Concerns among Asian and Middle Eastern investors centre on the unpredictable nature of US policy shifts in recent years…reports Asian Lite News

A growing number of investors in the Middle East and Asia, including some of the world’s largest sovereign wealth funds, are increasingly reluctant to put their money into US assets, according to one of Europe’s biggest private markets investment firms.

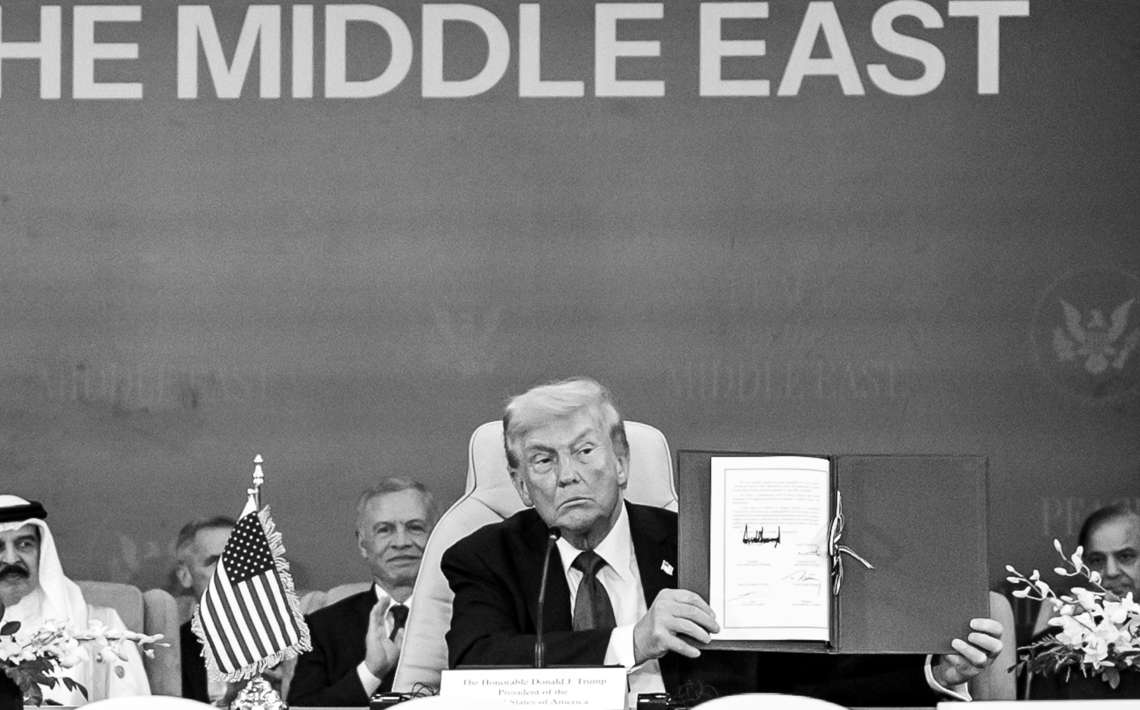

The Swiss-based Partners Group has revealed that institutional investors across the two regions have expressed mounting unease over exposure to the American market, citing policy volatility and uncertainty under the administration of former President Donald Trump. Executives say these concerns have prompted a notable shift away from US-focused portfolios and towards alternative investment destinations.

Roberto Cagnati, head of portfolio solutions at Partners Group, said the trend was particularly evident among larger, more influential funds. “There’s more people who look from Asia into non-US exposure,” he told the Financial Times. “People are more wary about what they’re exposed to.”

The firm, which manages more than $170 billion in assets worldwide—almost half of which is currently held in the US—confirmed that investors were increasingly requesting euro-denominated accounts rather than those tied to the US dollar. This reflects not only the apprehension about American economic policy but also a wider strategic diversification aimed at reducing reliance on the world’s largest economy.

Concerns among Asian and Middle Eastern investors centre on the unpredictable nature of US policy shifts in recent years. Issues such as tariffs, trade restrictions, and abrupt regulatory changes have cast doubt on the stability of returns from American markets. For many institutional players, the risk of being caught in sudden policy reversals outweighs the potential benefits of investing in the US.

Partners Group executives added that some clients had gone as far as to ask for total exclusion from US-related exposure, preferring instead to allocate capital into European, Asian, or global investment vehicles.

The hesitation is particularly pronounced among sovereign wealth funds, which manage vast sums on behalf of national governments and play a significant role in shaping cross-border capital flows. By steering clear of American assets, these investors signal a broader rebalancing of global financial strategies—one that could diminish the traditional dominance of the US market in international portfolios.

For the Swiss firm, this shift represents both a challenge and an opportunity. While demand for US assets may be slowing among its Middle Eastern and Asian clients, Partners Group is well placed to redirect capital into alternative regions, where investors perceive fewer political risks and greater stability.

Industry analysts note that while the US remains a magnet for global capital, ongoing uncertainty could accelerate the diversification trend. For investors wary of sudden policy shocks, the relative predictability of Europe and parts of Asia may increasingly outweigh America’s size and liquidity advantages.

As geopolitical tensions, trade disputes and shifting alliances continue to shape the global investment landscape, the decision by major funds to reduce exposure to the US highlights how fragile investor confidence has become. For Swiss managers like Partners Group, the focus will now be on guiding clients towards markets that promise steadier ground.