This highlights a lack of transparency in remittance fee structures, putting consumers at risk of hidden fees as they unknowingly pay more than advertised for the remittance service in the form of a marked up exchange rate…reports Asian Lite News

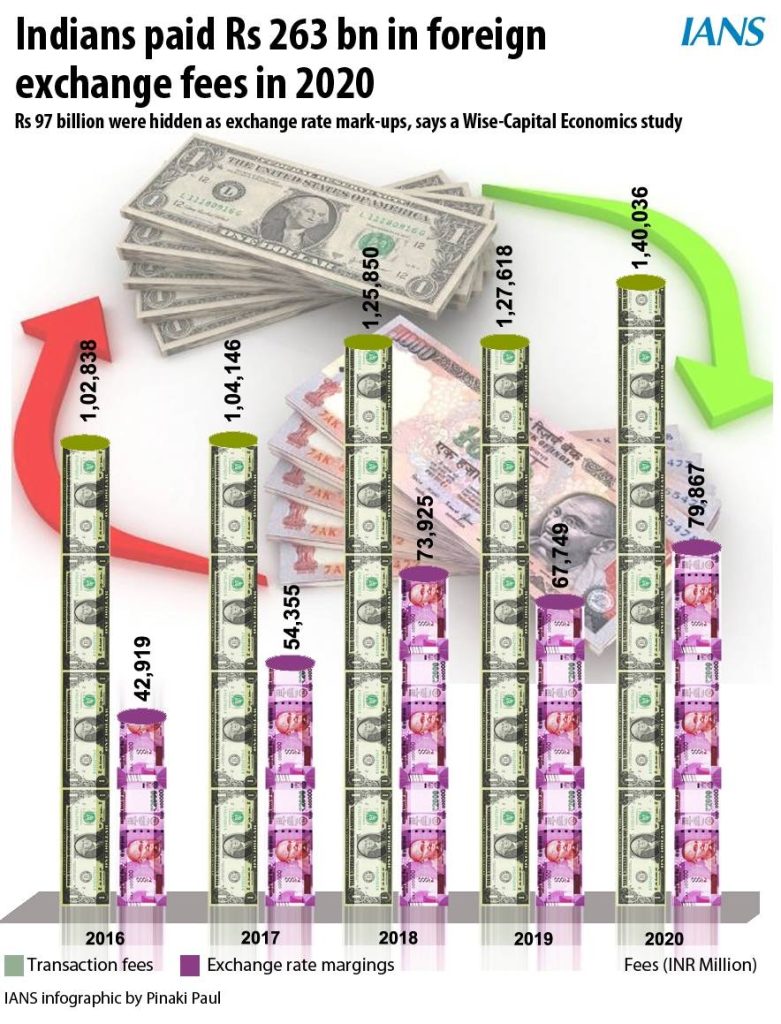

Indians paid over Rs 263 billion on foreign exchange fees in 2020, of which roughly Rs 97 billion were hidden as exchange rate markups on currency conversions, payments, and card purchases and the remaining Rs 166 billion were spent on transaction fees, a new report showed on Wednesday.

The research, carried out by global technology company Wise, along with independent economic research consultancy Capital Economics, also revealed that between 2016 and 2020, the annual amount Indians lost in fees and exchange rate markups increased from Rs 187 billion to Rs 263 billion.

While the overall amount Indians have spent on transaction fees for sending money abroad has decreased over the past five years, the fees paid to exchange rate margins are growing.

This highlights a lack of transparency in remittance fee structures, putting consumers at risk of hidden fees as they unknowingly pay more than advertised for the remittance service in the form of a marked up exchange rate, the report noted.

“The research exposes a severe lack of transparency in foreign exchange transactions as for far too long, consumers have been fleeced into paying unnecessary costs for foreign transactions when providers hide fees in exchange rate markups,” said Rashmi Satpute, Country Manager, Wise India.

“While technology and internet has eased some of the issues related to the convenience and speed of foreign funds transfers, the age-old practice of hiding fees in the exchange rate results in people spending too much on hidden foreign currency fees – money which should rightfully stay in their pockets,” Satpute added.

Consumers sending money into India from abroad are not spared from hidden fees.

Over the past five years, money lost to exchange rate margins on inward remittances has grown from Rs 42 billion to Rs 79 billion.

Meanwhile, fees paid to transaction costs have grown from Rs 102 billion in 2016 to Rs 140 billion in 2020.

A significant portion of these fees paid on remittances to India come from people in Gulf countries where most people are employed in blue-collar jobs to support their families back home in India.

“Of the share of total fees paid on inward remittances to India in 2020, Saudi Arabia ranked first at 24 per cent, followed by the US (18 per cent), the UK (15 per cent), Qatar (8 per cent), Canada (6 per cent), Oman (5 per cent), the UAE (5 per cent), Kuwait (5 per cent) and Australia (4 per cent),” the report showed.

The study also revealed that pre-pandemic, Indian travellers spent Rs 42 billion in foreign exchange fees in 2019 alone, of which Rs 24 billion is hidden in exchange rate markups.

Over 11 million people and businesses use Wise, which processes over 5 billion pounds in cross-border transactions every month, saving customers over 1 billion pounds a year.