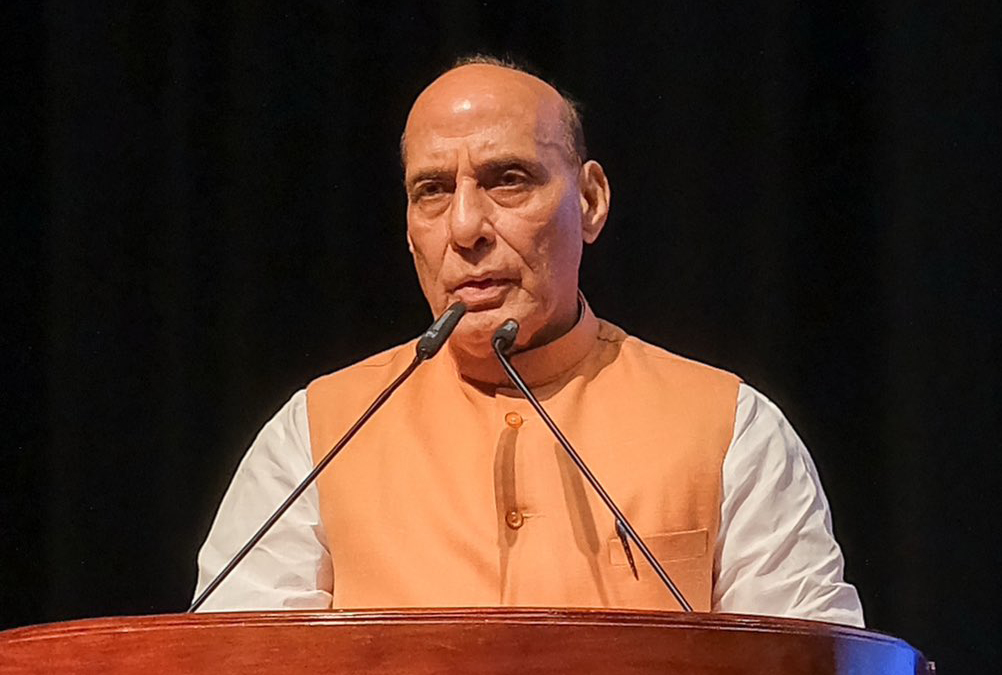

Malhotra expressed gratitude to taxpayers, mentioning that 51 per cent of direct tax revenue comes from the TDS…reports Asian Lite News

The Union Budget aims to simplify tax provisions and reduce complexity and disputes, while ensuring that those more capable bear a burden than the lesser, Revenue Secretary Sanjay Malhotra said here on Tuesday.

At a post-budget session at the leading industry chamber PHDCCI, Malhotra said the budget not only aims to adopt a collaborative, non-adversarial approach but also stimulate growth and employment, “with a significant shift from principal accounts to normative and presumptive methods”.

“This year’s budget is primarily focused on growth, development and inclusive progress. On the revenue side the goal is to support growth momentum as India stands out with a 7 per cent growth rate amid global economic challenges aiming for a ‘Viksit Bharat’ by 2047,” he emphasised.

On capital gains tax, the Revenue Secretary said the changes were driven by simplicity, fairness and equity. “Efforts were made to address various suggestions, including simplifying TDS, making appeal orders effective, rectifying cases, reducing the reassessment period, and merging charity schemes.”

Malhotra expressed gratitude to taxpayers, mentioning that 51 per cent of direct tax revenue comes from the TDS.

He also assured the full support of the government towards the upliftment of industry and trade.

According to PHDCCI President Sanjeev Agrawal, the steps announced for micro, small and medium enterprises (MSMEs), such as credit support during periods of stress, credit guarantee for manufacturing units and the new assessment model for public sector banks for providing credit to MSMEs, are going to provide a fillip to scores of small units.

“We are sure that the overall provisions of Budget 2024-25 would further boost the economy, attract investments and create employment opportunities for the growing youth population,” Agrawal told the gathering.

PHDCCI Executive Director, Dr Ranjeet Mehta, appreciated the government’s decision to eliminate the angel tax as a significant milestone for Indian startups, saying this will further boost innovation and investors’ confidence amid the funding challenges.

ALSO READ: Apple Stresses Responsible AI Model Training