The other two co-arbitrators in the panel are Professor Albert Jan van den Berg, a founding partner at Belgium-based law firm Hanotiau & van den Berg, and Professor Jan Paulsson, founding partner at London-based law firm Three Crowns LLP…reports Asian Lite News

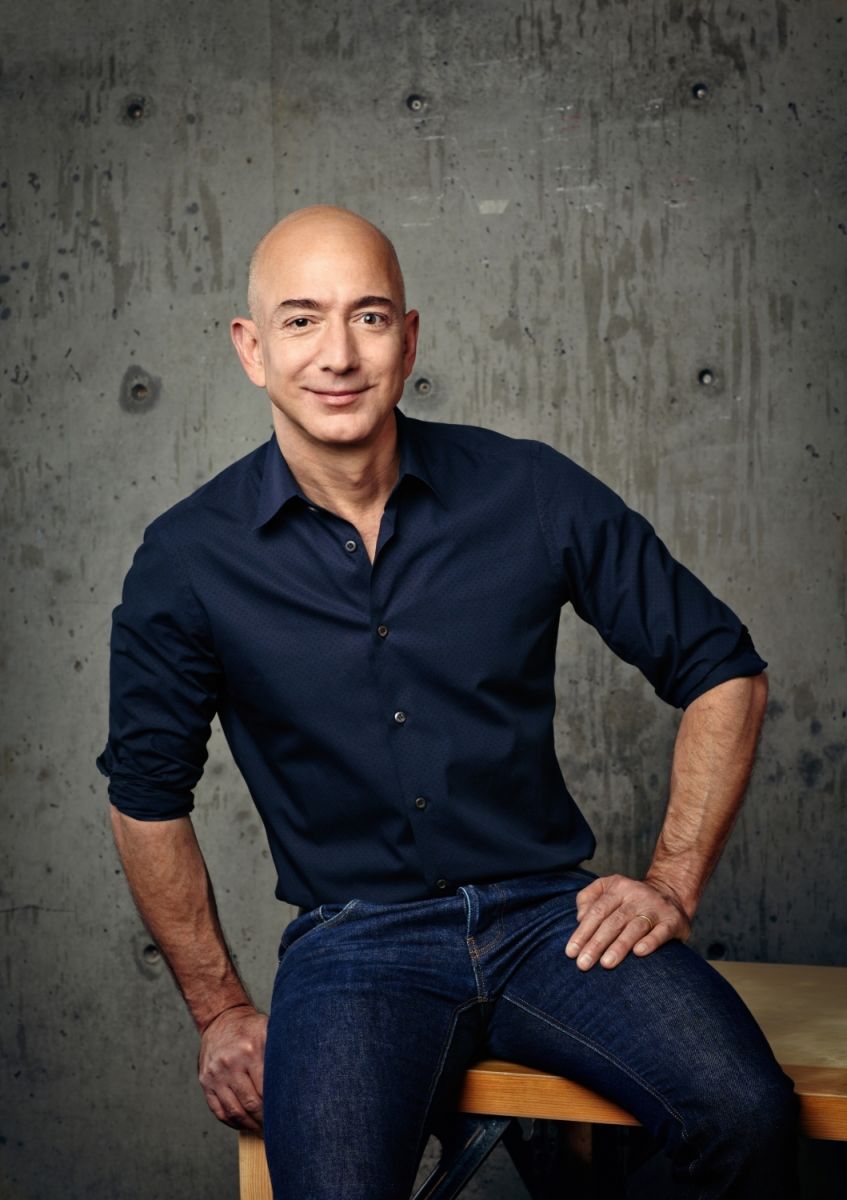

E-commerce giant Amazon and Kishore Biyani-led Future Retail has reached an agreement on the names of the three arbitrators required for the arbitration process. The arbitration will be held at the Singapore International Arbitration Centre (SIAC), The Indian Express reported.

According to The Indian Express reports, The three-member arbitration panel will be led by Michael Hwang, a former judicial commissioner of the Supreme Court of Singapore. Hwang, currently an arbitrator, focuses on international arbitration and mediation.

The other two co-arbitrators in the panel are Professor Albert Jan van den Berg, a founding partner at Belgium-based law firm Hanotiau & van den Berg, and Professor Jan Paulsson, founding partner at London-based law firm Three Crowns LLP.

The development comes after Kishore Biyani, Future Coupons and Future Corporate Resources have said that totally disillusioned and fed up with Amazon’s lackadaisical attitude, they were left with no option but to accept the offer from Reliance.

This communication to Amazon is a response to their notices and addressed on behalf of Future Corporate Resources Private Limited (FCRPL), Kishore Biyani and other promoters.

“At the further outset, we deny that we have acted contrary to and reneged on contractual obligations for personal gain or benefit, as alleged or at all. Such assertions are wholly unsubstantiated,” Biyani said.

“You were well aware that in light of the disruption caused due to the Covid-19 pandemic, the lenders were chasing various companies of the Future Group for honouring their obligations,” he said.

“Being totally disillusioned and fed up with your lackadaisical attitude, we were left with no option, but to accept the offer from the Reliance. Given the fact that Reliance is one of the largest conglomerates in the country and globally, we believed that this was the best deal in the interest of all the stakeholders of various companies of Future group including FRL, as it addressed the concerns of the lenders, employees, shareholders (public shareholders of the listed companies) of the Future Group companies including FRL. You, alone, are responsible for contributing to this situation, having failed to bail out FCPL and/or the Promoters from preventing alienation or disposal of the Promoter FRL Securities,” Biyani told Amazon.

Also read:Independent Sellers Saw Huge Growth During Holidays: Amazon