The trust gap between Pakistan and IMF widened unabated after previous authorities contravened the agreed terms…reports Asian Lite News

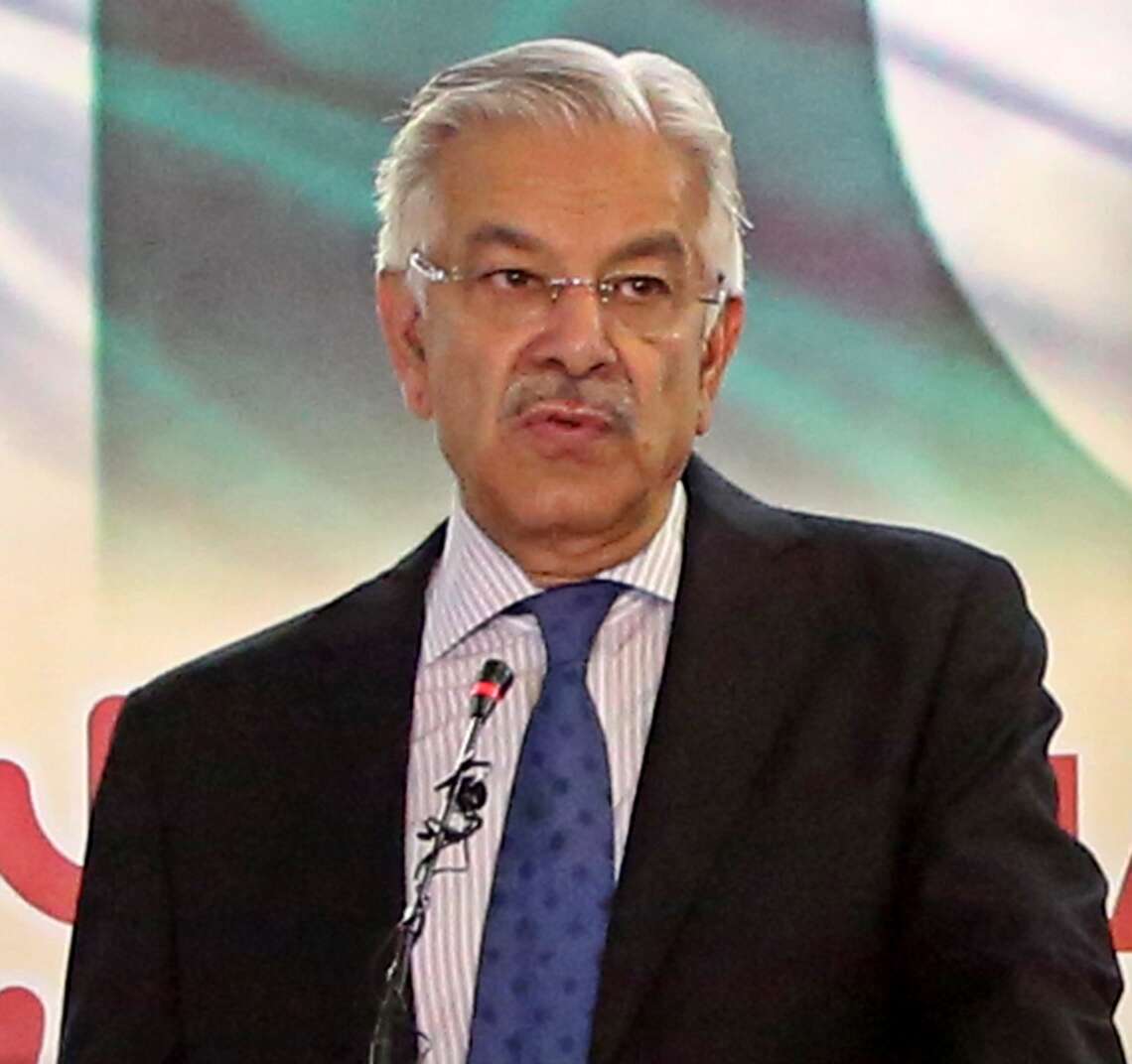

Former Finance Minister of Pakistan Miftah Ismail on Friday said that the International Monetary Fund (IMF) doesn’t trust Pakistan’s Ministry of Finance, reported Geo News.

In an exclusive interview with Geo News, the Pakistan Muslim League-Nawaz (PML-N) leader dissected the main issues which — evolved during the last year– conked out the critical deal with the IMF, steeping the country in a hydra-headed crisis of ginormous proportions and said, “There’s lack of competence and shortage of credibility.” Pakistan is relying on funds from the multilateral lender to avoid defaulting on its international obligations and revive its USD 350 billion economy.

The funds will be crucial to ease widespread shortages, curb record prices and bolster foreign reserves that are now barely enough for over a month’s worth of imports.

Commenting on the holdup in the IMF programme, Miftah said the finance minister had been saying the government would get the review done in one week for many weeks, but now “he doesn’t even say one week”.

“The issue I think is that the Pakistani government has done all it could and now we needed the friendly foreign countries to fund us so that our external accounts are not in deficit and our external requirement is fulfilled,” he said explaining that the real issue, according to him, was that the “IMF doesn’t trust the finance ministry,” reported Geo News.

To win the lender’s support, Pakistan has increased tax rates and energy prices, while it has jacked up the policy rate to 20 per cent, the highest in 25 years, as advised by the IMF. The nation also allowed its anaemic currency to massively depreciate to become one of the worst performers globally.

The trust gap between Pakistan and IMF widened unabated after previous authorities contravened the agreed terms.

Meanwhile, amid a dollar crunch, investors have also raised concerns about the nation’s ability to make good on its international debt payment obligations, reported Geo News.

The nation needs to repay about USD 3 billion in dues in upcoming payments until June, while USD 4 billion is expected to be rolled over.

When asked to comment on Chief of Army Staff Asim Munir’s statement “worst is behind us”, which he gave in a recent meeting with the businessmen, Miftah said in his view the economy would remain deep in the woods for the next few months more without giving a clear time period.

“I think this is too long a delay in striking a staff-level agreement even after accepting and implementing every term the IMF has imposed on Pakistan,” he said expressing concerns over the delay, reported Geo News.

The former finance minister said that this delay spoke volumes about the IMF’s scanty confidence in our ability to manage the debt effectively, while our friendly countries dragging their feet on making the announcements were only following the international bailout master’s suit.

“I mean obviously, not only there’s a lack of competence, but also a shortage of credibility. Beyond this, Pakistan is in the grip of a political and economic crisis. It is going to be a tough few months for us — but only a few,” Miftah claimed.

The politicians in Pakistan are adept at misleading their own people as evident from last week’s claim of Pakistan Finance Minister Ishaq Dar that the external financing assurance was not one of the IMF’s conditions for clearance of the bailout funding.

Contrary to it, the fact is that “all IMF programme reviews require firm and credible assurance that there is sufficient financing to ensure that the borrowing member’s balance of payments is fully financed over the remainder of the programme.”

The next tranche of the IMF bailout package would depend on Pakistan’s quick measures to arrange for full financing of its balance of payments deficit for the fiscal year 2022-23. (ANI)