Pakistan is currently grappling with a dire economic situation, as it faces a multitude of challenges. These challenges include a balance-of-payment crisis, a devaluing currency, skyrocketing inflation, and impending debt obligations later this year … writes Dr Sakariya Kareem

Pakistan continues to face ongoing economic woes, with no immediate end in sight. The International Monetary Fund (IMF) has yet to agree on releasing the pending amount of USD 1.1 billion, which has been pending since November of last year. To secure the renewal of the bailout package set to expire on June 30, the Pakistani government presented the highly anticipated annual budget earlier this month. Expectedly, the budget fell short of the IMF’s expectations, resulting in disappointment from the global lender. The IMF criticised Islamabad for missing an opportunity to broaden the tax base in a more progressive manner.

With foreign currency reserves barely sufficient to cover one month’s worth of imports, the Shehbaz Sharif-led Pakistan Democratic Movement (PDM) government is desperately seeking to resume the IMF bailout package by the end of the month. Doing so may potentially open doors for Pakistan to borrow funds from other countries or international financial institutions.

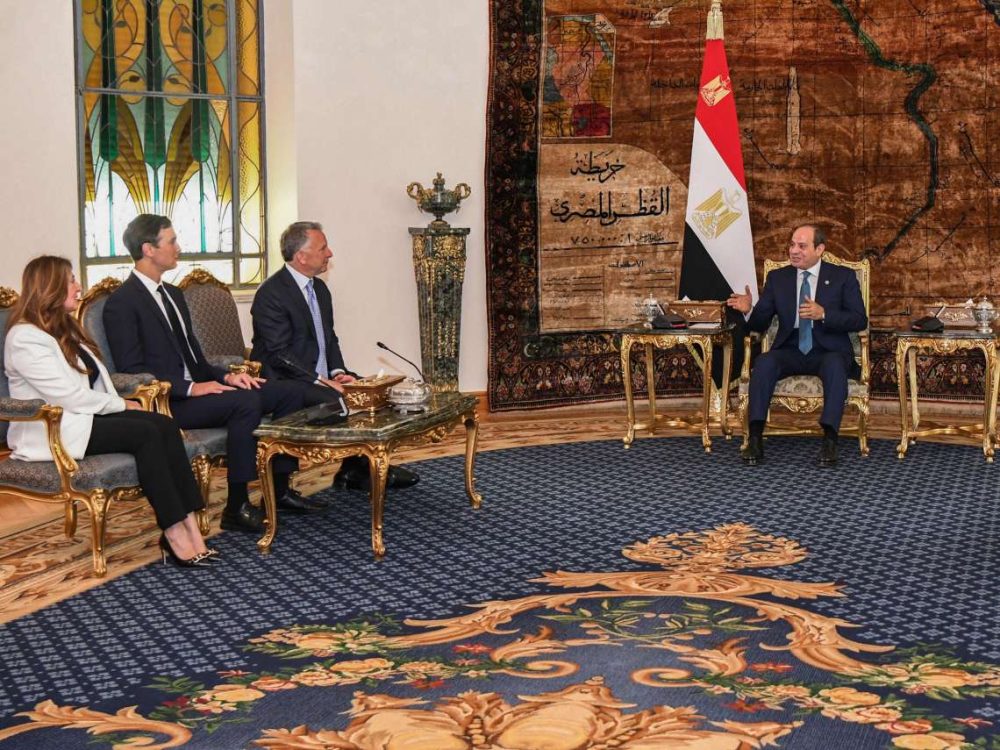

Many analysts predict that the recent budget falls short of meeting the objectives of the IMF program. It seems that, as it stands, Pakistan’s current budget will not gain acceptance from the IMF for the resumption of the bailout prior to June 30. In a last-ditch effort, Prime Minister Shehbaz Sharif met with IMF’s managing director, Kristalina Georgieva, in Paris on June 22, asserting that Pakistan had fulfilled all the global lender’s terms and conditions.

Following the meeting, Georgieva tweeted, “Very pleased to meet Pakistan PM @CMShehbaz on the margins of the Paris Summit. We had a productive discussion on how the IMF can continue to closely collaborate with Pakistan on policies to uphold macroeconomic stability and foster inclusive growth for the Pakistani people.” However, the tweet did not instil much hope for Pakistan regarding the future of the IMF bailout package.

Pakistan is currently grappling with a dire economic situation, as it faces a multitude of challenges. These challenges include a balance-of-payment crisis, a devaluing currency, skyrocketing inflation, and impending debt obligations later this year. Of utmost concern is the severe liquidity issue, as the State Bank of Pakistan holds a mere USD 4 billion in foreign currency reserves, which is reportedly sufficient to cover only four weeks’ worth of imports.

Additionally, the country’s currency has depreciated by over 50 percent against the US dollar over the past year. Official data further reveals that Pakistan’s annual inflation reached an unprecedented 38 percent in May, surpassing even Sri Lanka in Asia. Meanwhile, the IMF has forecasted a meagre 0.5 percent growth for Pakistan’s economy this year, a significant drop from the six percent growth observed in 2022.

As a desperate measure, the Pakistan Army has taken matters into its own hands to revive the country’s economy with the recent establishment of the Special Investment Facilitation Council (SIFC). This government body will receive “technical assistance” from the Pakistan Army, including security agencies such as the Inter-Services Intelligence (ISI). Army Chief General Syed Asim Munir will be part of the Apex Body of the SIFC. Following the violent events on May 9 against the military establishment, Rawalpindi has decided to further tighten its grip and “de facto” rule the country, leaving a weak and divided civilian government in place.

According to reports, the primary focus of the SIFC will be on defense production, agriculture, mines and minerals, information technology, and the energy sectors, with the aim of attracting USD 100 billion in foreign direct investment within three years. The ultimate objective of the SIFC is to elevate Pakistan’s GDP to USD 1 trillion by 2035. Security agencies will play an active role in “cross-frontier operational management” to ensure the success of this ambitious plan.

In reality, the newly established body has only offered some long-term economic plans for the country, offering little visible solution to address the pressing short-term issues. The renewal of the IMF bailout programme and debts relief from the lenders are two pressing issues for providing urgent economic relief for the country.

Pakistan’s economy has reached its breaking point after years of financial mismanagement. The situation has been worsened by a global energy crisis after the Russia-Ukraine war and unprecedented floods that submerged a significant portion of Pakistan in 2022. Adding to the uncertainty is the ongoing political crisis and visible rifts between the military establishment and judiciary, triggered by the brief arrest of opposition leader Imran Khan last month, resulting in violent street clashes on May 9 and a “state-imposed” mobile internet blackout that lasted for several days.

Elections are scheduled to take place no later than October, and the government has already acquiesced to IMF demands by discontinuing popular subsidies on gas and electricity, which had previously provided some relief during the cost-of[1]living crisis. Nevertheless, the imminent financial default and severe food shortages in Pakistan cannot be disregarded, especially considering the stagnant progress in the IMF program and the persisting political uncertainty. The prevailing “polycrisis” in Pakistan has the potential to intensify the likelihood of internal instability and violence within the country.