The Fed also signalled that Wednesday’s hike may be its last one for now…reports Asian Lite News

The US monetary policy committee, seeking to achieve inflation at the rate of 2 per cent in the long run, hiked key interest rate by another 25 basis points to 5.0-5.25 per cent at its latest two-day review meet held during May 2-3.

The Committee of the Federal Reserve, US’ central bank on Wednesday went for another rate hike. The Committee said it remains “highly attentive” to inflation risks.

The Fed also signalled that Wednesday’s hike may be its last one for now, BBC reported.

The latest hike was the same as the previous rate increase in the March meeting and marked its tenth straight rate hike.

Meanwhile, consumer inflation in the US moderated in March to 5.0 per cent from 6.0 per cent the previous month, but the numbers are still way above the 2 per cent target. It was at 6.4 per cent in January, and 6.5 per cent the month before.

The US central bank’s current policy rate, which is now in a target range of 5.0-5.25, the highest in several years, and notably, it was near zero in the early part of 2022.

Raising interest rates typically help in cooling demand in the economy and thus helps in managing inflation.

“The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation,” the US Fed said in its monetary policy statement, adding that the Committee is strongly committed to returning inflation to its 2 per cent objective.

Economic activity expanded steadily in the first quarter, job gains have been robust in recent months, and the unemployment rate has remained low.

‘Bank crisis tightened credit conditions’

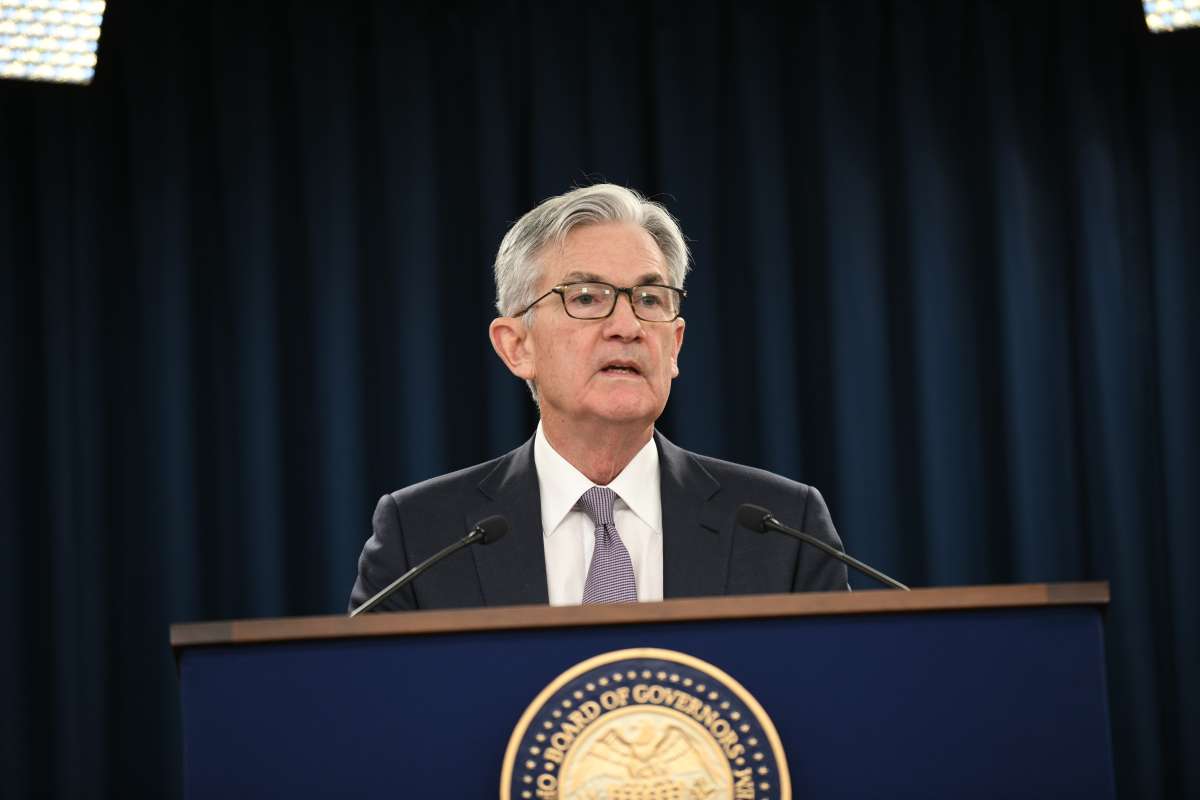

The recent banking crisis in the US appears to have resulted in tighter credit conditions and they are likely to hurt economic activities, said US Federal Reserve Chair Jerome Powell after the two-day monetary policy review meeting where it once again hiked interest rates in their pursuit of managing inflation.

Powell said in a press conference that credit conditions had already been tightening over the past year in response to the US monetary policy actions and a softer economic outlook.

“But the strains that emerged in the banking sector in early March appear to be resulting in even tighter credit conditions for households and businesses. In turn, these tighter credit conditions are likely to weigh on economic activity, hiring, and inflation,” Powell said, adding that the extent of these effects remains uncertain.

One of the most prominent lenders in the world of technology startups, Silicon Valley Bank, which was struggling, first collapsed on March 10, after a run on the bank by the depositors. Its closure led to a contagion effect and the subsequent shutting down of other banks, including Signature Bank and First Republic Bank.

The collapse of a few regional banks in the US, which started with Silicon Valley Bank, has sent ripples across the global banking industry and posed fears of a contagion effect across economies.

Going ahead, the US central bank will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments for any further actions.

“We remain committed to bringing inflation back down to our 2 per cent goal and to keep longer-term inflation expectations well anchored. Reducing inflation is likely to require a period of below-trend growth and some softening of labour market conditions. Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run.” (ANI)