The interim budget has been successful in strengthening global confidence in India’s growth story, which is more organic as well as democratic in nature, writes Shishu Ranjan and Ajit Jha

The interim budget which is a vote for an account to temporarily manage the expenditure is generally presented before the election-eve. It has been often seen that the incumbent government brings a populist budget before an election to appease voters and to beat anti-incumbency.

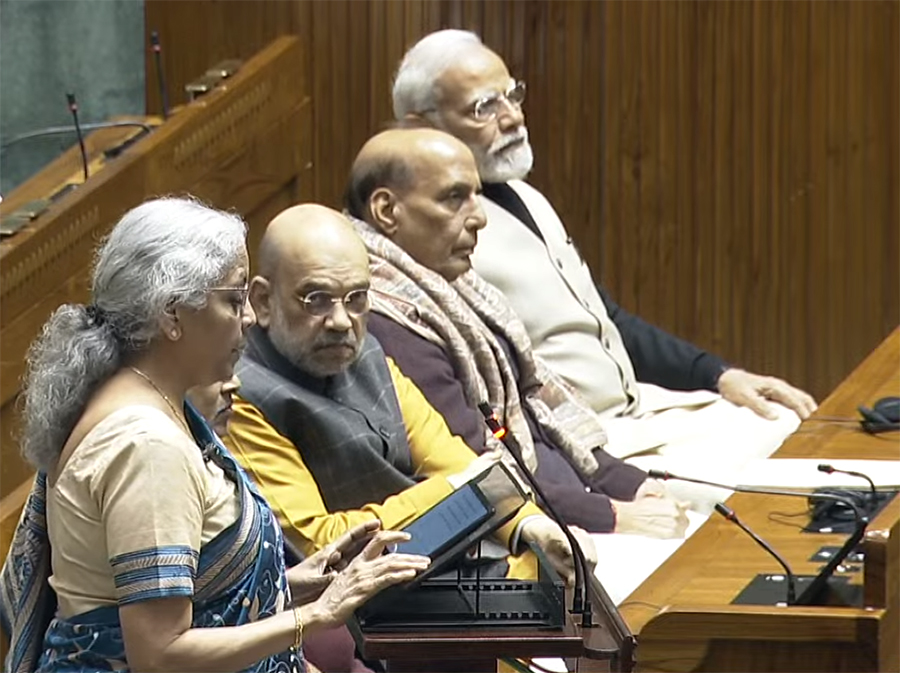

However, the interim budget presented by Finance Minister Nirmala Sitharaman has broken that practice as it is not only crisp and short but also focuses on social and geographical inclusiveness. Besides, it gives highest priority to the upliftment of the poor, women, youth, and farmers, while attaching importance to infrastructure development and fiscal consolidation.

The interim budget also shows the vision and intention of the government to pull the economy from ‘fragile five,’ to scale it up to the stage of major five economies and to becoming one among the top three economies in the next couple of years.

Reflecting on the Financial Year (FY) 2023-24, the Indian economy has pulled a stellar macroeconomic performance amid a challenging global economic environment. It has proved all previous forecasts wrong to register a growth rate of 7.3%, which is highest in the world. Along with this, the interim budget reflects the government’s decision to lower its deficit target for the fiscal year ending March 2024 to 5.8% of GDP from the targeted estimates of 5.9%.

Further, the government has shown commitment to achieve the target of 4.5% fiscal deficit in FY 2025-26. Even with the revised GDP growth estimates by global economic institutions such as World Bank and International Monetary Foundation (IMF), several economists were skeptical of achieving the fiscal deficit budgetary estimates (BE) for the simple reason that the revised estimates (RE), in the middle of the year 2023, have to increase the MGNREGA (a rural employment guarantee scheme) allocation by more than 33%, which is from ₹60,000 crore to ₹89,000 crore. Additionally, the food, fertilizer and fuel bill breached the BE of ₹3.75 lakh crore to reach ₹4.13 crore in (RE) in FY 2023-24.

Therefore, overachieving the fiscal deficit target for FY 2023-24 and setting the targeted fiscal deficit at 5.1% for FY 2024-25 signaled the international community about the stability and continuity in the union government economic policy, which is essential for long term investment plan by global and domestic firms.

The high fiscal deficit is not appreciated by investors, global economic institutions or credit rating agencies for the two reasons. One, it creates inflationary pressure in the economy as it inflates demand and amid constrained supply in the short to medium run, increases the general prices, thus lowering the rate of return on investment on the one hand and putting downward pressure on exchange rate on the other hand, which further erodes rate of return, especially on foreign investment.

India being a capital scarce country cannot run the risk of sustained inflation, a phenomenon under which European nations are struggling in the post Covid19 period as the capital investments will be subject to flight risk in favor of other growth destinations.

Two, high fiscal deficit creates upward pressure on cost of capital from the supply side due to the crowding out effect on private investment. Nonetheless, the private investments are taking place at the higher scale and it is expected that the lower borrowings by the government will further facilitate larger availability of credit for the private sector.

In her budget speech in the parliament, Finance Minister Sitharaman said the capital expenditure would be 3.4% of GDP and it will have positive multiplier effects on economic growth and employment creation in the medium term. Further to infuse funds in the market to create a condition of crowding-in for the private sector the gross and net market borrowings have been lowered to 14.13 and 11.75 lakh respectively which is lower than that in 2023-24.

The new solar scheme to install rooftop solar plants at 1 crore households is another significant scheme that serves not only India’s strategic interest to be self-sufficient in the energy sector, but is also aligned to the global vision of carbon net neutrality.

BE for solar power grid has been increased from ₹4,970 (FY 2023-24) crore to ₹8,500 crore, which is more than 70% jump over last year. Similarly, the national green hydrogen mission BE allocation increased by more than 100%, a jump from ₹297 crore in FY 2023-24 to ₹600 crore in FY 2024-25. These announcements reflected India’s commitment to global welfare and sustainable development.

If the developed countries will have the golden opportunity to partner India for production and execution using their technological and capital investments, less developed countries will have an opportunity to learn from Indian resolve and leverage India’s learning towards setting and executing similar goals to ensure sustainable economic development.

Continued focus on the housing sector by committing additional 2 crore houses for rural families and new schemes for middle class families will not only be a major growth contributor, but also enhance the social security and living standards of Indians.

Housing sector is considered to be a core sector which has more than 100 linkages to different industries. A new house involves land development, bricks, mortar, steel, cement, paint, wood, plastic, fiber, sanitary fittings, plumbing, carpentry, machinery, and many more sectors, creating huge employment as well as growth opportunity.

The government’s support to people in fulfilling their dream to own a house, imparts thrust to self-respect, improves self-belief, confidence and living standards, and acts as a means to improve social security as well as community health and hygiene. The investment in the housing sector will help India to uplift its growth rate and sustain it over the next several years.

On the social front, the focus on four pillars has got major attention. The NITI Ayog report showed that in the last 10 years, the government has helped 25 crore people to come out of multidimensional poverty. It shows a new approach of tackling poverty in India which is based on empowerment of the poor rather than focus on the entitlement-based system.

Youth employment in the last five years has increased. Under the Skill India Mission 1.4 crore youth have been trained. 54 lakh youth have been upskilled and reskilled, 3000 new ITIs have been established.

A scheme like PM Vishwakarma was launched in September 2023 to empower traditional artisans, employment and income generation at the rural level. The Direct Benefit Transfer has helped in transferring 34 lakh crore in the PM-Jan Dhan accounts and it has also saved 2.7 lakh crore of the government.

Overall, the interim budget has been successful in strengthening global confidence in India’s growth story, which is more organic as well as democratic in nature.

India’s vision of developing its economy by 2047 has a roadmap and the roadmap ticks all the right boxes in economic management, which is refraining from a populist budget, high investment in infrastructure, robust capital expenditure, commitment to low fiscal deficit, goal towards zero revenue deficit, better human resource, continuation of social welfare programs in order to have inclusive growth and commitment to fulfill global sustainability goals.

(Shishu Ranjan is Vice President at Barclays Bank in India and Ajit Jha is Assistant Professor at Institute for Studies in Industrial Development (ISID), New Delhi.) – India News Network

ALSO READ: INDIA’S GLOBAL ROLE: Insights from Munich Security Meet 2024